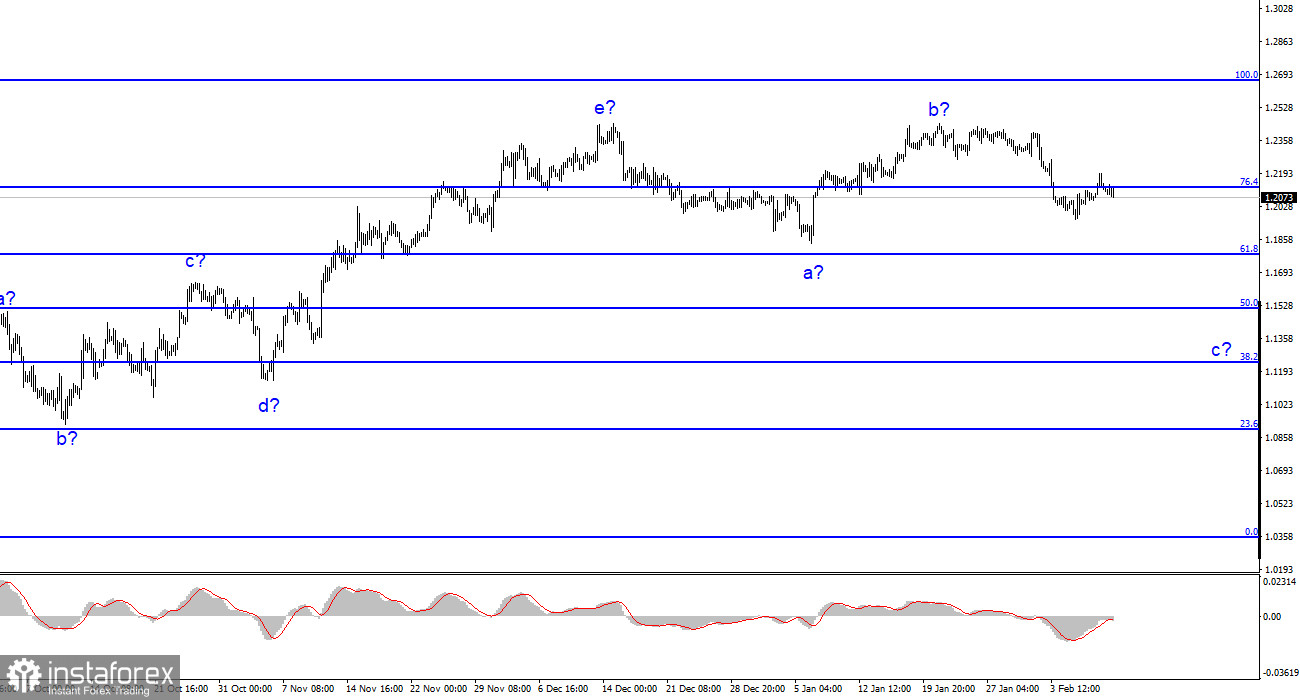

Although the wave analysis for the pound/dollar pair now appears extremely complex, clarifications are not necessary. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend segment has the pattern a-b-c-d-e and is most likely already finished. I anticipate that the downward portion of the trend has started to take shape; it will at least have three waves. Wave B appeared to be unnecessarily long, but it did not cancel. As a result, last week, a wave could have started to form with a downward component of the trend, the targets of which are situated below wave a's low. The price would be at least 200–300 points less than it is at the moment. Although it's too soon to speculate, I believe wave c may end up being deeper and that the entire downward section of the trend may potentially adopt a five-wave pattern. The pair has been on the verge of restarting the development of an upward trend section for a while, and it wasn't until last week that it was able to start moving quotes away from the peaks reached with the help of the news background. Because wave c hasn't finished yet, the low of assumed wave a hasn't been broken.

The British pound has not yet completed its fall.

The pound/dollar exchange rate rose by 60 basis points on Monday, but this movement in no way deviates from the present wave analysis. The internal waves inside a and b were not visible to us, so they shouldn't be inside wave C. The demand for the British pound should continue to fall this week because wave c itself still doesn't appear to be finished. By the way, this week will have a strong news background. What value do reports on US or UK inflation have? Both indices are most likely going to keep declining, but at this point, it matters more how quickly inflation is falling and how long it will last before it ends.

