On Wednesday, the key report of the week - US consumer inflation for January - was released. The consumer price index stood at 6.4% y/y, slightly above consensus estimates of 6.2%, while core inflation came in at 5.6% (against a forecast of 5.5%). Compared to December, inflation still eased, but the pace of its decline slowed down to the lowest level.

After a short period of increased volatility, market participants concluded that the released data would force the Fed to raise interest rates further. Yields rose, while stock indices reacted mixed.

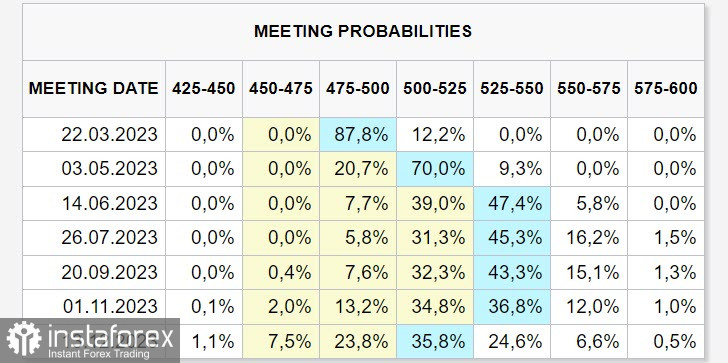

Notably, a decline in prices initiated three months ago was primarily due to a pullback in energy prices after their steep gains, which helped stabilize commodity prices. As for inflation in the services sector, it is not in a hurry to slow down. The situation with the construction sector and housing prices is similar. "Inflation is normalizing but it's coming down slowly," Federal Reserve Bank of Richmond President Thomas Barkin was forced to admit, commenting on the data received. The forecast of the Fed's interest rate through futures trading points to a shift in the range of 5.25-5.50% by June, while markets expect the cycle reversal to begin in December.

According to the market reaction, the current environment contributes to a possible rise in the dollar.

NZD/USD

Australia and New Zealand Banking Group released its quarterly economic outlook consisting of several key markers. ANZ sees inflation peaking, domestic indicators point to weakening consumer demand, and the labor market shows signs of weakening after a fairly long period of growth. All this makes investors think that the regulator will slow down the pace of interest rate increases.

ANZ sees a 50-basis-point rate hike in February followed by two more 25-basis-point rate increases. As a result, the rate is expected to peak at 5.25%. In the second half of the year, the central bank is forecast to start cutting rates.

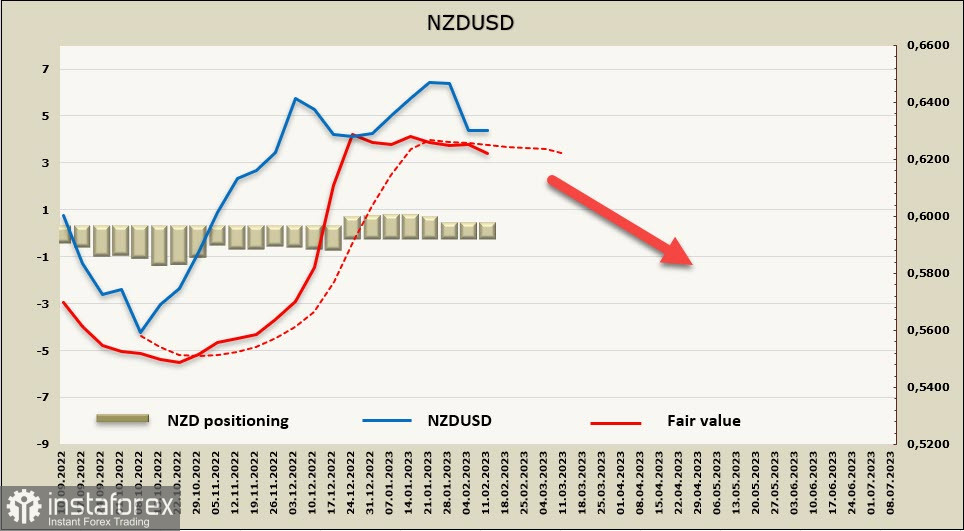

This forecast is likely to put pressure on the currency. A few months ago, the forecast for the RBNZ peak interest rate was above the forecast for the Fed rate. That is, expectations for the yield differential were in favor of the kiwi, which paved the way for a rise in the NZD/USD pair. Now we see the whole thing flipping. Market sentiment is changing from bullish to bearish. There is a week left before the RBNZ meeting. Thus, the kiwi will most likely spend it under pressure.

