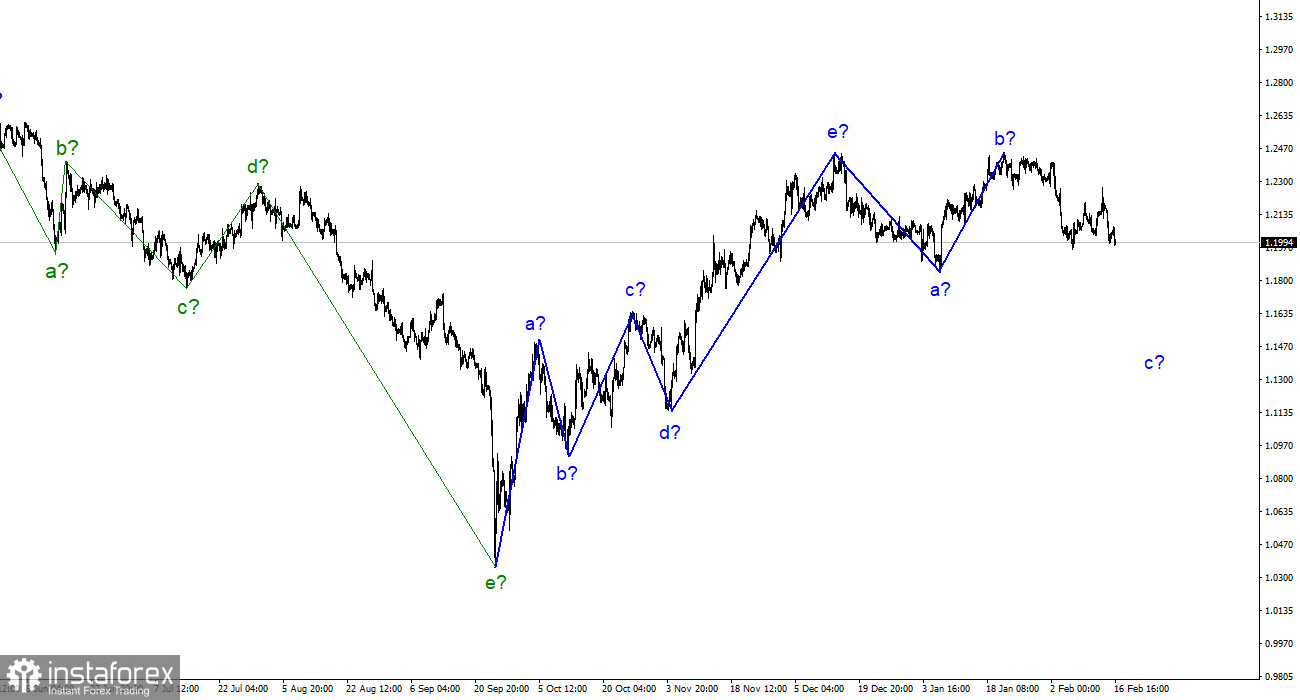

Although the wave analysis for the pound/dollar pair now appears extremely complex, clarifications are not necessary. The wave analyses for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I anticipate that the downward section of the trend has started to take shape; it will at least have three waves. Wave B appeared to be unnecessarily long, but it did not cancel. So, it is presumed that a wave development process has started with a downward part of the trend, the targets of which are situated below wave a's low. So, the price would be at least 100–200 points less than it is at the moment. It's too soon to speculate about the wave c's potential amplitude or whether the entire downward section of the trend will take a five-wave pattern. It took a long time for the pair to start moving quotes away from the peaks reached, although it had been on the verge of restarting the development of an upward trend. Since wave c has not yet finished, the low point of the assumed wave a has not yet been overcome.

On Wednesday, the pound/dollar pair's exchange rate decreased by 140 basis points; today, it decreased by an additional 55. The topic of inflation has dominated the entire current week. The market interpreted both of the pertinent news that we received from the UK and the US against the British pound. As regards the American report, I have no concerns. Only 0.1% of inflation slowed, which is a very small amount. The market has started to question whether it is possible to avoid future tightening of the Fed's monetary policy. This may be an accident, and next month we will see a stronger decline. Inflation data cause very subtle market reactions. Although there were discussions about 1-2 increases a week ago, the likelihood of a rate increase this year has now grown to 3 or 4.

