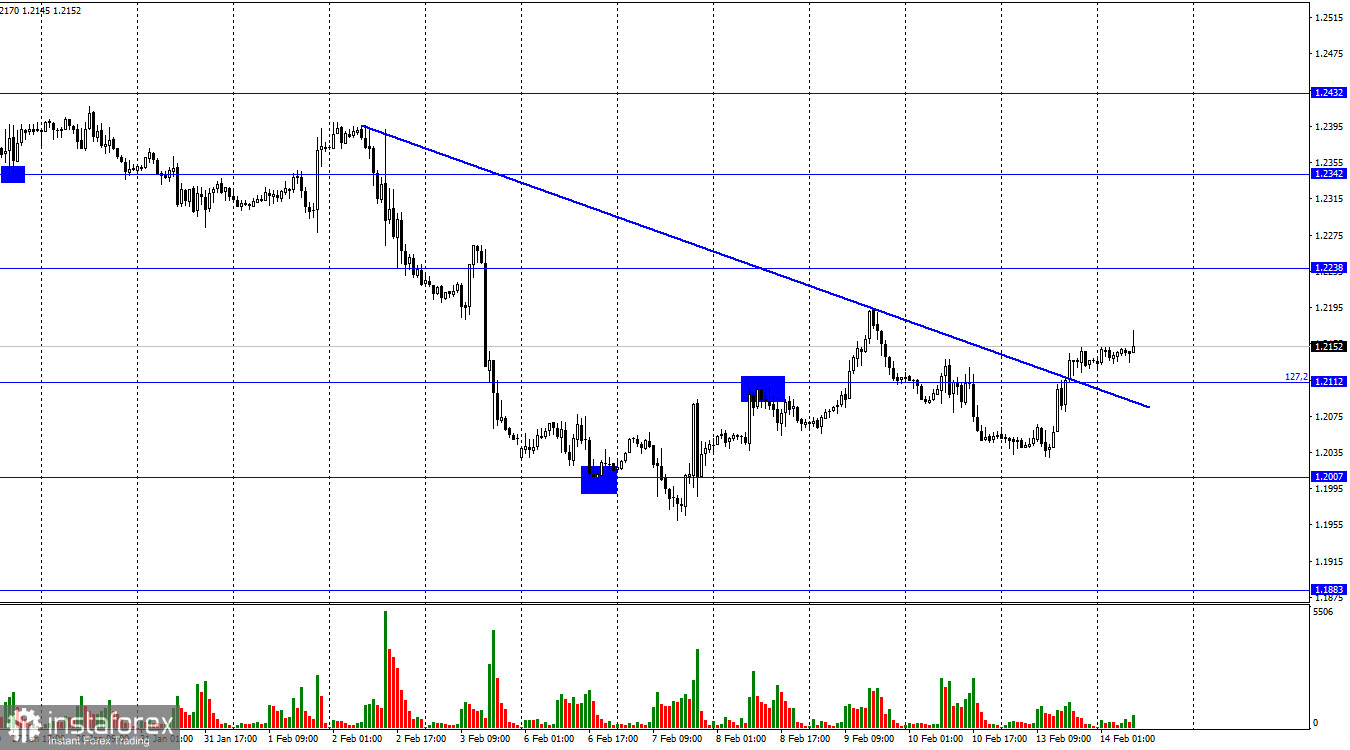

On Monday, the GBP/USD pair conducted a consolidation above the correction level of 127.2% (1.2112), and above the falling trend line, according to the hourly chart. The trading mood has now turned "bullish," and growth can now proceed in the direction of the level of 1.2238. The bears may once more regain the initiative, though, when a report on inflation in the United States is published today in the afternoon. There is reason to believe that it will be incredibly surprising. But before we get too far, let's think about the reports that were released in Britain this morning.

At the end of December, the unemployment rate was 3.7%, remaining unchanged from November. The fact that the unemployment rate did not go to 3.8% as some experts had predicted is undoubtedly excellent news for the British pound. In December, average earnings increased by 5.9%, which is less than anticipated, while bonus payments surged significantly, by 6.7%, above traders' expectations. The British pound gained strength as a result of the economic statistics package, but things could change later in the afternoon. A sudden increase in US inflation could lead to a significant strengthening of the US dollar.

