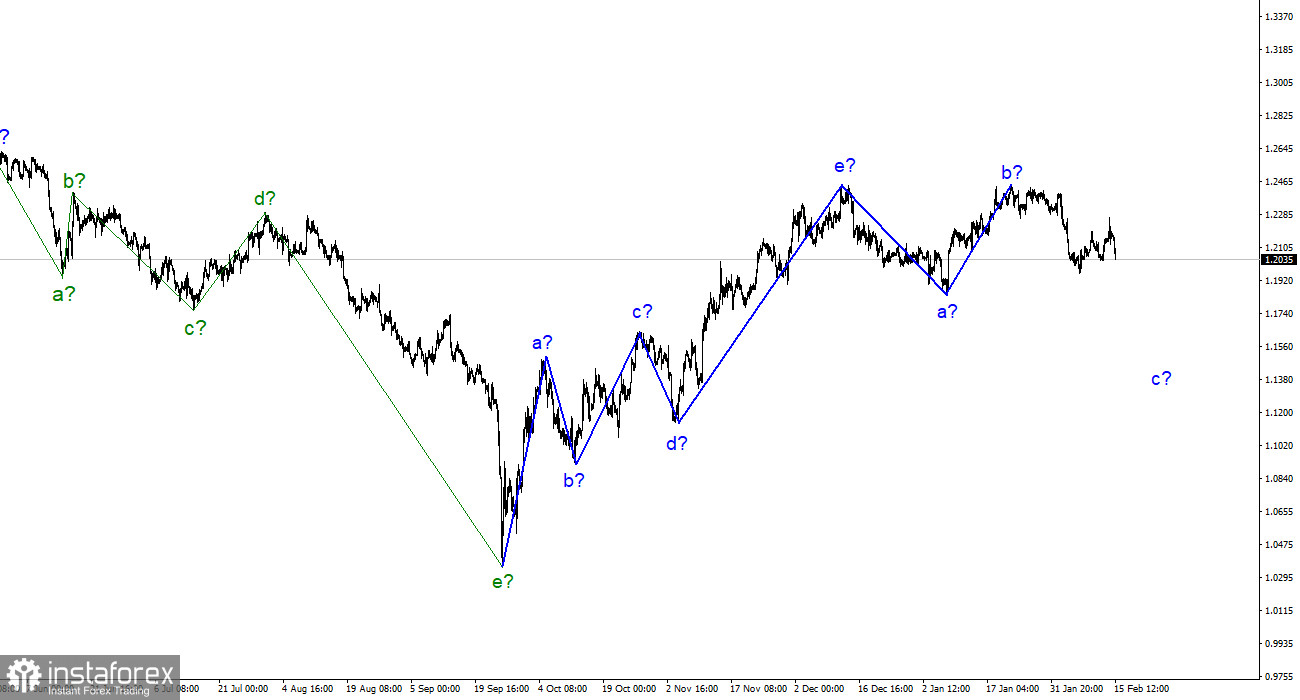

The wave pattern for the pound/dollar pair now appears fairly confusing, but it does not call for any clarifications. The wave analyses for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I anticipate that the downward section of the trend has started to take shape; it will at least have three waves. Wave B appeared to be unnecessarily long, but it did not cancel. Therefore, it is now anticipated that a wave has started to form with a downward trend section, the targets of which are situated below wave a's low. The value would be at least 200–300 points less than it is at the moment. Although it's too soon to speculate, I believe wave c may end up being deeper and that the entire downward section of the trend may potentially adopt a five-wave pattern. It took a long time for the pair to start moving quotes away from the peaks reached, although it had been on the verge of restarting the development of an upward trend section. Because wave c hasn't finished yet, the low of assumed wave a hasn't been broken.

The British pound was not supported by inflation.

