You require the following to open long positions on the GBP/USD:

I focused on the level of 1.2186 when I made my morning forecast and suggested trading actions based on it. Let's take a look at the 5-minute chart and see what happened. Despite the pound's rise to 1.2186, it did not test this level for the first time, and following positive data indicating a good UK employment market, a breakdown of 1.2186 occurred, so I did not wait for signs to enter the market. The technical picture has been updated as a result.

Everything in the United States is dependent on inflation, and whether the British pound increases in the afternoon or declines to near yesterday's lows depends on it. Strong data and growing US inflation will cause the pound to suddenly depreciate. So, based on the outcomes of the first half of the day, I will rely on the nearest support level of 1.2139. If a false one forms there, we may anticipate that the pound will strengthen and return to the area of 1.2198, which also developed during the European session. Weak US inflation statistics will cause consolidation and a top-down test of this range, providing yet another signal to start long positions with GBP/USD moving up to the maximum of 1.2255. An exit above this range will also create opportunities for growth above 1.2322, where I'll fix profits. The pressure on the GBP/USD will rise significantly if the bulls are unable to complete the duties assigned and miss the price target of 1.2139, leaving everything up to US inflation. In this situation, I urge you to wait before making any purchases and only start long positions close to the next support level of 1.2085, just above which the moving averages cross. I'll buy GBP/USD right away only if it recovers from 1.2033 in the hopes of a correction of 30-35 points during the day.

You require the following to open short positions on the GBP/USD:

Bears remain passive, obviously waiting for compelling evidence of a price increase in the US in January of this year. Protecting the new resistance of 1.2198 is a crucial responsibility. A sell signal with a significant movement of GBP/USD down to the area of 1.2139 (intermediate support) where bulls will attempt to enter the market would be possible with just one more formation of a false breakdown there in the afternoon following the release of the CPI index data. If we do not see active growth from this level, I anticipate a breakout and a reverse test from the bottom up, canceling all purchasers' plans for ongoing growth, strengthening the position of bears in the market, and establishing a sell signal with a fall below 1.2085. The 1.2033 level will be the farthest target, and any updates there will signal a potential return of the bear market. I'll set the profit there. The strength of the bulls will be felt with the possibility of a GBP/USD rise and the lack of bears at 1.2198 during the American session, which is most likely to occur. In this instance, the only entry point for short positions is a false breakdown in the area of the following resistance level of 1.2255. In the absence of activity, I will sell GBP/USD as soon as it reaches its highest level of 1.22320, but only if I believe the pair will decline by 30-35 points during the day.

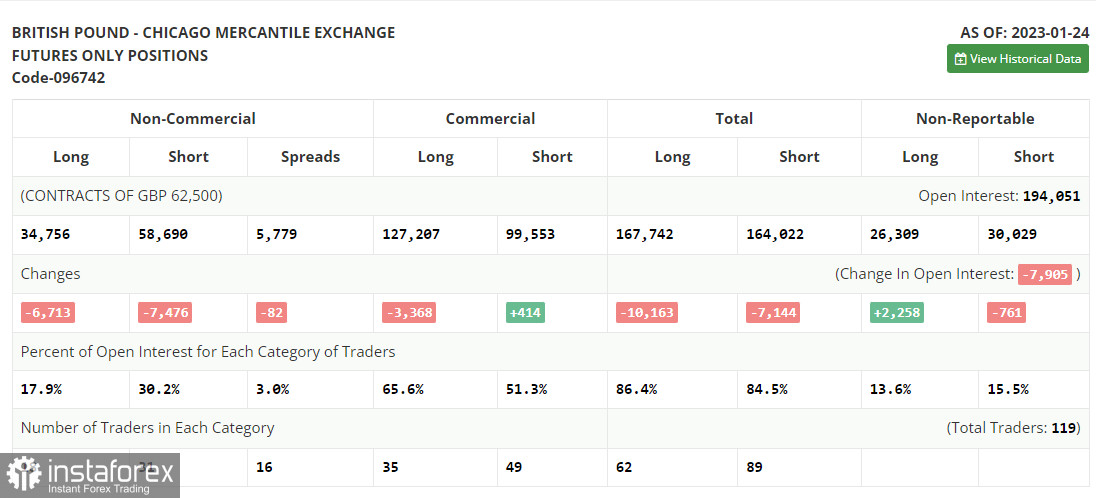

The CFTC has been experiencing a technical issue that has prevented the publication of new COT reports for more than two weeks. The most recent statistics only covered January 24.

Both long and short positions were dramatically reduced in the COT report (Commitment of Traders) for January 24. However, given the difficulties the UK government is now facing, including dealing with strikes and demands for wage increases while also attempting to achieve a continuous fall in inflation, the recent reduction was within the acceptable threshold. But for the time being, all of this is receding into the background as we await the meetings of the Federal Reserve System, whose policy is anticipated to be less aggressive, and the Bank of England, whose pronouncements are certain to keep an aggressive tone by raising the rate by 0.5% once more. All of this will benefit the British pound, therefore I'll wager on it strengthening even more, unless, of course, something extraordinary occurs. According to the most recent COT data, long non-commercial positions declined by 6,713 to 34,756 while short non-commercial positions decreased by 7,476 to 58,690, resulting in a fall in the non-commercial net position's negative value to -23,934 from -24,697 a week earlier. We will continue to keep a careful eye on the economic indicators for the UK and the decision made by the Bank of England because such insignificant changes do not significantly alter the balance of power. In contrast to 1.2290, the weekly ending price increased to 1.2350.

Signals from indicators

Moveable Averages

Trading is taking place above the 30 and 50-day moving averages, which suggests that the pound will continue to rise.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.2220, will serve as support in the event of a downturn.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.