The situation in the cryptocurrency market is gradually moving into the stage of consolidation movement with increasing volatility. As a result, the price of BTC produces sharper and deeper movements, as happened on Monday.

The corrective movement of Bitcoin continues to intensify and is supported by external fundamental factors. The price reacts weakly to the aggressive policy of the SEC, but the facts suggest that market sentiment is deteriorating and trading volumes are falling.

Factors affecting the crypto market

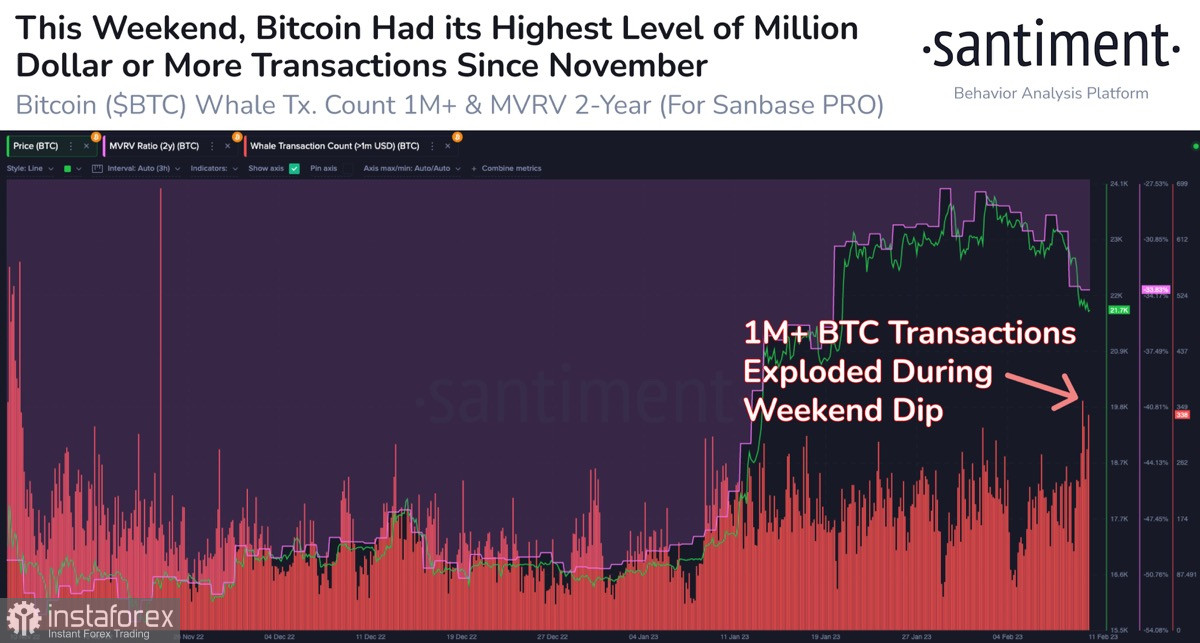

Analysts at Santiment recorded a sharp increase in the volume of "whale" transactions over the weekend. It can be assumed that most of the transactions were related to a set of positions, but given the subsequent price decline, there is also a possibility of profit taking.

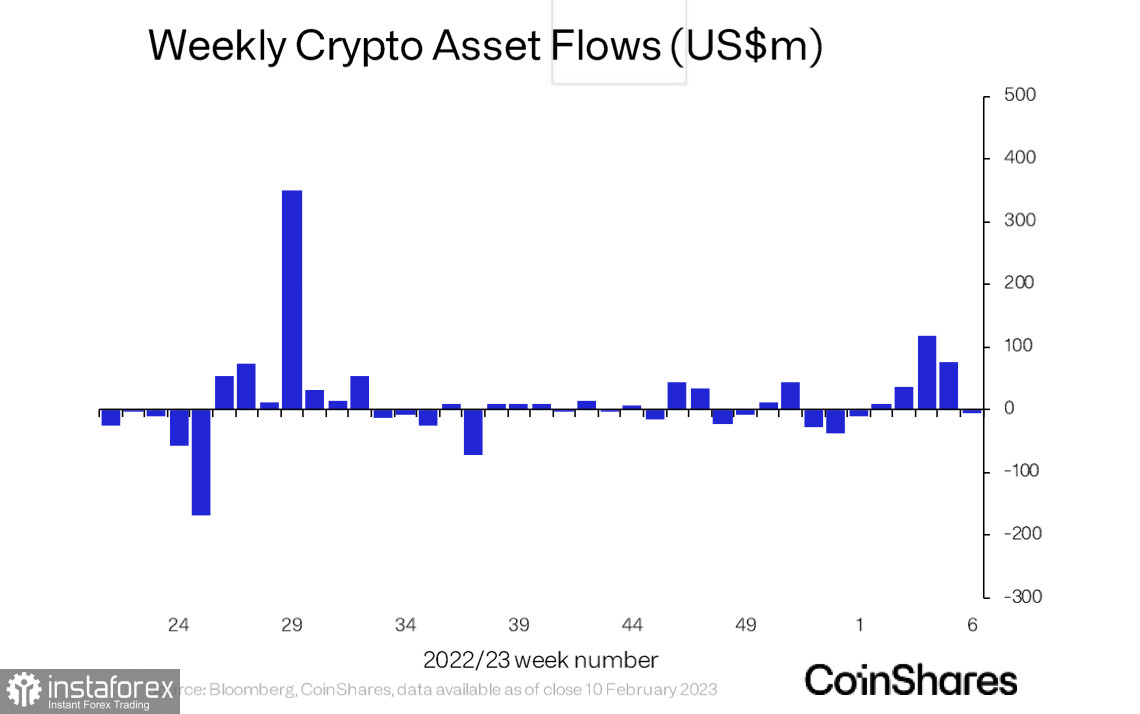

In addition, CoinShares experts recorded an outflow of funds from crypto products in the amount of $7 million after two weeks of solid inflows. This also indicates a deterioration in market sentiment, which will affect trading volumes and the movement of the BTC price.

