On Thursday, the EUR/USD currency pair attempted to resume its downward trend, although the volatility was quite low. Many reports were released in the US throughout the day, but as we had previously warned traders, all of them turned out to be secondary. Perhaps there was a 20–30 point response to a single report, but should we have anticipated such a response? So, we won't even concentrate on macroeconomic data from other countries.

The technological picture has significantly improved in terms of interest. If a long-term downward trend has developed on the 4-hour TF and is not reversed, then the pullback we are currently seeing on the 24-hour TF is not particularly convincing. Although the Kijun-sen line has officially been passed, the pair is still extremely close to it, so anything can happen at any time. The major events of this week are all over, so we can't anticipate a lot of volatility or a significant trend change in the coming days. The daily TF, however, clearly demonstrates how weak the current downward correction is in comparison to the prior upward movement, therefore we are still waiting for a further collapse from the pair. We think that the dollar has fallen so much in recent months unfairly and that the euro currency is still significantly overbought. The rhetoric used by ECB and Fed officials is still described as "hawkish," and both sides have made pronouncements and dropped signals about a potential tightening of monetary policy that might be more pronounced than anticipated. As a result, the rates between the euro and the dollar are currently roughly identical.

Another speech by Christine Lagarde was made this week. The ECB chief has been speaking quite a bit lately, but what new information does she have to share with the market given that everyone is already aware of the regulator's plans? The market anticipated two successive rises of 0.5% and a further 0.25% even before the rate hike in February. As a result, the market was unaffected by Ms. Lagarde's comments regarding an almost certain tightening of monetary policy by half a percent in March. As we just mentioned, since these solutions have been there for a while and are well known, the market has been working on them. The central bank must keep taking aggressive action because inflation is still high, according to Ms. Lagarde. There's nothing new here.

At the same time, Gabriel Makhlouf, the president of the Central Bank of Ireland, predicted that the deposit rate would rise over 3.5% and stay there for a considerable amount of time. The key rate is currently 2.5 percent, and the deposit rate is considerably lower. Even a 3.25% rate, in our opinion, won't be sufficient to bring inflation back to 2% in the near future. We, therefore, believe that the ECB rate will increase for more than two meetings. The European Central Bank (ECB) has a considerably greater capacity for tightening than the Federal Reserve, although much will depend on the condition of the European economy, which is on the verge of entering a recession. As a result, the European currency may resume its movement toward the north during 2023. Although we are not opposed to this scenario, we must remind you that trends cannot exist without corrections. As a result, at this point, we anticipate that the pair will keep declining. The road map for future rises is unlikely to clear up by March when there will be a new ECB meeting, but after that, new clues from regulator officials will start to flow in. As a result, the pair can continue to adjust until mid-March. All indications point to a downward trend: the lower linear regression channel is pointing downward, the moving channel is likewise pointing downward, and the price updated its local minimum yesterday. We do not have any leading purchase indications because the CCI indicator did not move into the oversold area. The pair may continue to advance toward Senkou Span B on a 24-hour TF.

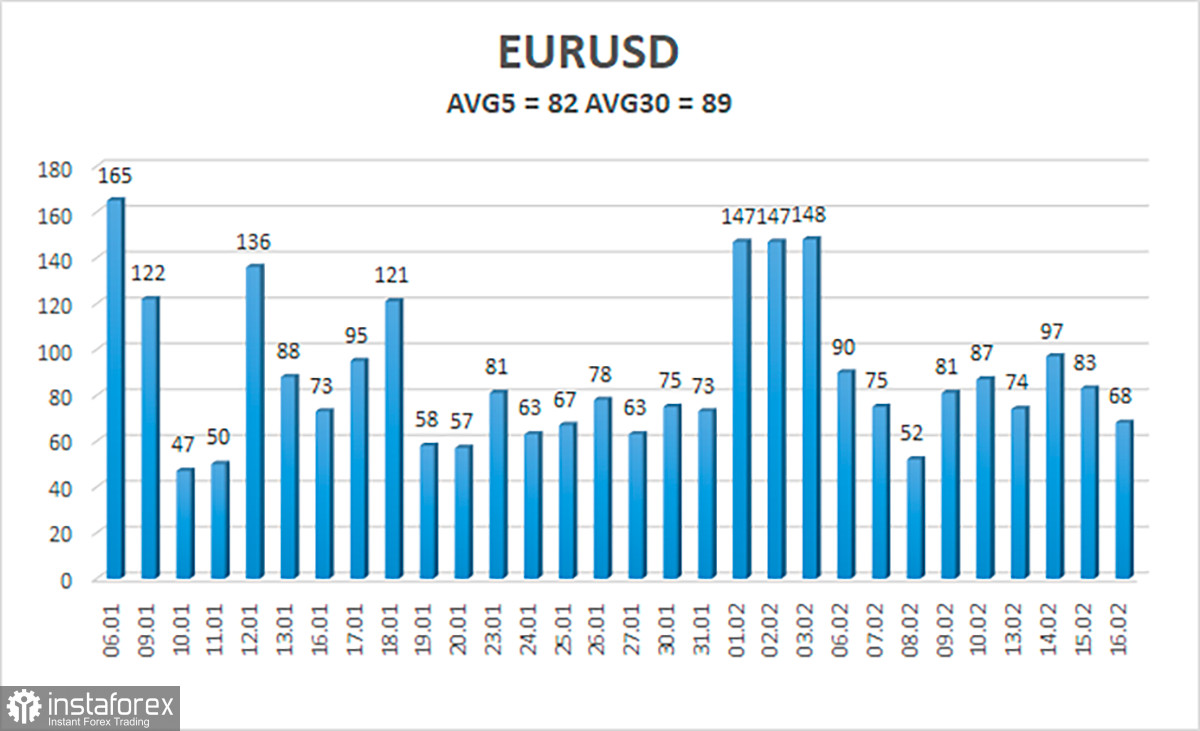

As of February 17, the euro/dollar currency pair's average volatility over the previous five trading days was 82 points, which is considered "normal." As a result, we anticipate that the pair will move on Friday between 1.0603 and 1.0767. A new round of corrections will be signaled by the Heiken Ashi indicator's upward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Suggestions:

The EUR/USD pair maintains a downward trend. Before the Heiken Ashi indication comes up, we can now consider opening new short positions with targets of 1.0603 and 1.0620. If the price is established above the moving average line with a target of 1.0864, long positions can be opened.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.