The producer price index for the United States was announced today. It grew by 0.7% every month, which is significantly more than the market anticipated. Both the annual rate and the primary inflation have fallen to 6% and are still declining. Moreover, the base indication is falling. Due to the US dollar's continued growth, the market remains unsatisfied. There's a chance that the only connection is wave analysis, even if this might be because of UK economic figures. Regardless of the news background, it is intended to develop a three-wave part of the trend, as I have already stated. As a result, despite news, stories, and occurrences, the market can still sell. It would be helpful to comprehend the current challenging situation from Bank of England members' statements, but they are largely neutral and lack detail. I think it's best to simply rely on the waves.

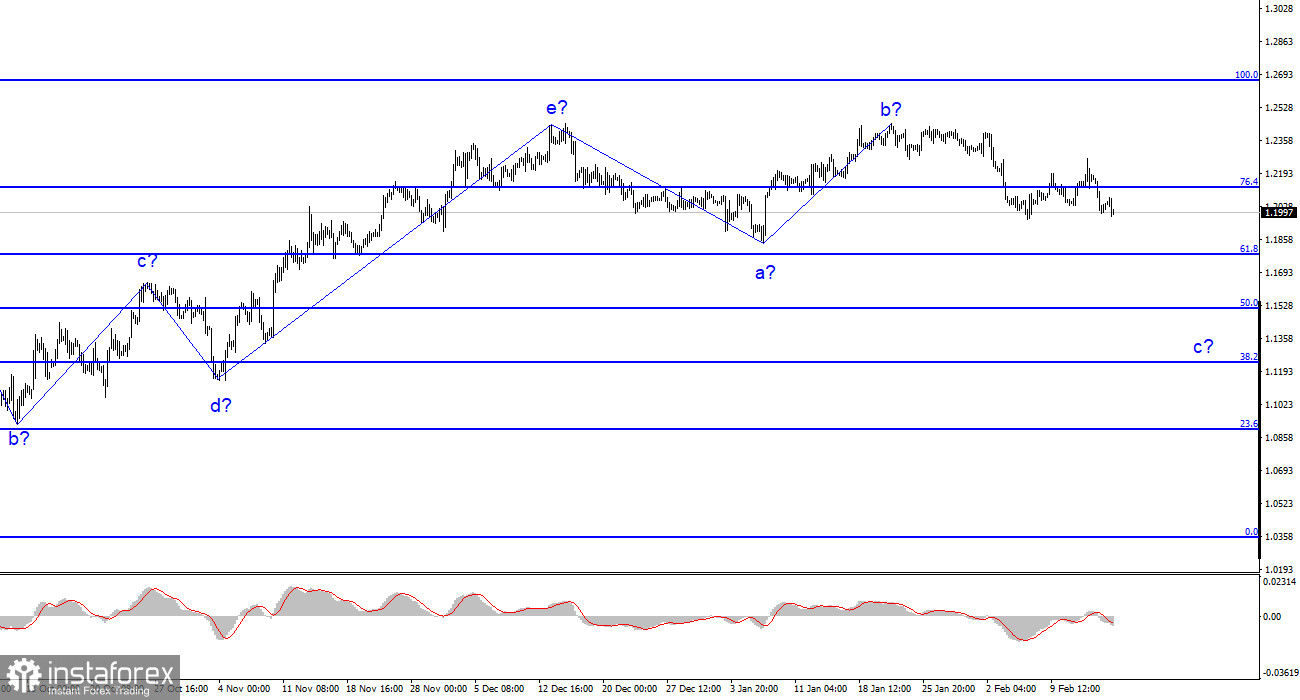

Conclusions in general

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Although wave c might be shorter in duration, for the time being, I anticipate a further 100–200 point decline.

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.