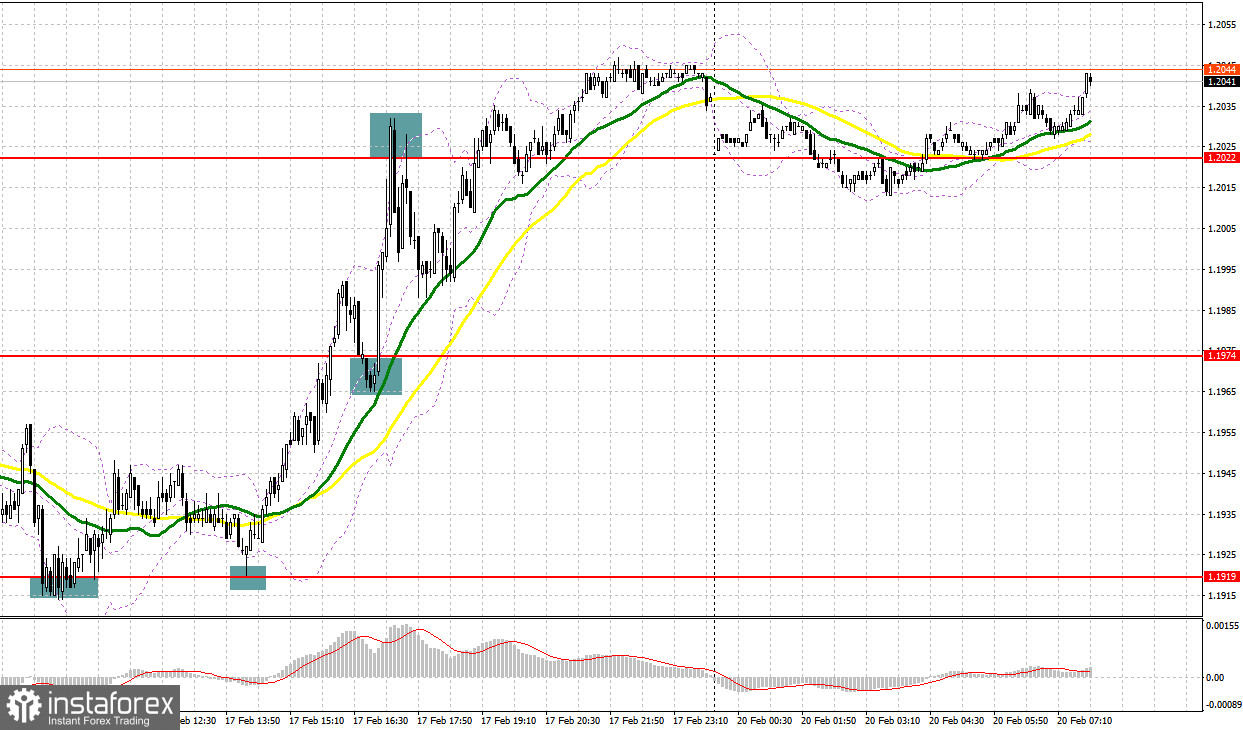

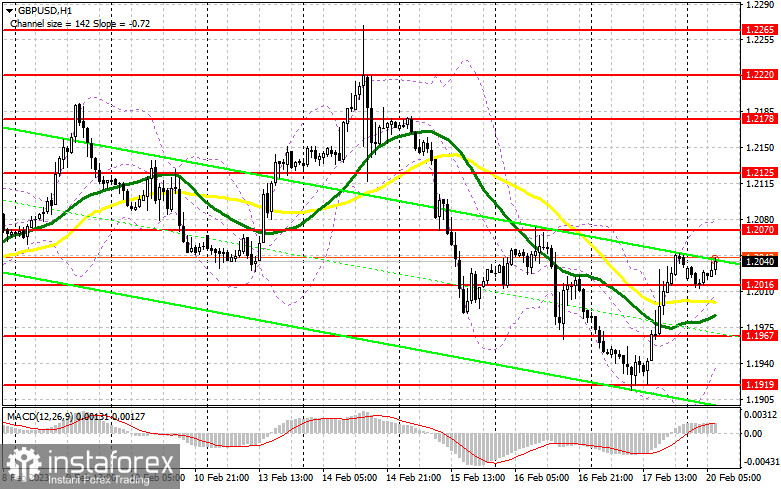

When to open long positions on GBP/USD:

