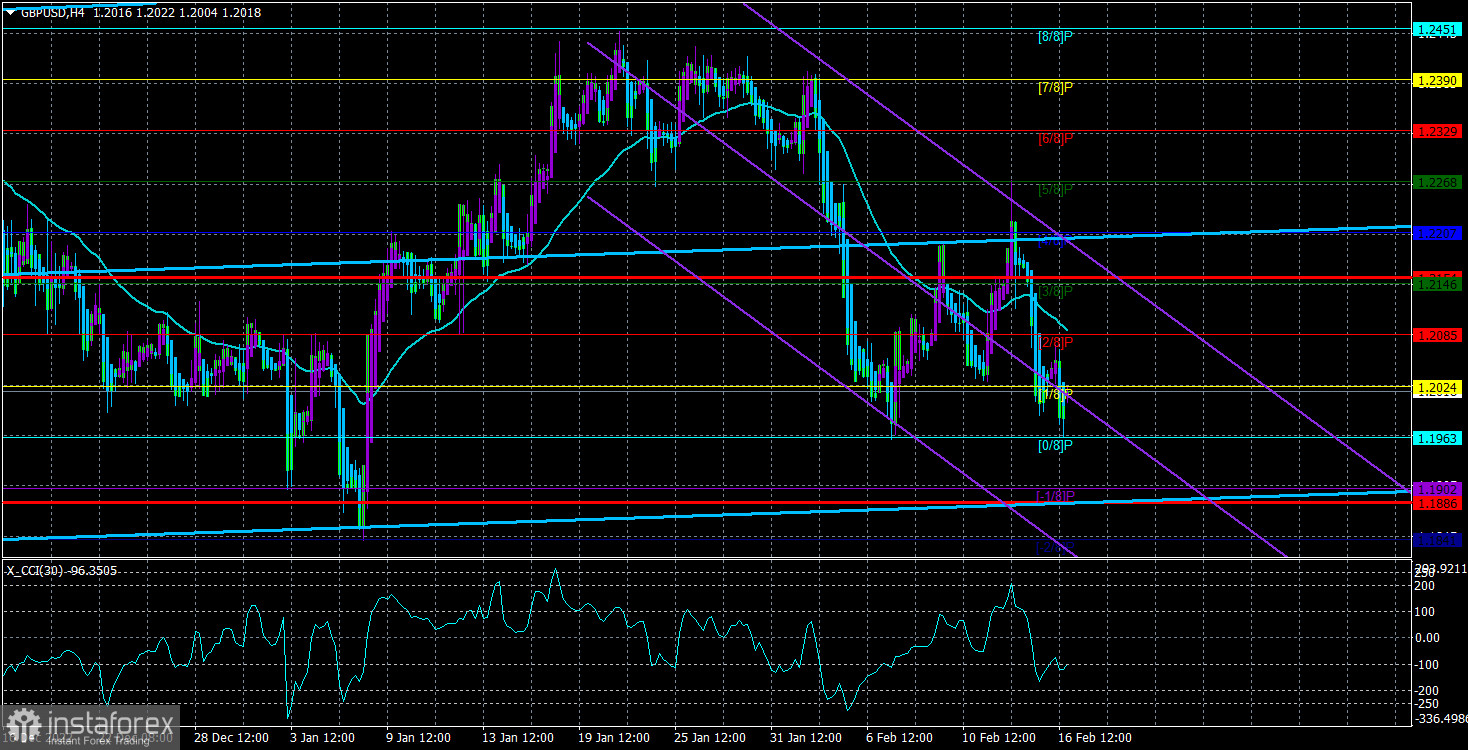

The GBP/USD currency pair kept moving downward on Thursday, eventually reaching the Murray level of "0/8," or 1.1963. Thus, a "double bottom" of the local scale was created in addition to the "double top" of the senior scale. If a second rebound occurs from the level of 1.1963, this might result in a fairly considerable upward movement, but the "double top" will not be seen as fully worked out, so we should anticipate another round of the British pound's decline. Since there is no justification for the pound to increase, we continue to anticipate a decline. The market has already factored in the BA and Fed's decisions to raise rates once more, as well as the most recent inflation statistics and, in the case of the US, information on the labor market and unemployment. In other words, the majority of the most critical and relevant studies have already been released this month. And for the British currency, we can draw discouraging conclusions.

In the United Kingdom, inflation is initially declining slowly. If the BA rate was no longer 4%, this might imply that the Bank of England would continue to adopt an aggressive monetary policy for a considerable period. Hence, the regulator can continue to slow down the rate of interest rate growth even with significant inflation (over 10%). Especially given Andrew Bailey's prediction of a significant reduction in the consumer price index this year. The inflation response to tighter monetary policy probably occurs with a longer lag than in the US. Then, Mr. Bailey's statements make perfect sense. We may be putting a stop to BA's efforts to reduce inflation early as the rate of inflation in Britain started to drop three months ago. To be certain that Chairman Bailey is correct or incorrect, it may be prudent to wait a few more months.

Rishi Sunak is working to improve relations with the European Union.

