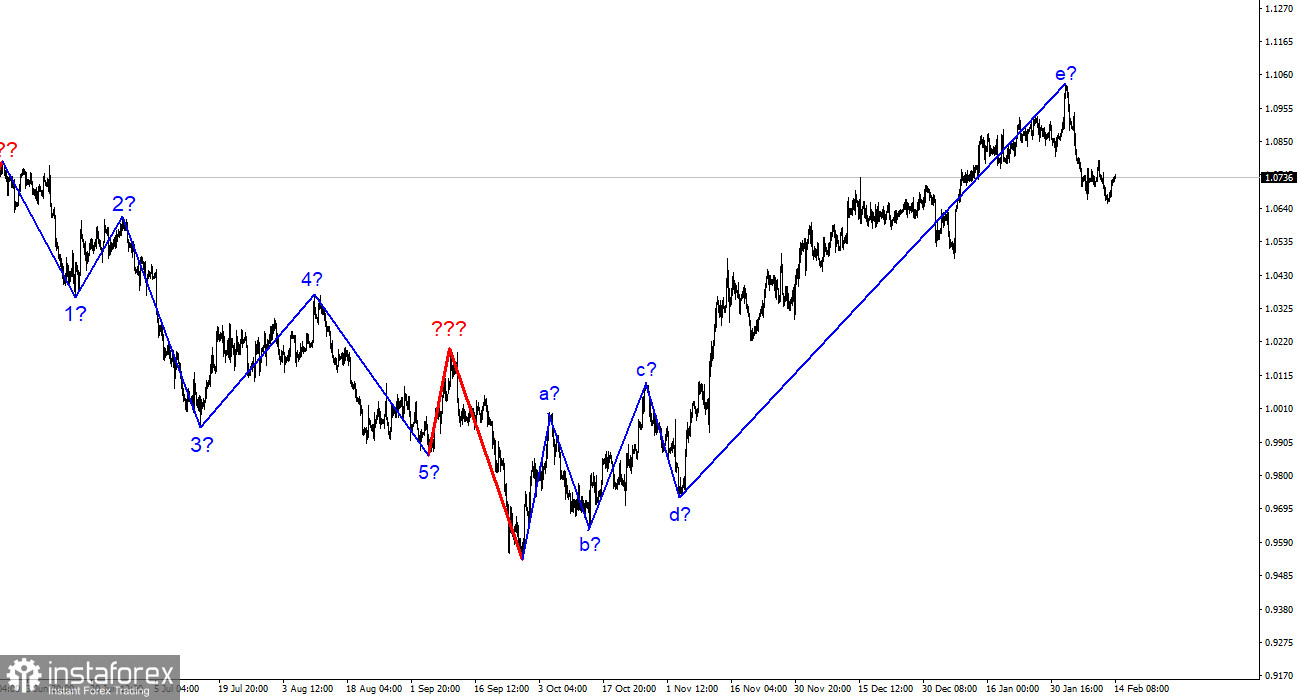

The 4-hour chart for the euro/dollar pair still shows the same wave structure, which is excellent because it allows us to predict how the situation will play out. Although its size would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this structure's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro currency was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to deviate marginally from previously reached peaks. The US currency did, however, manage to escape market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new negative trend section, which I was simply hoping for. I hope that the current news environment and market sentiment will not prevent the formation of a downward series of waves this time.a

The US inflation rate is declining, but it's already a lot lower.

On Tuesday, there was a noteworthy increase in the movement of the euro/dollar pair, and it had a quite high amplitude. The value of the euro rose by 55 basis points. The European Union presented a report on GDP in the fourth quarter this morning. It indicated an increase of 0.1%, which is consistent with the indicator's preliminary estimate that was made public a month earlier. As a result, this report can be forgotten because the market has no justification for responding to it. The US just released a report on January's inflation, and at this point, we should instantly note the entire intermission. There were disagreements in the market before the publication of this report. According to some observers, the rate of inflation will stop decreasing. Some analysts anticipated that the decrease would accelerate. This would determine the Fed's monetary policy decisions in the future.

The consumer price index continued to slow down, but much weaker than anticipated and far weaker than the pace of December or November, proving that both the first and the second predictions were incorrect. Core inflation dropped from 5.7% to 5.6% while overall inflation dropped from 6.5% to 6.4% y/y. These numbers, in my opinion, are essentially the same as no slowing at all. Overall, the report did not provide a solution to the query of what pair dynamics to anticipate in the near future. The wave analysis predicts a further decrease, although, within the context of the corrective upward wave, quotes may continue to diverge from the established low. Even yet, it can't stay for too long because the first wave wasn't deep enough to justify waiting for a powerful corrective wave. I keep moving forward from the wave markup because of everything mentioned previously. The eagerly anticipated American inflation report did nothing to benefit the euro or the dollar.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. However, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend segment. The likelihood of an even bigger complication of the upward trend segment still exists.

On the older wave scale, the ascending trend section's wave analysis has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The negative section of the trend is already taking shape and can have any form or extent.