Equity markets rose markedly at the end of Monday's trading, reflecting continued hopes that today's inflation data in the US will once again show a smooth decline. Forecasts have said that year-to-year CPI will fall to 6.2% in January, while on a monthly basis, it will rise by 0.5%. Underlying CPI may also adjust to 5.5% y/y and 0.4% m/m.

Seeing such data will certainly raise demand for stocks as it will convince investors that the Fed will take a pause in raising interest rates at least until May. And if in March and April the fall in inflation continues, the central bank might not resume the hike at all.

Of course, in the wake of such events, there could be renewed decline in Treasury yields, which will put pressure on dollar. However, the currency will fall against other major currencies only if other global central banks pursue a further tightening of monetary policies. That will not last long though as thre is mutual influence between the US and Western economies.

Forecasts for today:

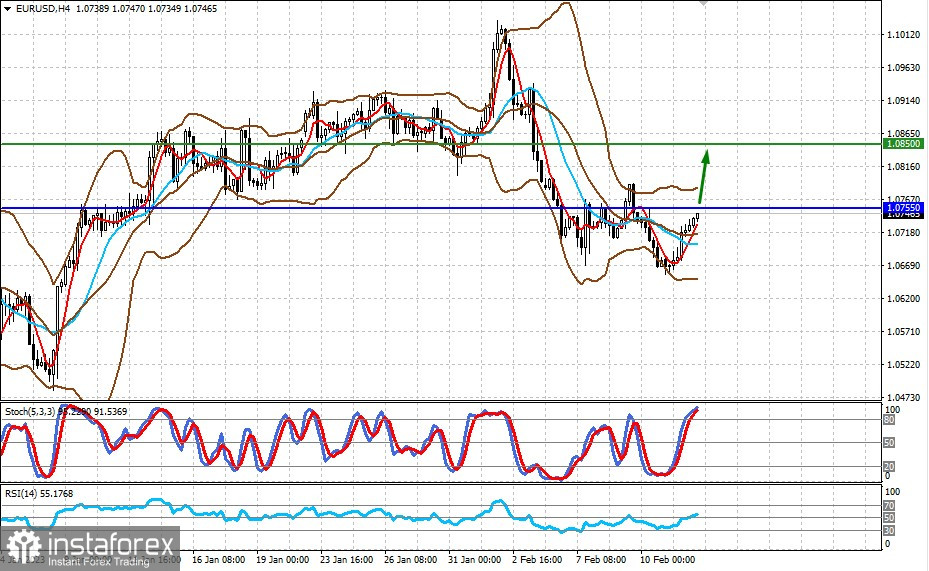

EUR/USD

The pair could gain notable local support on the back of a further decline in US inflation. Overcoming the level of 1.0755 could strengthen this growth and lead the pair to soar to 1.0850.

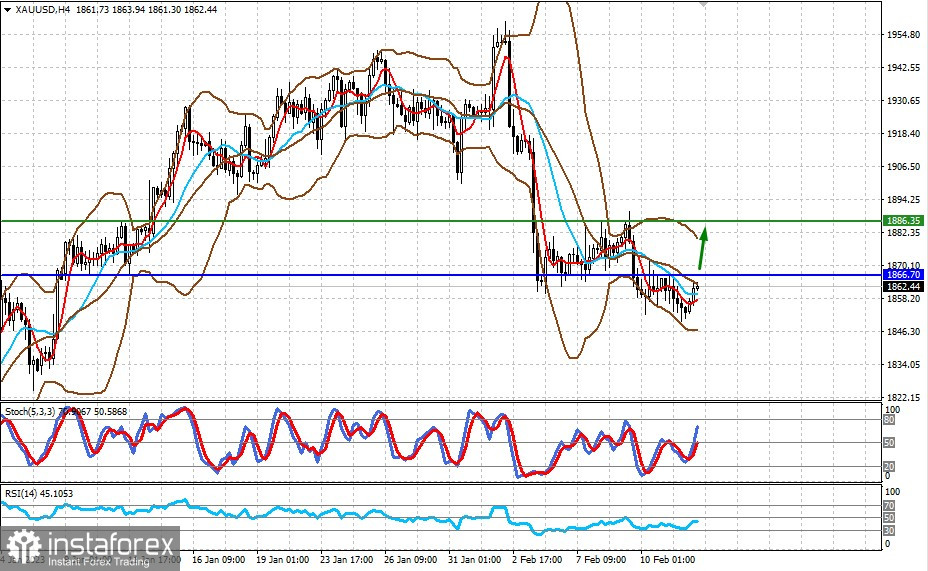

XAU/USD

A weaker dollar should support gold prices, pushing push it up towards 1886.35 after surpassing 1866.70.