A new week has started, and I will highlight two of the most important events. In fact, there will be many more events, but the UK and US inflation reports are rightly at the top of the list of importance. The fact is that inflation is still the key report for many central banks. This is the case in the U.S., the U.K., and the European Union. So let's take a closer look at what we can expect from these two reports.

First of all, I would like to point out that both instruments should continue to decline, according to the current wave layout. Pullbacks to the upside are okay, but the downward scenario is still the main option. Ideally, we need to get data such that the demand for the dollar continues to rise. This is especially true for the GBP/USD instrument, as both inflation reports will have a direct bearing on it. So, US inflation may slow down in January by another 0.2-0.3%. This will not be enough for the Federal Reserve to "get the evidence" that Fed Chairman Jerome Powell and other FOMC members have been talking about lately. As a reminder, the monetary committee believes that the tightening cycle should end when inflation shows a clear intent to return to 2% in the near term. If inflation slows to 6.2-6.3% this week, that would be a "routine slowdown." There is still quite a long way to go to 2%. Inflation could fall at a much slower pace in 2023, since the Fed has already taken all of its most aggressive and harsh steps. Right now, the rate could rise at a maximum of 25 points. But at the same time, a pause scenario is also possible. Not in a rate hike, but in lower inflation. Oil and gas prices have fallen to their lows, and may rise rather than fall in the near future. And rising energy prices could reignite the inflation spiral. My point is that the victory is not yet won.

The situation in the UK is completely different. Inflation may show a decline for the third straight month, but it is so inconclusive that I find it hard to talk about it as a decline at all. At the end of January, the Consumer Price Index (CPI) may slow down to 10.3%. The index would then move away from its peak by 0.8% in three months. This is very little, given all the tightening of the Bank of England, which began back in 2021. So far, the British central bank is losing the fight against inflation, and there are fewer and fewer tools it can apply. If it were possible to raise the rate as much as it wants, there would be no problem. But no central bank has that option. We can only hope for a miracle, because even falling energy prices have not particularly affected the growth of prices in Britain. I think that such background news should play on the dollar's side.

