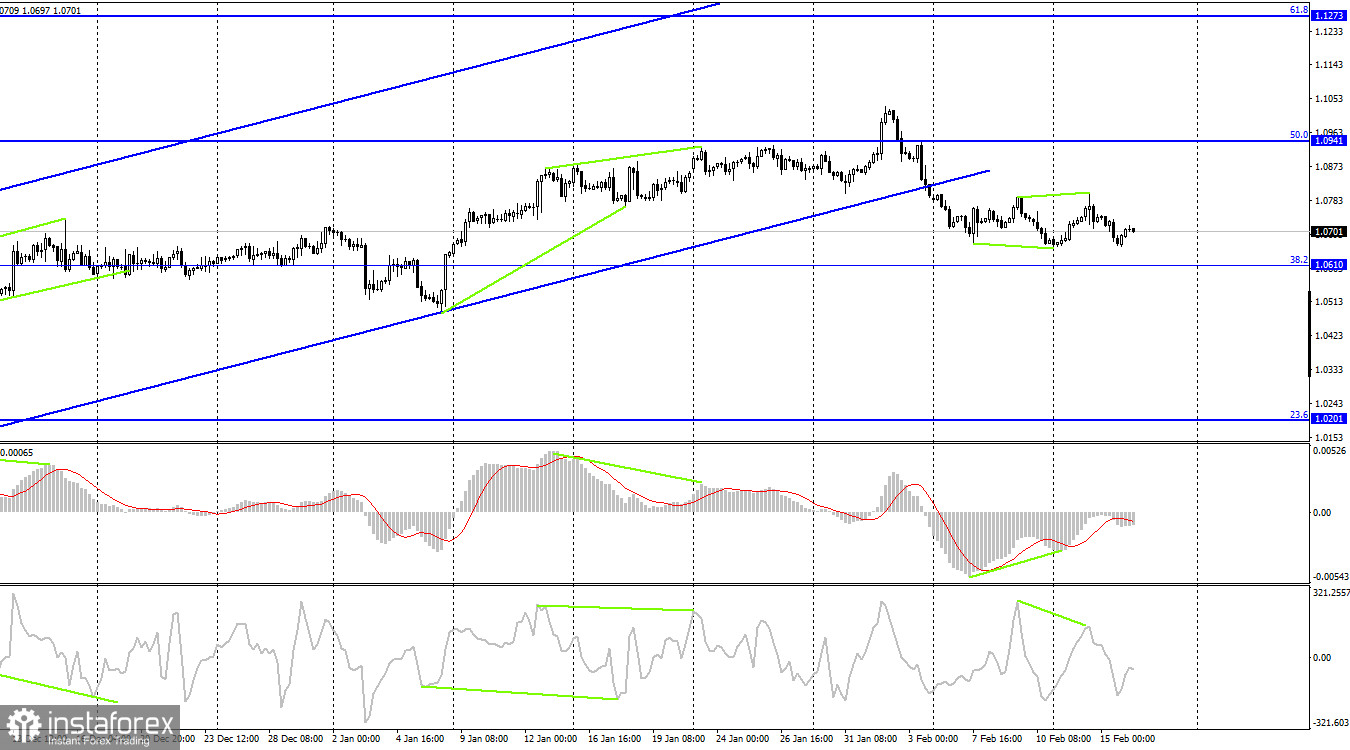

On Wednesday, the EUR/USD pair continued its downward trend in the direction of the corrective level of 1.0614 (161.8%). Only towards the very end of the day did things turn around in favor of the euro and even slightly increase. The movement is now horizontal. Reversals can therefore happen practically anywhere. After closing over the downward trend line, the traders' attitude did not change to "bullish."

There were quite a few newsworthy developments yesterday, but few of them were significant for the euro or the dollar. The UK inflation report attracted considerable attention from traders. Yet, Christine Lagarde reiterated in a speech to the European Union that the rate will rise by 0.50% in March. We can anticipate a 100% increase in the rate by another 0.25% in May because the ECB is unlikely to abruptly stop raising rates. For the record, traders have been viewing this scenario as the primary one for the past month and a half, so Lagarde's comments did not at all come as a surprise to them. The president of the ECB also stated that after the meeting's outcomes, a full review of the pace of the inflation decrease will be conducted and the next course of monetary policy will be decided. These statements indicate that the ECB is getting ready to slow down the rate of tightening, however, not all ECB members are in favor of this. Some individuals think that the rate has to be increased by 0.50% at least twice more. The rate of inflation in the European Union is declining, but not too quickly, and an early rejection of rapid tightening can stop the process of inflation from reaching 2%. If merely based on the consumer price index, the rate should rise further until inflation falls to at least 5%. Lagarde's rhetoric, however, does not yet strengthen the euro because the market is already familiar with it.