In the absence of CFTC data, the estimated price turned negative. This means that those components of the calculations that are tied to the dynamics of stock indices and government bond yields of key countries show a redistribution of financial flows in favor of the dollar.

The NZD/USD pair pulled back from highs after the FOMC meeting and then spent some time in the consolidation zone. Thus, there is a likelihood that the pair will extend losses. The price is expected to test the nearest support level of 0.6265 and then 0.6186. This is currently the most likely scenario. An upward pullback is limited by the 0.6384 mark. A return to this level is unlikely. The pair's attempts to gain value can be used for entering the market with short positions.

AUD/USD

The Australian economy looks more stable than the economy of New Zealand. The National Australia Bank (NAB) Business Confidence Index rose to 18 in January from 13 points, while Australia's NAB business confidence index rose to 6 from 0. This is primarily due to an easing of virus curbs in China, which contributes to a recovery in energy demand from Chinese companies. This in turn will lead to an increase in exports in Australia.

The NAB report contrasts with the Westpac-Melbourne Institute consumer sentiment index released a day earlier. The latter slid by 6.9% in February, erasing a 5.0% bounce in the previous month. This further confuses the situation.

Data on employment for January will be published on Thursday morning. Forecasts are neutral. Traders may also take notice of the Melbourne Institute's survey of consumer inflationary expectations. This data may have an impact on the RBA rate forecast and cause a slight increase in market volatility.

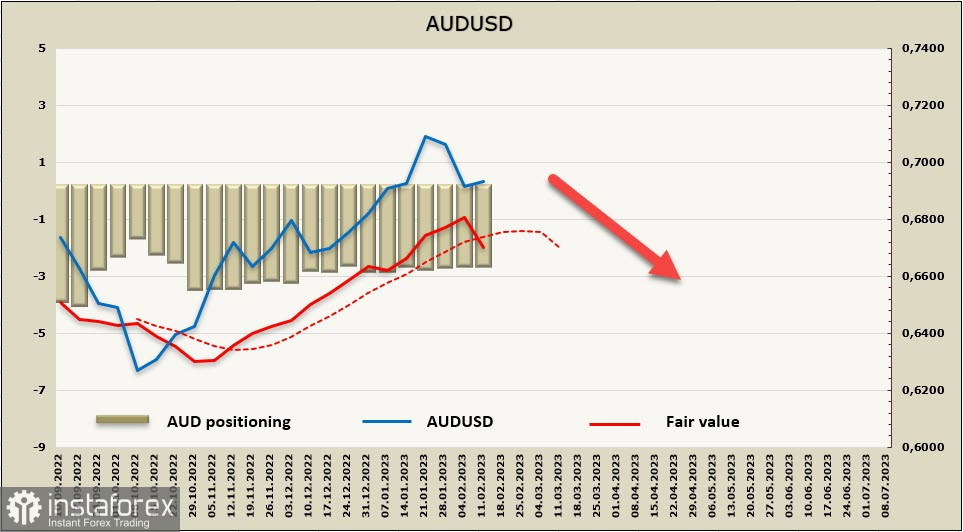

Markets now price a terminal RBA cash rate of 4.14% in August, from 3.72% ahead of the February meeting. Nevertheless, the revised outlook is unlikely to act as a driving force for the Aussie as the Fed's rate forecast has risen to 5.5% from 5%. Perhaps the situation will change this week as Reserve Bank of Australia Deputy Governor Philip Lowe is set to speak twice before parliamentary committees.

In the absence of CFTC data, the estimated price of the Australian dollar turned negative along with the kiwi.

According to forecasts, a return to 0.7030 is unlikely. The nearest support is 0.6010/20. The next support levels are 0.6890 and 0.6860. The area of 0.6770/90 can be seen as the main target. The Aussie is expected to trade downwards unless it is supported by the news from China, the main trading partner.