Market sentiment in gold declined quickly as prices ended below $1900 for the second week in a row. But even if a further decline is expected, many see this as an opportunity to buy.

The latest weekly gold survey shows that Wall Street analysts are bearish for the short-term, while bullish sentiment among retail investors has fallen to its lowest level since late October.

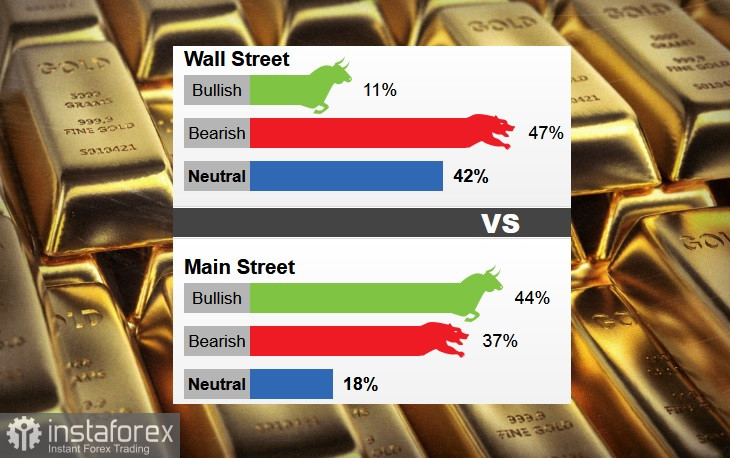

Last week, 19 Wall Street analysts took part in a gold survey in which 9 analysts, or 47%, were bearish on the current week. Two analysts, or 11%, were optimistic, while 8 analysts, or 42%, thought prices will trading in a sideways range.

In the online surveys, 324 respondents out of 733, or 44%, said prices will rise this week, while 274, or 37%, forecast it would fall. 135 voters, or 18%, were neutral.

Selling pressure in gold continues as members of the Fed reiterated their hawkish stance on interest rates. Some said they are expecting the rate to exceed 5% before inflation can be controlled. Federal Chairman Jerome Powell even mentioned that although he sees signs of disinflation, monetary policy will need to remain restrictive for some time.

With these comments, some analysts said that inflation could trigger lower gold prices. They said inflation should be much weaker to reverse the current correction.

Some, however, do not see lower gold prices as a negative for the market as it provides a new entry point. For example, Michele Schneider, director of trading education and research at MarketGauge, said she sees a buying opportunity if gold can hold support above $1,850.

She added that gold's safe-haven characteristic will continue to attract long-term investors.