The BUSD scandal is still raging and the stablecoin has already lost its peg to the U.S. dollar amid sharp negative statements. At the same time, it is worth noting that Bitcoin behaves with restraint and does not show a clear decline against the backdrop of this news, which indicates the formation of a bullish margin of safety.

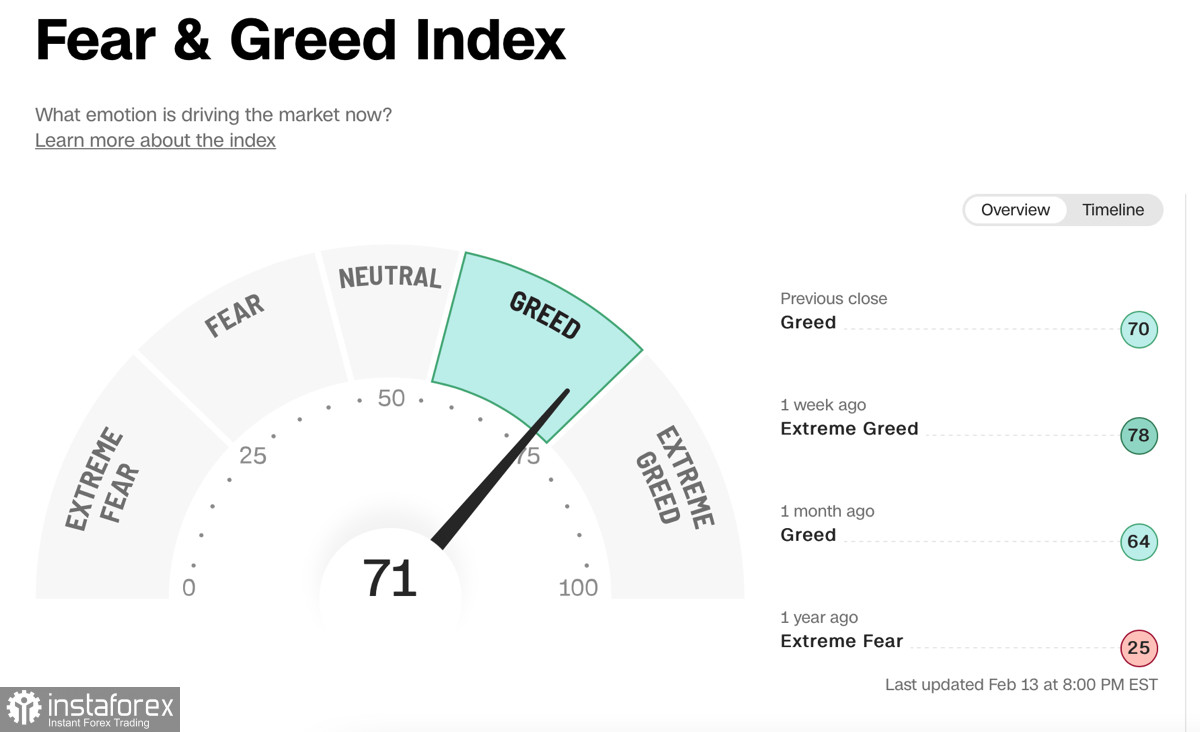

However, the second part of February risks becoming a difficult period for the stock market. According to the latest data, the fear and greed index in the stock market remains at the "greed" level. However, there is every reason to believe that the indices will begin to decline in the near future.

This is primarily due to the growing correlation between the shrinking Fed balance sheets and SPX price action. Bank of America said this week that the U.S. system is again experiencing a decline in liquidity. Given this, we should expect a decrease in the SPX indices and cryptocurrencies.

Also, Carlson analysts say that February is a historically weak month for U.S. stocks. Multinational banks continue to publish pessimistic forecasts about stock indices, but the only thing that we saw in the first half of February was a less confident movement in SPX.

However, the resumption of the Fed's balance sheet reduction process may affect the quotes of the stock index. In this case, a similar movement awaits Bitcoin.

BTC/USD Analysis

Bitcoin continues to move within the $21.3k–$21.9k range. As a result of yesterday, the bears significantly increased pressure and managed to push the price of BTC/USD to the support level of $21.3k. Thanks to the activation and confident repurchase by buyers, the asset ended the trading day with doji candles.

A confident buyback may indicate a gradual completion of the consolidation and the resumption of the upward movement of Bitcoin. As of writing, technical indicators of the cryptocurrency continue to move in a flat direction, but the situation may change ahead.

Despite the ambiguous situation in the stock market, Bitcoin can enlist the support of the SPX index with appropriate events. Today at 12:30 UTC, inflation data will be released. Yesterday, the final forecast was formed in the region of 6.2%.

If the indicator falls below this mark, the market may react with an impulse growth. Considering the BTC consolidation preceding the publication of the CPI, the likelihood of an impulsive price movement is high.

Results

Bitcoin remains closely associated with stock indices, which will gradually go into a corrective peak. Forecasts of SPX falling to $3,600 raise questions, but in the event of any corrective movement of funds, BTC will also decline.

As for the short-term outlook, an option with an upward spurt of 1-2 days to the levels of $22.8k–$23.4k is possible. However, market sentiment is changing and the stock market is approaching the start of a correction, so BTC is not expected to rise above $25k in the medium term.