On Wednesday, the exchange rate for the pound/dollar pair decreased by 125 basis points, and such a drop could only be explained by one thing. When the UK announced inflation data in January, the decrease in pound demand started early in the day. It was revealed that the indicator decreased from 10.5% to 10.1%, and this change is analogous, in my opinion, to the reduction in inflation in the United States. This means that it is still utterly unclear if the consumer price index is falling quickly as Andrew Bailey predicted or whether the normal slowdown is 0.2-0.3% each month and we will have to wait for a return to 2% for the next five years. In terms of annual growth, inflation has dropped by precisely 1% over the last three months. In other words, I lost roughly 0.3% monthly. And this is after 10 rises in the Bank of England rate, as well as accounting for the sharp drop in oil and gas prices, which had a significant role in the global acceleration of inflation. In the near future, I believe we should anticipate a slowing of the rate of decline, but we might also learn what the Bank of England will do. And if we don't learn quickly, we'll learn at the following meeting in a month.

One thing is certain: at this rate of fall, the Bank of England won't reach price stability for several years, at most. The need for the rate to keep rising by 50 basis points is likewise obvious as day. However, the rate has already increased to 4%, a high figure for Britain. According to Andrew Bailey, who recently stated that the recession will not be as severe as previously anticipated, it might still last for a long time and be severe. Or otherwise, the Bank of England will have to ignore the issue. The British pound has yet to benefit from these figures.

Conclusions in general

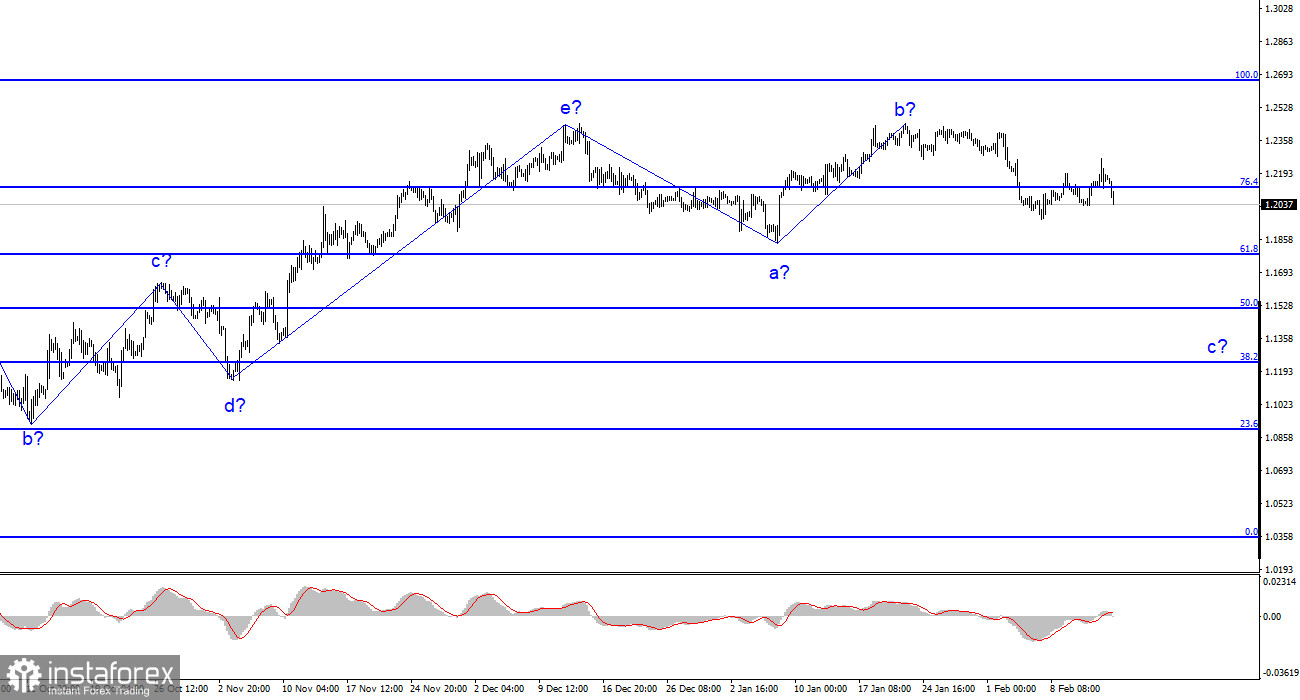

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave C could be shorter in duration, but for the time being, I anticipate a further 200–300 point decline.

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.