Even though the reports that were released today in the UK are significant, traders do not now place a high priority on them. This week's speeches by FOMC members are far more significant, particularly those that come after the publication of the inflation data. Especially if unexpected results about inflation are revealed. And tomorrow, an inflation report will be presented in Britain. From this report, it is very difficult to expect shocks, as in the UK, the absence of any growth or reduction is not a surprise. The Central Bank is currently powerless to stop the country's high level of inflation.

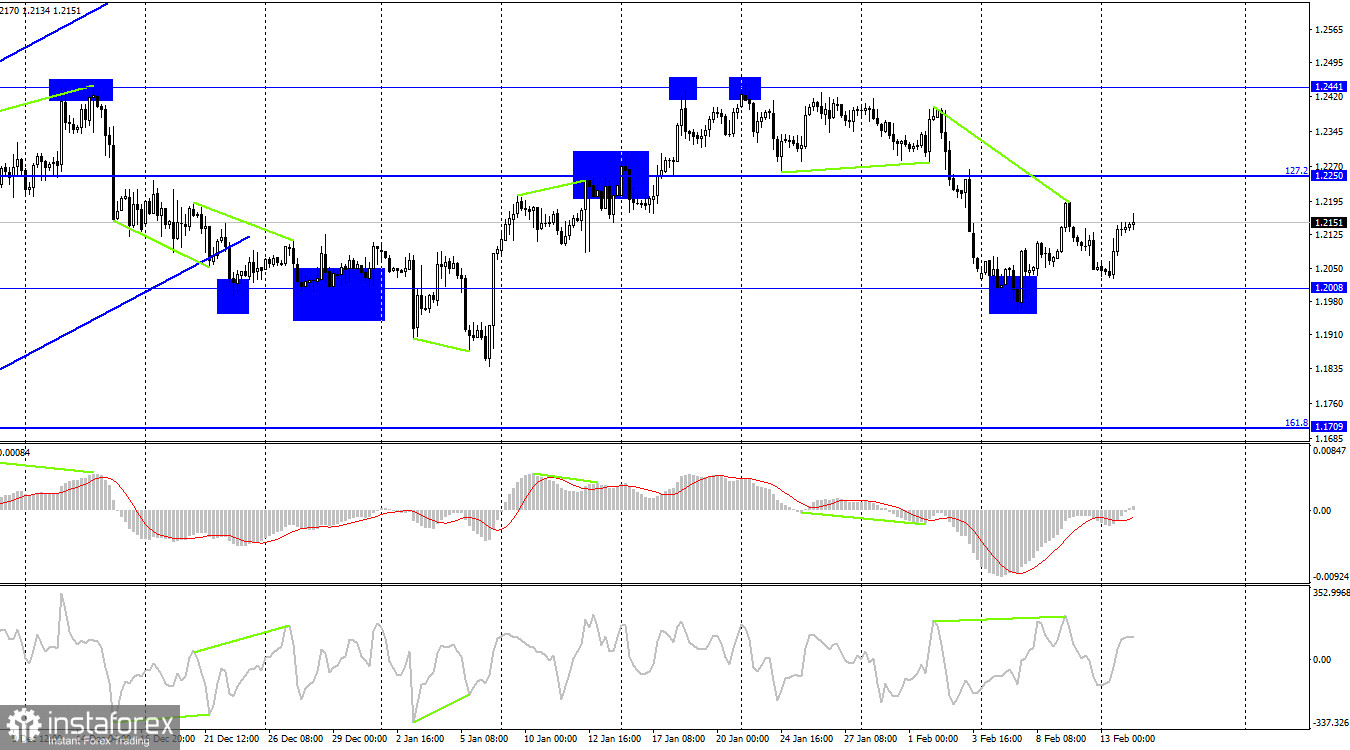

The pair reversed on the 4-hour chart in favor of the British pound, and growth in the direction of the corrective level of 127.2% (1.2250) started. The US dollar will benefit from the return of prices from this level and a new decline in the direction of the 1.2008 level. No indicator today shows any new emerging divergences. The likelihood of continued growth toward the next level of 1.2441 will increase if the pair's rate is closed above the level of 1.2250.