Today, the United Kingdom will see the release of the Rightmove house price index, but it will unlikely affect the market. Therefore, the bulls could extend the corrective move that came on Friday after a strong rebound. A fall and a false breakout through support at 1.2016, which is located slightly below the bearish moving averages, will make a buy signal, targeting 1.2070. The price may then go to the 1.2125 high in case of consolidation and a downside retest of this range. If the quote then rises above this mark, another upward target will be seen at 1.2178 where I am going to lock in profits. If the bulls lose their grip on the 1.2016 mark, the bears will take the market under their control, and the GBP/USD pair will face stronger pressure. In such a case, long positions could be considered near support at 1.1967 after a false breakout as well as on a rebound from the 1.1919 monthly low, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

After reaching a new monthly low on Friday, the bears partially lost control over the market. They should now protect the nearest support at 1.2070 as that could generate a buy signal. Growth and a false breakout through the barrier will make a sell signal, driving the GBP/USD pair down to 1.2016. The bears should take this level under control as soon as possible. Selling pressure will mount in case of a breakout and a retest of this range, producing a sell signal with the target at 1.1967. The most distant target is seen at 1.1919. Should the price reach the mark, the bearish trend will extend. That is where I am going to lock in profits. If GBP/USD goes up and there is no bearish activity at 1.2070, the bullish activity will increase. The bears will loosen their grip on the market until fresh data comes upbeat in the United States. A false breakout through the 1.2125 resistance level will create a sell entry point. If there is no trading activity there as well, I am going to sell GBP/USD on a rebound from the 1.2178 high, allowing a bearish correction of 30 to 35 pips intraday.

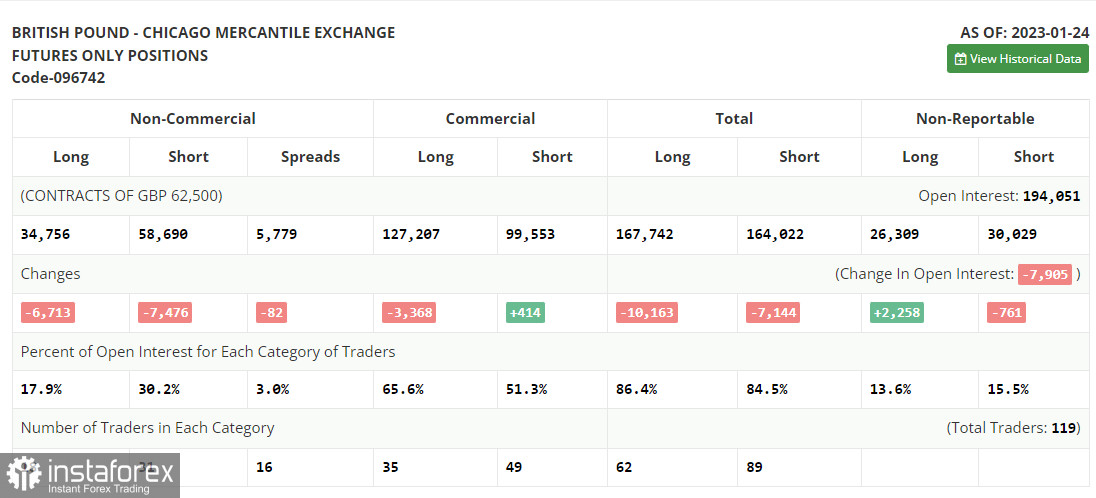

Commitments of Traders:

The CFTC reportedly suffered a technical glitch. There have been no fresh Commitments of Traders data for over two weeks now. The latest report dates back to January 24th.

The COT report for January 24 logged a plunge in both long and short positions. However, this drop was within the limits, especially if taking into account the problems the UK is now facing. Its government has to deal with strikes for fair pay and fight against stubborn inflation at the same time. According to the latest COT report, short non-commercial positions decreased by 7,476 to 58,690, and long non-commercial positions fell by 6,713 to 34,756. As a result, the non-commercial net position came in at -23,934 versus -24,697 a week ago. These are insignificant changes. Therefore, they are unlikely to affect market sentiment. That is why it is important to monitor macroeconomic reports in the UK and the BoE's rate decisions. The weekly closing price rose to 1.2350 from 1.2290.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating the bulls' attempt to extend a correction.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.2070, in line with the upper band. Support stands at 1.1960, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.