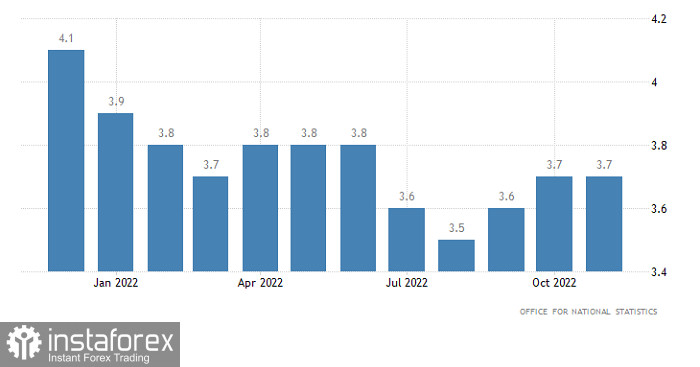

With euro and pound falling sharply since the start of February, yesterday's rise can hardly be called a rebound. It did, however, manage to recover some positions, but in today's European session, pound is likely to lose ground again as the UK unemployment data is expected to rise from 3.7% to 3.8%.

Unemployment rate (UK):

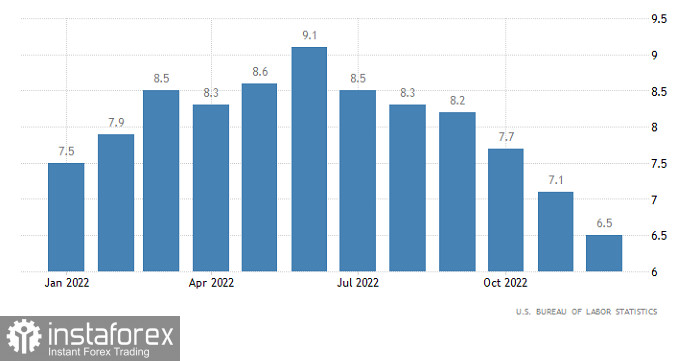

After the opening of the US trading session, it will be back to current levels as CPI in the US should slow down from 6.5% to 6.3%. And despite Fed Chairman Jerome Powell's recent statements about the need for further interest rate increases, the decline in inflation will give investors hope that the Fed will change its mind. A fall in inflation will also have a negative impact on dollar.

Inflation (US):

EUR/USD rose as around the level of 1.0650, there was a contraction in short positions, which led to a rebound of about 80 pips. This indicates that the market is in a correction, and for a change of trading interest to occur, the pullback must hit above 1.0800. Until then, the overall market situation will not change.

In GBP/USD, there is a rebound from the psychological level of 1.2000 to 1.2150. Holding the price above this level will lead to further strengthening of pound, while a decline will prompt a further fall of the pair.