Analysis of the market situation:

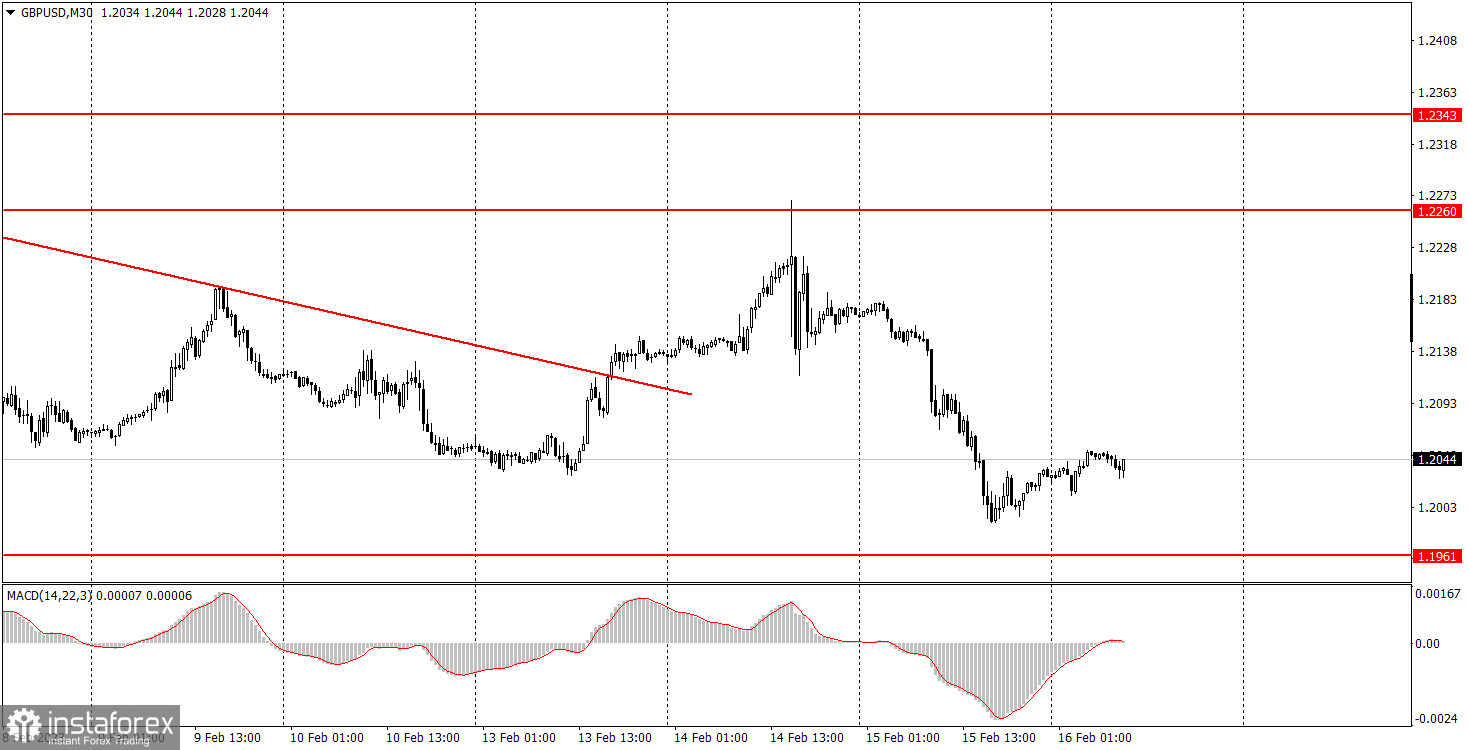

30-minute chart

Analysis of the market situation:

30-minute chart

On Wednesday, the pound/dollar pair dropped. It was falling all day. The decline began on Tuesday when the pair bounced off the level of 1.2260. There were some macroeconomic reasons for that. The UK published its inflation report, which unveiled a slowdown of 0.4% on a yearly basis. In fact, this slackening had neither a negative nor positive effect on the pound sterling. On the one hand, inflation has been falling for the third month in a row. This should cause a smaller likelihood of the aggressive monetary policy tightening by the BoE. On the other hand, inflation is still very high and the regulator has to continue to raise the key rate. However, the market supposes that the BoE will hardly raise the benchmark rate to 6%. This led to a drop in the pound sterling. We think that the British pound should continue losing value since it has gained a lot in recent months. Now, it needs correction.