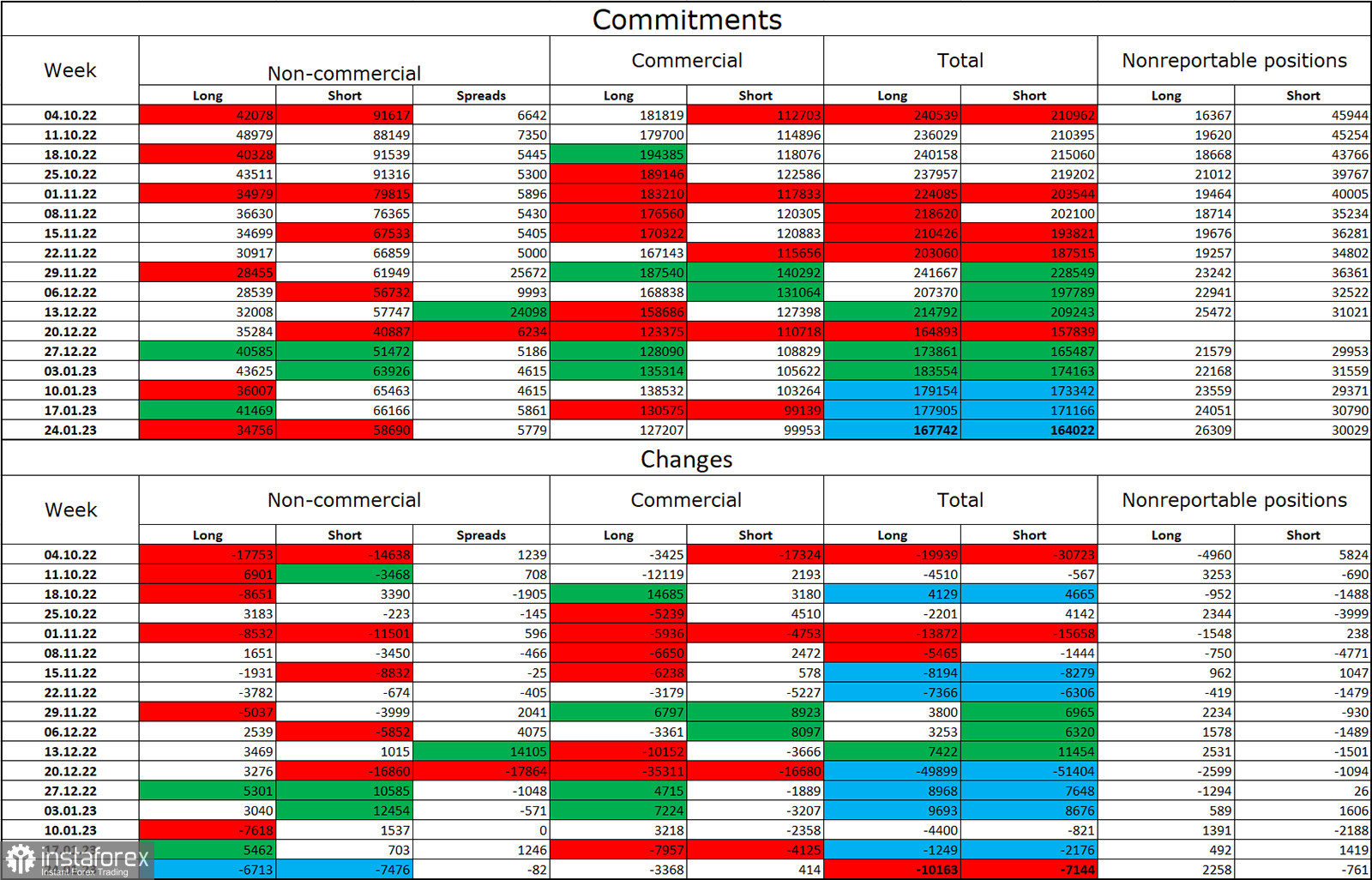

Report on Commitments of Traders (COT):

In comparison to the previous reporting week, the sentiment among traders in the "Non-commercial" category has grown less "bearish." The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators is nearly doubled once more. As a result, the outlook for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. An exit from the three-month upward sector was visible on the 4-hour chart, and this development may have stopped the pound's growth.

News calendar for the USA and the UK:

UK – unemployment rate (07:00 UTC).

UK – change in average wages (07:00 UTC).

US – consumer price index (CPI) (13:30 UTC).

The most significant report, American inflation, is the only one still available to traders on Tuesday after other UK figures were been made available. The background news can have a significant impact on how traders feel the rest of the day.

Forecast for GBP/USD and trading advice:

When the British pound recovers from the levels of 1.2238 or 1.2250, new sales can be initiated with targets of 1.2112 and 1.2007. On the hourly chart, I suggested purchasing the pair with a target price of 1.2238 when it closed above the trend line. This agreement may now be maintained, at least through the US inflation report.