On Monday, the EUR/USD currency pair adjusted once again to the moving average line, but it has yet to overcome it. The pair did not remain still, yet their movement was neither resonant nor trend-forming. Simply a regular local upward trend with no specific justification. We think it makes sense at this point to try to see the big picture while removing yourself from specific macroeconomic reports. From our perspective, the European currency should continue to depreciate because it has grown excessively and for an extended period. It might emerge from the overbought state after falling 200–300 points, at which point it will be possible to discuss its growth prospects. However, it is still too high right now.

It is important to comprehend the following point. There is a trend (such as the downward one over the past two years), and as a result, the pair moves in a certain direction for very particular reasons. Due to traders closing deals in line with the trend, the trend ends and the correction starts. In other words, the pair is moving in opposition to one another, but it appears to be doing so randomly. Therefore, just 50% of the recent increase in the value of the euro was warranted. Therefore, it is important to consider the essential background in general. Additionally, it demonstrates how well-positioned the US economy is given the current situation. The labor market is strong, the recession has not yet begun, and unemployment is at its lowest level in 50 years. Undoubtedly, certain individual signs could use improvement. Everything in the European Union is not entirely awful either. Although neither the economy nor unemployment has entered a recession, it is important to keep in mind that the key rate in Europe is considerably lower than in America. Even with low oil and petrol prices that made it possible to escape an energy crisis, there will be an economic slowdown if the ECB rate rises further (which is not inevitable).

Waiting for an inflation-related resonance value is no longer worthwhile.

Reports on inflation are still crucial for the market, but they are starting to mean different things now. It is a truth that inflation cannot go down each month. Since the Fed substantially tightened monetary policy last year, the rate of inflation has fallen six times in a row, each time rather sharply and quickly. But this situation cannot continue forever. Oil and petrol prices won't stay low indefinitely because the Fed is no longer raising the rate by 0.75%. Therefore, at best, we can expect an inflation decrease of 0.2-0.3% per month. There may be months when the consumer price index doesn't indicate any slowdown at all. The point is that while inflation is getting closer to the desired level, it can still be another year before it is achieved. And it's all right. A slight decrease in inflation cannot be viewed as an insufficient outcome of the Fed's efforts. Additionally, minor changes in inflation won't cause a significant market response. Simply said, it makes little sense for the Fed to raise the rate much higher than the current levels. Now, the regulator will move cautiously.

Another rate increase will be feasible, for instance, if inflation does not slow down or does so only slightly for a period of two to three months. However, none of these adjustments will significantly alter either inflation or monetary policy. We believe that the pair of the euro and the dollar is entering a lengthy phase of consolidation. In other words, a 24-hour TF is capable of a flat or "swing." An assertive stance by the ECB is required to maintain the expansion of the euro. However, the ECB has already slowed down the pace of tightening itself and can do so again in a single meeting, demonstrating its opposition to such a strategy. Therefore, we think that the euro has almost certainly reached the end of its growth potential. In any case, it is pointless to discuss purchases at this time because the pair is trading below the moving average.

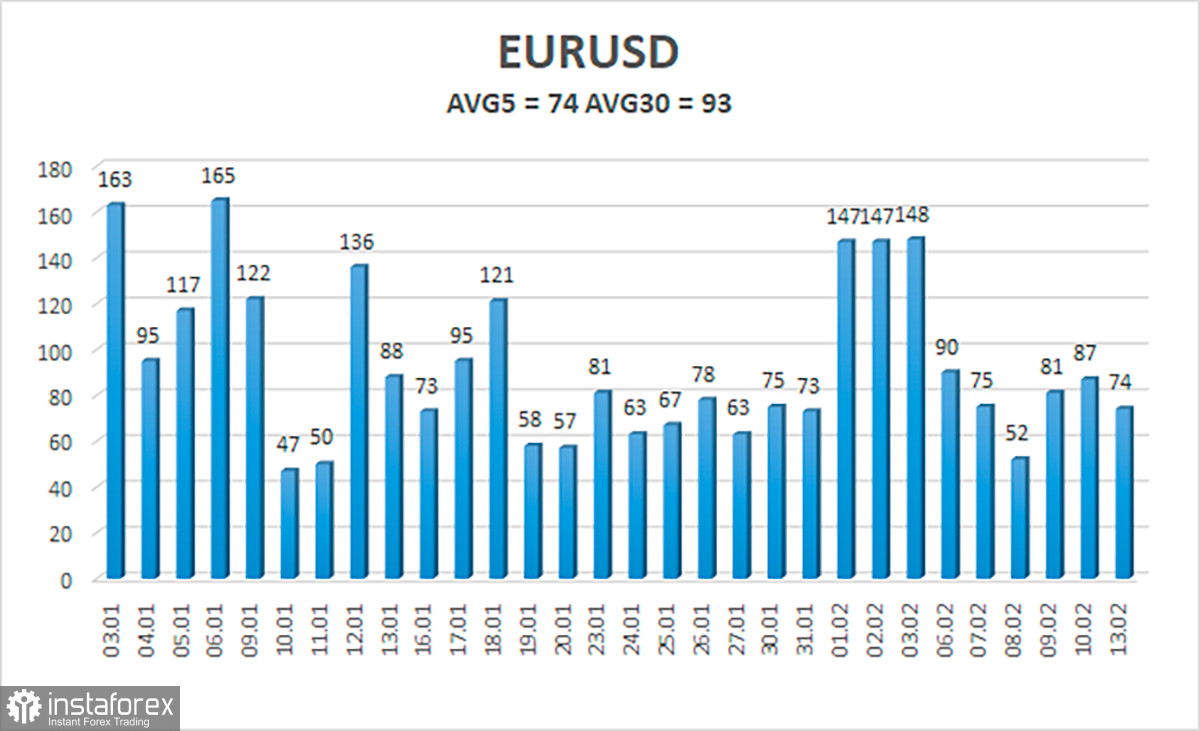

As of February 14, the euro/dollar currency pair's average volatility over the previous five trading days was 74 points, which is considered to be "normal." So, on Tuesday, we anticipate the pair to move between 1.0659 and 1.0807. The Heiken Ashi indicator's downward turn will signal the start of a new downward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Advice:

The EUR/USD pair is still moving south. When the Heiken Ashi signal turns down, we can now consider opening new short positions with targets of 1.0659 and 1.0620. After the price is stabilized back above the moving average line, long positions can be initiated with targets of 1.0807 and 1.0864.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.