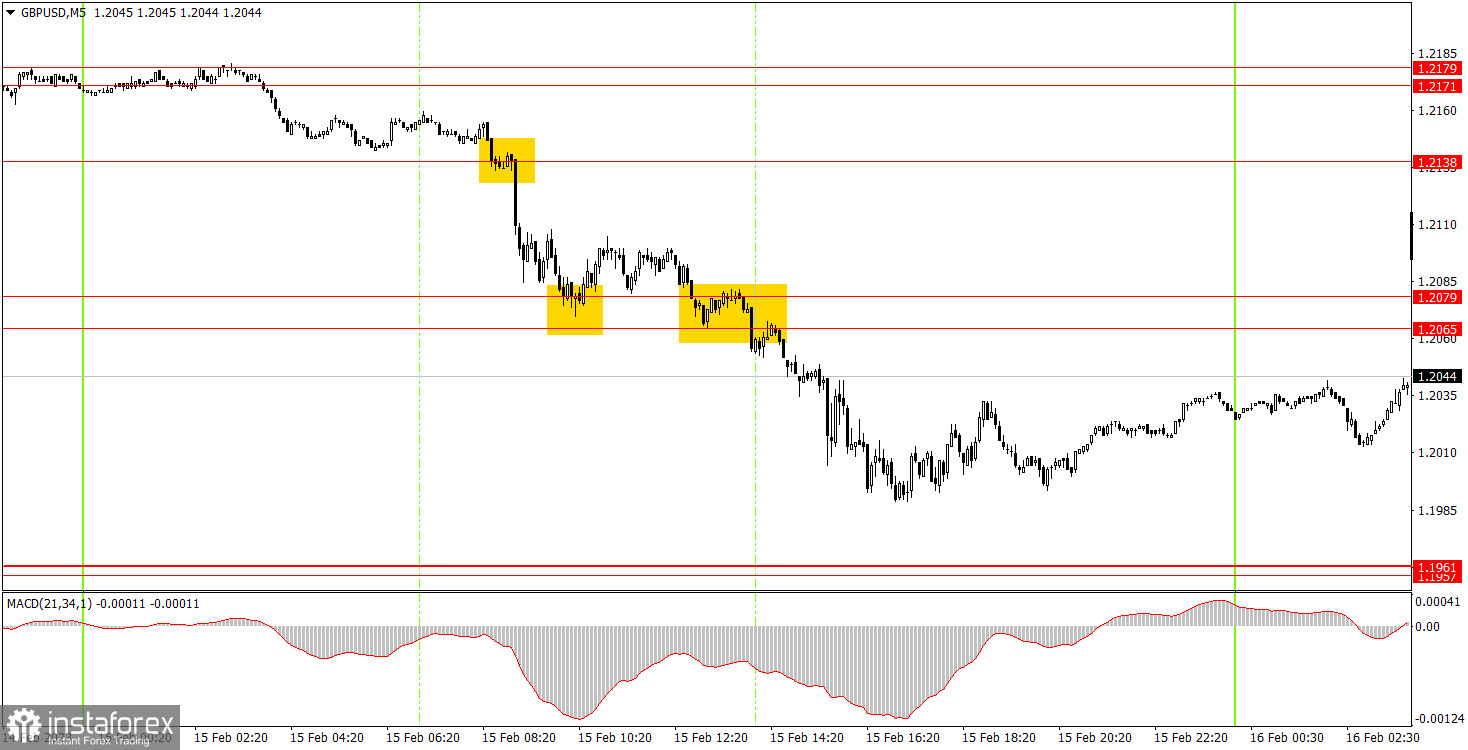

5-minute chart

Yesterday, the pair formed several trading signals in the 5-minute time frame. At first, the price settled below 1.2138, dropped to the area of 1.2065-1.2079, and bounced off it. Traders should have opened short orders to gain 20 pips. A buy signal turned out to be false as the price failed to climb by at least 20 pips. As a result, such positions were closed with losses. Then, traders got a sell signal. The pair passed the area of 1.2065-1.2079 and dropped by 40-50 pips. In general, there were two profitable trades and one trade closed with losses.

How to trade on Thursday

In the 30-minute time frame, the pound/dollar pair may resume the downward trend amid two cycles of the upward correction. Notably, the pair failed to overcome the level of 1.2260. All the most important reports of this week have already been published. Thus, the pair may show insignificant changes until the weekend. Tomorrow, on the 5-minute time frame, it is possible to trade at the levels of 1.1863-1.1877, 1.1950-1.1957-1.1961, 1.2065-1.2079, 1.2138, 1.2171-1.2179, 1.2245-1.2260. When the price moves by 20 pips in the right direction, traders could set a Stop Loss order at breakeven. There are no important publications and events scheduled for Thursday in the UK, and only minor reports will be released in the US. We do not expect a strong market reaction to the macroeconomic data today.

Basic rules of the trading system:

1) The strength of the signal is calculated by the time it took to generate the signal (rebound or a breakout of the level). The less time it took, the stronger the signal is.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In case of a flat movement, any pair can form a lot of false signals or do not form them at all. In any case, it is better to stop trading at the first signs of a flat movement.

4) Trades are opened in the time period between the beginning of the European session and the middle of the American session when all positions must be closed manually.

5) On a 30-minute time frame, signals from the MACD indicator can be traded only if there is good volatility and the trend is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered a support or resistance area.

What we see on the trading chart:

Support and resistance levels are targets when opening buy or sell orders. Take Profit levels can be placed near them.

Red lines are channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

The MACD indicator (14,22,3) is a histogram and a signal line. It is an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (you can find them in the macroeconomic calendar) can greatly influence the movement of a currency pair. Therefore, during the publication, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every position cannot be profitable. The development of a clear strategy and money management are the key to success.