Yesterday, Rishi Sunak, the British prime minister, delivered a crucial message. He claimed that by opting for Brexit in 2016, the majority of Britons made a mistake, which the UK government will now attempt to right. Despite the referendum results, the administration plans to pursue a course to mend fences with the EU. Mr. Sunak observed that although his country has taken some steps since 2017 to reap the benefits of its non-aligned status, all of these steps have been detrimental to it. They will be canceled repeatedly and gradually. "I believe that the British people have completely recognized over the past seven years that the 2016 choice was incorrect. It's time to move on and forget about this, even if I can't hold him responsible for his choice. We'll carry on as usual with our relationships with our European brothers. Such damaging choices are in no way justified," according to Sunak.

As we previously stated, recent opinion surveys of the British population have been repeated, and the results are crystal clear. If only 51.9% of residents backed Brexit in 2016, then the percentage of people in favor of leaving the EU has been progressively declining each year. Far more people regret their decision to leave the EU and desire to return to it. Although a scenario in which Britain rejoins the Alliance is unlikely to occur in the near future, both the EU and the former can gain from this if Britain once more pursues rapprochement with the latter. Additionally, if the Kingdom resumes the process of integrating with the Union, Scotland might reconsider having its vote. From our perspective, this one will take years, but in the long run, it is good news and a sign of the right way for Britain and the British pound, which has lost two times as much value against the dollar since 2007. We are anticipating a further decline because the pound is currently trading below the moving average. It is too early to consider the "double bottom" pattern established. Tomorrow's reduction in quote marks will end it. The overbought or oversold territory for the CCI indicator has not recently been reached. The pair is confidently advancing to the range of 1.1800-1.1850 on the 24-hour TF.

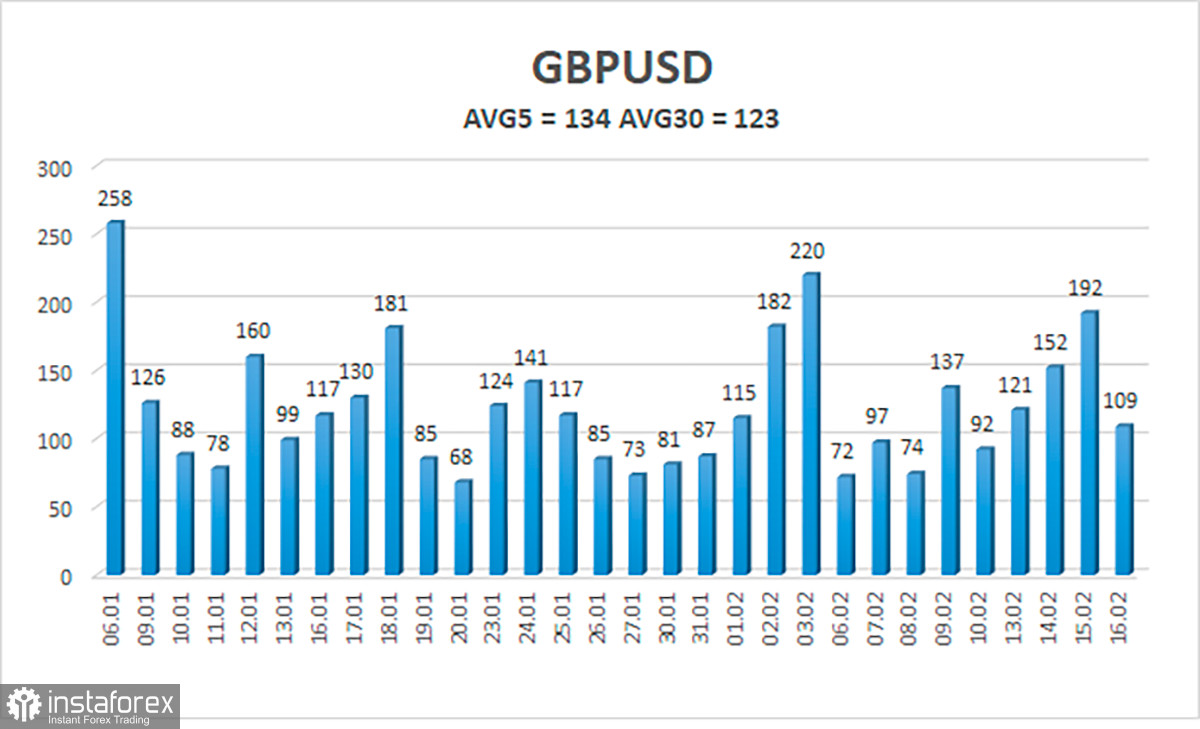

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 139 points. This figure is "high" for the dollar/pound exchange rate. So, on Friday, February 17, we anticipate movement that is limited inside the channel and is constrained by levels 1.1886 and 1.2154. A cycle of corrective movement begins when the Heiken Ashi indicator reverses upward.

Nearest levels of support

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest levels of resistance

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

Trade Suggestions:

Over the 4-hour timeframe, the GBP/USD pair reversed the downward trend. So, until the Heiken Ashi indicator turns up, it is possible to hold short positions with targets of 1.1963 and 1.1902. If you consolidate above the moving average with targets of 1.2146 and 1.2207, you can start buying.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.