On Monday, Jonathan Haskel, a member of the Bank of England's board of directors, delivered an interview. He claimed that the pandemic and Brexit had caused several issues for the British economy, some of which were still unresolved. He added that while there are no alternative ways to deal with excessive inflation, high central bank rates cause a decline in investment. The interest rate should be increased even though doing so will cause the economy to slow down and cool off. But thus far, things aren't as bad as they may be for the UK economy, which might just experience a mild recession. Let me remind you that the GDP and industrial production numbers reported on Friday were historically disappointing. Additionally, Haskel pointed out today that industrial production has been declining quickly in recent years. I believe that the instrument should keep declining because there is still a long period until the next central bank meetings.

Conclusions in general

The development of a downward trend section is implied by the wave pattern of the pound/dollar instrument. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Everything now depends on the decisions made by the Fed and the Bank of England in March, as well as on economic indicators, particularly those related to inflation. Wave c may take on a less protracted form.

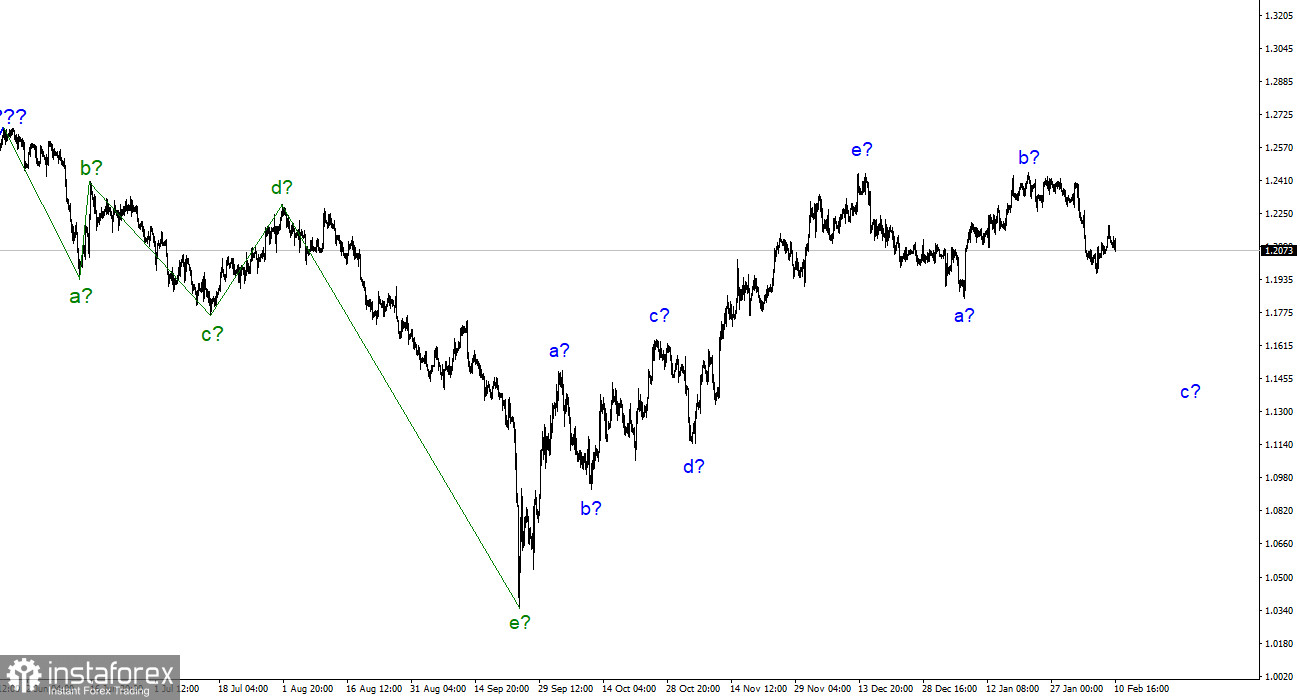

The image resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.