The pair was held under the upward trend line on the 4-hour chart. Because the pair left the area where they had been since October, I believe this moment to be of utmost importance. There is strong growth potential for the US currency with targets of 1.0610 and 1.0201 now that traders' mood is described as "bearish." The likelihood of a further decline in the pair is increased by the CCI indicator's new "bearish" divergence.

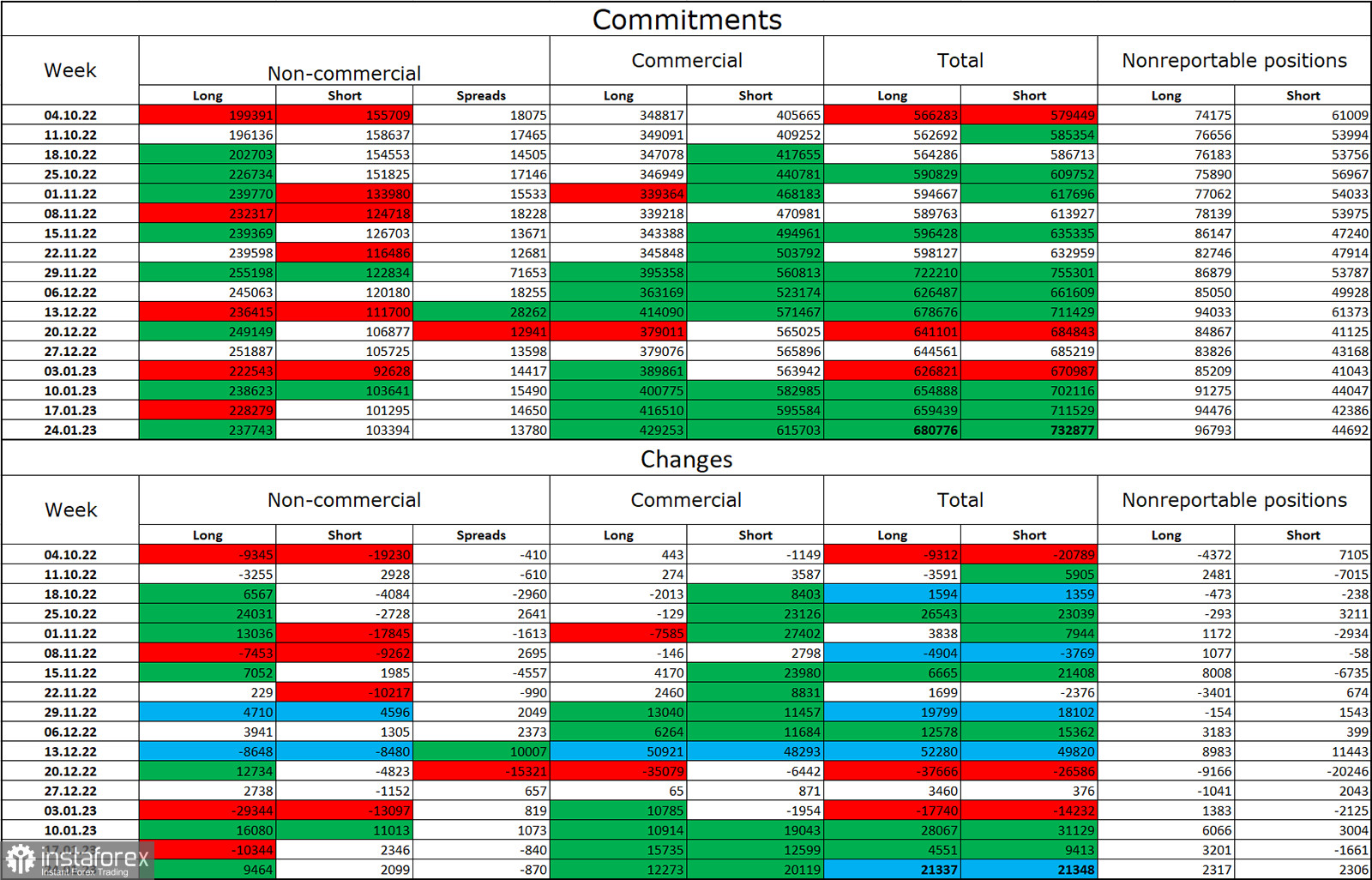

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

US – number of construction permits issued (13:30 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

On February 16, there are no noteworthy events scheduled for the European Union's economy, and there will only be two reports of ordinary importance in the USA. The information foundation may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

As the pair recovers from the 1.0750 level on the hourly chart, new sales of the pair with a target of 1.0614 are probable. In the 4-hour chart, purchases of the euro currency are possible when it recovers from the level of 1.0610 with a target of 1.0750.