Long positions on GBP/USD:

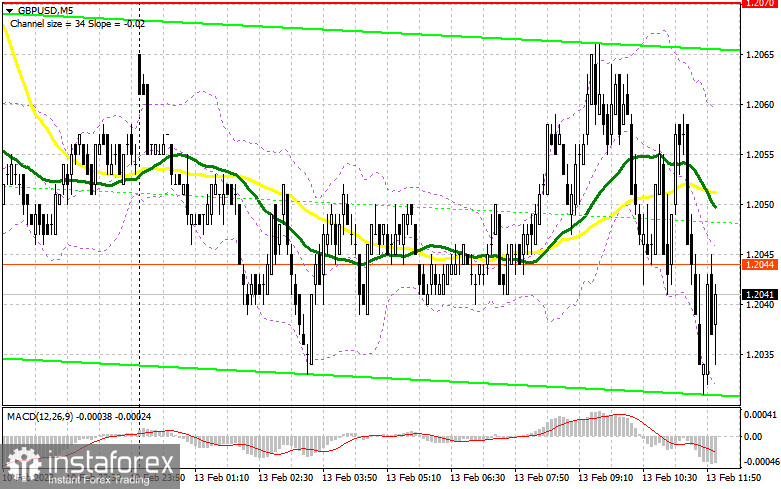

In my previous forecast, I drew your attention to the level of 1.2070 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze the situation. Despite the fact that the pound sterling managed to reach the area of 1.2070, the currency failed to test this level, so there were no buy entry points. From the technical point of view, nothing has changed. The trading plan remains the same.

Comments by Federal Reserve officials on further interest rate hikes in the US today may strengthen the US dollar. FOMC member Michelle Bowman is scheduled to speak today. That is why in case the pair will continue falling, I plan to watch the buyers' activity only after a false breakout at 1.2011, the support level, which was formed in the middle of the previous week. This may allow the British pound to rise back to 1.2070. However, we may see a battle for this level. Only if the price settles above this level and performs a test of it from above amid the absence of important statistics, we may see the GBP/USD pair continue the uptrend to the high of 1.2124. Reaching above this level, the price may grow to 1.2186, where traders may book profits. If bulls fail to protect 1.2011, the pressure on the pair is likely to increase quite strongly. In this case, it would be better to open long positions only near the support level of 1.1964 and only after a false breakout. One can also buy GBP on a rebound from 1.1881, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears acted quite aggressively and did not let the pair go above 1.2070. They need to prevent the price from reaching above this resistance, just above which the moving averages are located. The MAs are supporting bears. If the pair grows and forms a false breakout there in the afternoon, it may create a sell signal and decline to the area of 1.2011, the support level, where bulls are likely to return to the market. If we do not see growth from this level, the pair may break through 1.2011 and perform a downward test of it. This may cancel bulls' plans for a quick comeback after Friday's sell-off, strengthening bears' presence in the market and generating a sell signal with the target at 1.1964. The next target is located at 1.1881. Hitting this level, a new downtrend may develop. Traders may fix profits at this level. If the GBP/USD pair increases and we see weak activity from bears at 1.2070 during the American session, bulls may take control of the market again. In that case, only a false breakout near the resistance of 1.2124 may give an entry point into short positions. If there is no activity there, it would be better to sell GBP from the high of 1.2186, counting on an intraday rebound of the pair down by 30-35 pips.

Indicators' signals:

The currency pair is trading below the 30- and 50-day moving averages. It indicates that GBP may decline.

Moving averages

Note: The period and levels of moving averages are considered by the author on the 1-hour chart and differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair goes down, the indicator's lower boundary at 1.2030 will offer support.

Description of indicators

- Moving average determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence. Quick EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

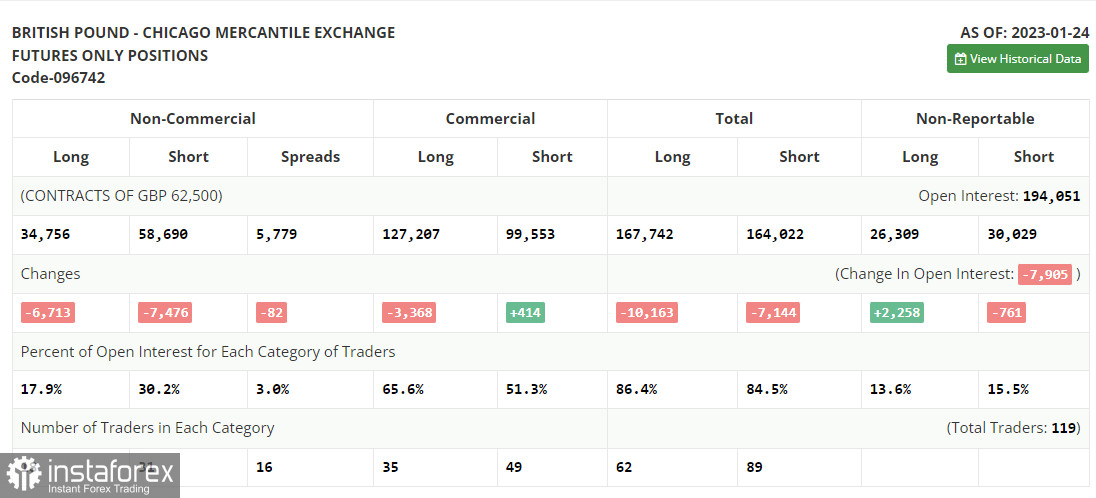

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.