GBP/USD corrected a bit on Monday and even managed to overcome the moving average. However, this upward move doesn't matter a lot under current market conditions. Indeed, we have stronger sell signals. First, let me remind you about the double top pattern which is still valid because the price hasn't dipped to its local low at 1.0850 yet. Thus, we still expect a further decline. Second, the price slipped below the key level on the 24-hour timeframe which also set the stage for a downward move. If something changes in the fundamental background today or tomorrow, traders will be able to revise sentiment and turn sharply bullish. Interestingly, the fundamentals could really encourage the bullish sentiment and traders could bet on the sterling's strength!

In the article about EUR/USD, we have already discussed the report on the US inflation which could sharply change the trajectory of the market or reinforce the downward move. In case the CPI doesn't reveal a notable change in inflation in January, the market could respond in any way. Tomorrow, the UK is due to release a similar report! As we discussed earlier, there is no precise definition of what pace of inflation deceleration can be considered convincing and considerable. On the grounds of such speculations, traders will have to draw the conclusion about what further moves will be implemented by the Federal Reserve and the Bank of England at the nearest meetings. That's why we can expect any response from the market. Only a variant of a strong decline in inflation in the US and the UK could be clear-cut bearish for these currencies.

GBP hurt by ailing UK economy

The thorny issue in the UK is not only high inflation but also the ailing economy. Indeed, the domestic economy has not recovered in full yet after the Brexit and pandemic. Representatives of the Bank of England have acknowledged this openly. All in all, the Kingdom has been going through a challenge which comprises simmering inflation, limping economy, the cost-of-living crisis, a decline in investments, and high borrowing costs.

The hawkish Bank of England has enough leverage to save the pound sterling. Nevertheless, the regulator will hardly be able to raise interest rates as long as necessary. The central bank is likely to moderate the pace of rate hikes in the nearest months. Apart from this, we should not forget that the UK has got stuck in a grave political crisis for a few years. The crisis has been put on a back seat after Rishi Sunak was elected the Prime Minister, but still more and more Britons express discontent. More than 6 years have passed since the Brexit referendum, but citizens haven't realized the upside of the exit from the EU. The pandemic overshadowed the gravity of the post-Brexit development. Importantly, the government led by Boris Johnson failed to tackle the pandemic crisis properly. A new economic crisis, elevated taxes, and soaring inflation are derailing economic growth. Such headwinds affect the political ratings of the Tories. They could lose the next Parliamentary election. Their rivals, the Whigs, could take over the power.

The issue with Scotland also remains open. London, of course, will never voluntarily give a new permit for a referendum, but Edinburgh, led by Nicola Sturgeon, is not going to give up. If the first Premier of Scotland is counting on official permission from London, then we would say that the chances of maintaining the integrity of the United Kingdom are great. However, don't forget that Sturgeon pledged the Scottish people a referendum. This was the essential vow of her campaign. If Nicola Sturgeon doesn't keep the pledge, she is unlikely to win the next election.

The economy is closely interwoven with politics. The pound sterling has slumped twice against the US dollar since 2007. On the one hand, we could predict that the sterling is completing its global downtrend. On the other hand, the pound finds it hard to assert strength amid the current fundamental background which has been shaped in recent years. The outlook for the sterling is bleak both in the long term and short term.

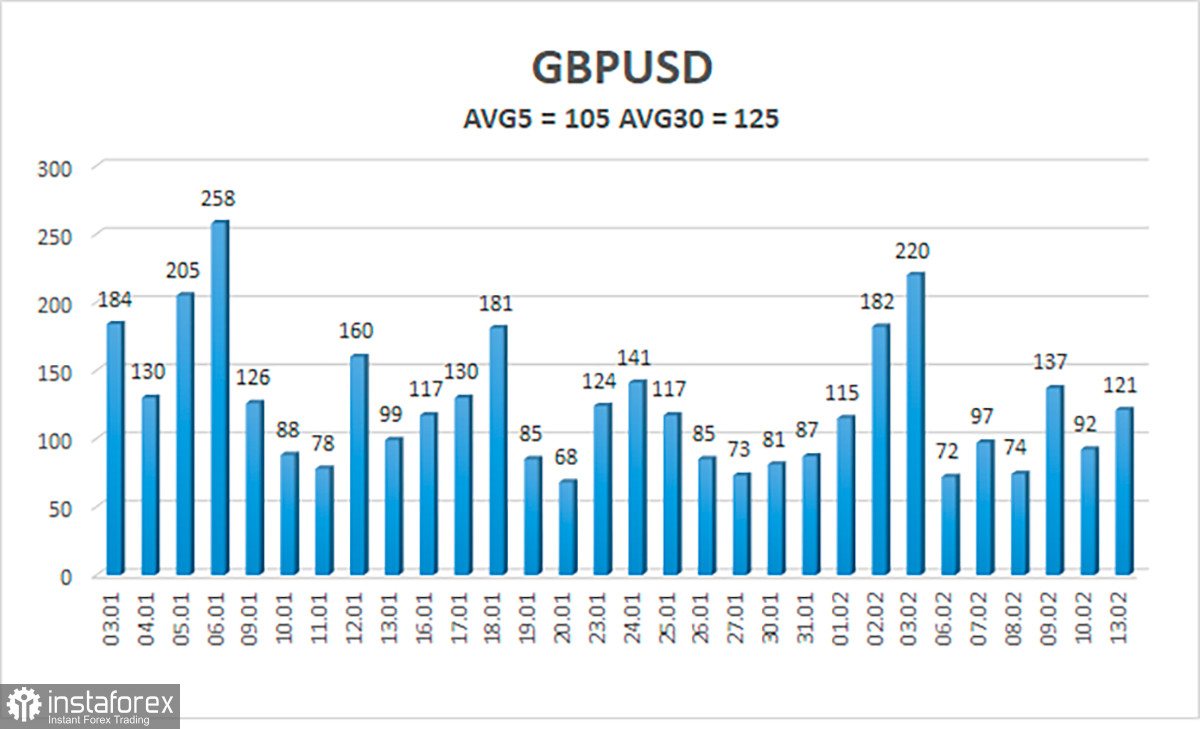

The average volatility of GBP/USD measured 105 pips in the last 5 trading days. It is a historically median value for the currency pair. On Tuesday, February 14, we expect the instrument to trade within the corridor between 1.2038 and 1.2248. If the Heikin-Ashi indicator reverses down, this will signal a resumption of the downward move.

Nearest support levels

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading tips

GBP/USD is still trading lower on the 4-hour chart despite the fact that the price has passed a moving average. Now we can plan new short positions with downward targets at 1.2024 and 1.1963 after the price settled below the moving average. Long positions with the target at 1.2207 could be opened, BUT in case the Heikin-Ashi indicator reverses, long positions should be closed manually.

Comments on charts:

Linear regression channels help to determine the ongoing trend. If both channels point in the same direction, a strong trend is unfolding now.

The moving average (settings 20.0, smoothed) determines the short-term trend and the direction in which you should now trade.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are a likely price channel in which the pair will trade in the nearest 24 hours, based on current volatility indicators.

The CCI indicator. Its entry into the oversold area (below -250) or overbought area (above +250) means that the price is about to reverse in the opposite direction.