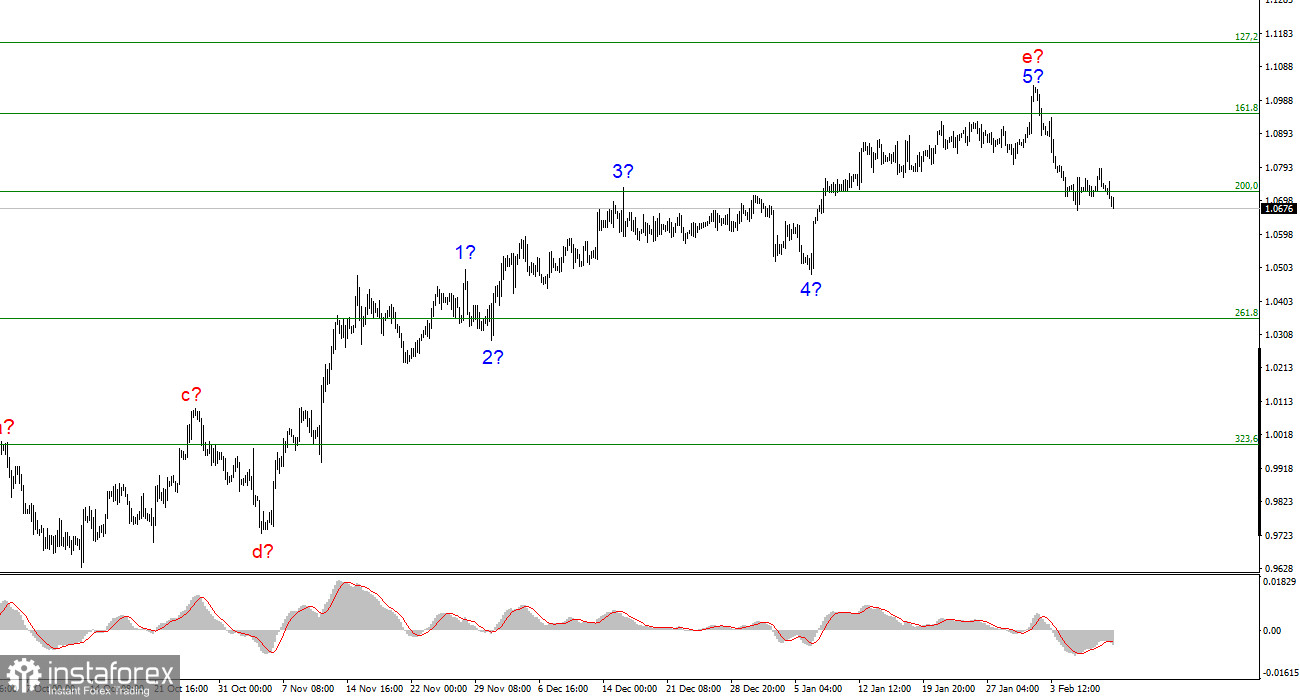

Based on the analysis, I conclude that the ascending part of the trend has been built. So now it is possible to consider short positions with the targets located near the calculated mark of 1.0350, which corresponds to 261.8% of Fibonacci. There is still a chance that we might face complications regarding the uptrend section, but for the first time in recent weeks, we can consider the start of a new downtrend.

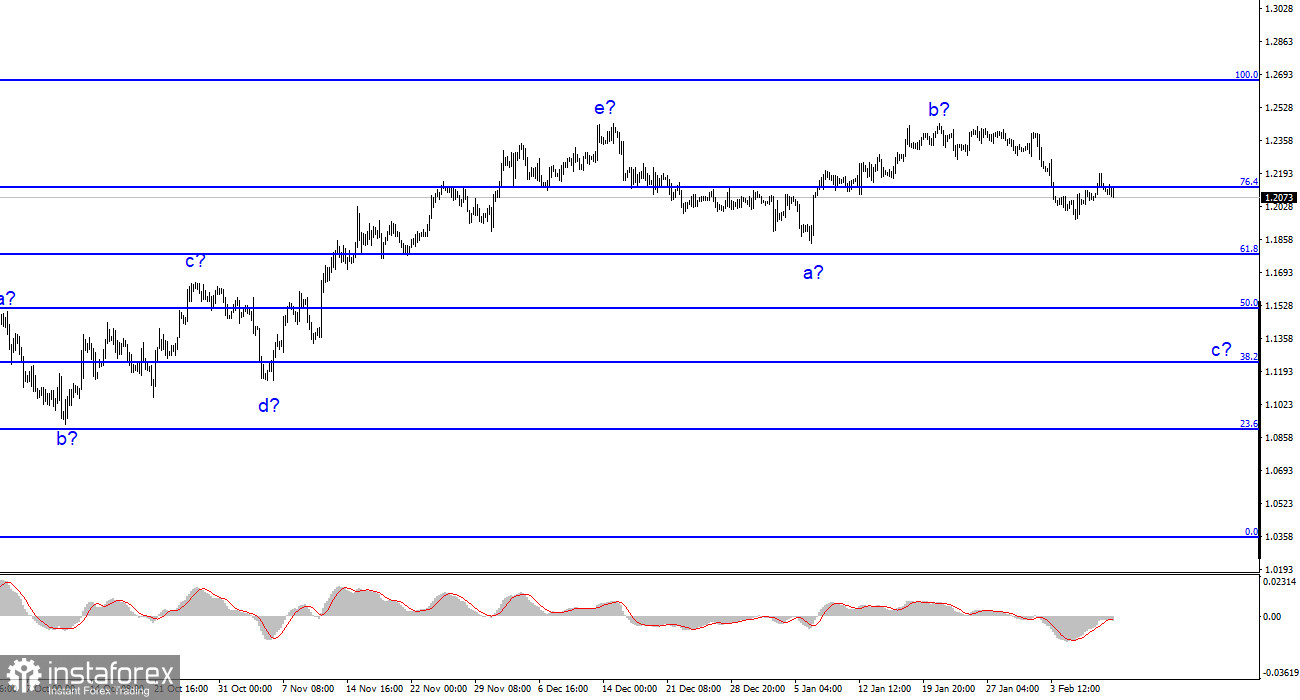

The wave pattern of the Pound/Dollar instrument implies that a downtrend is being built. At this time, it is possible to consider short positions with targets located near 1.1508, which is equal to 50.0% Fibonacci. You could place a Stop Loss order above the peaks of waves e and b. Wave c may take a less extended form, everything will now depend on the Fed and the BoE's decisions in March, as well as on the economic reports, primarily on inflation.