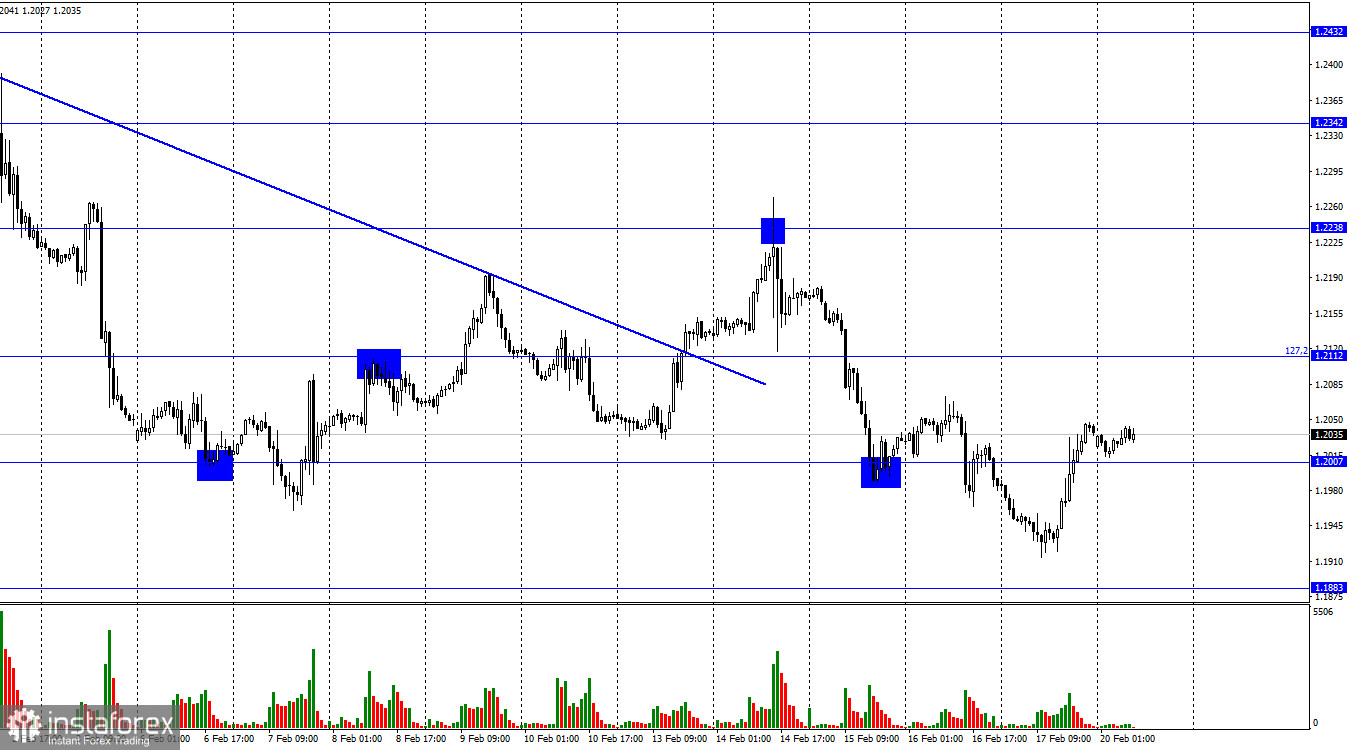

Hello, dear traders! According to the 1-hour chart of GBP/USD, the pair fell to 1.1883, reversed, and went above 1.2007 on Friday. The quote may consolidate below 1.2007 in the coming days, allowing traders to push the paid down to 1.1883.

On Friday, the United Kingdom saw the release of retail sales data. Although the report came better than expected, traders were still reluctant to buy the pair. The price showed strength only with the opening of the North American session. In my view, growth came when traders started liquidating short positions, but market sentiment generally remained the same.

In terms of fundamental factors, all the important events of the month, namely the inflation reports and rate decisions of the Bank of England and the Federal Reserve, have already taken place. The rest of the coming publications will be of little importance. Meanwhile, speeches from FOMC and BoE officials could shed some light on the interest rate situation as there are still many unclear issues. In other words, traders are completely unaware of how high rates could be raised. Last week, Jerome Powell and other Fed representatives made it clear that more rate hikes could follow, especially in light of slowing inflation. At the same time, the Bank of England is likely to keep lifting interest rates by 0.50% for as long as inflation goes down steeply. Therefore, it is important to monitor charts now. The situation on the charts is quite mixed, which is clearly seen in the 4-hour time frame. That is why traders should not expect any trend movements or frequent reversals this week.

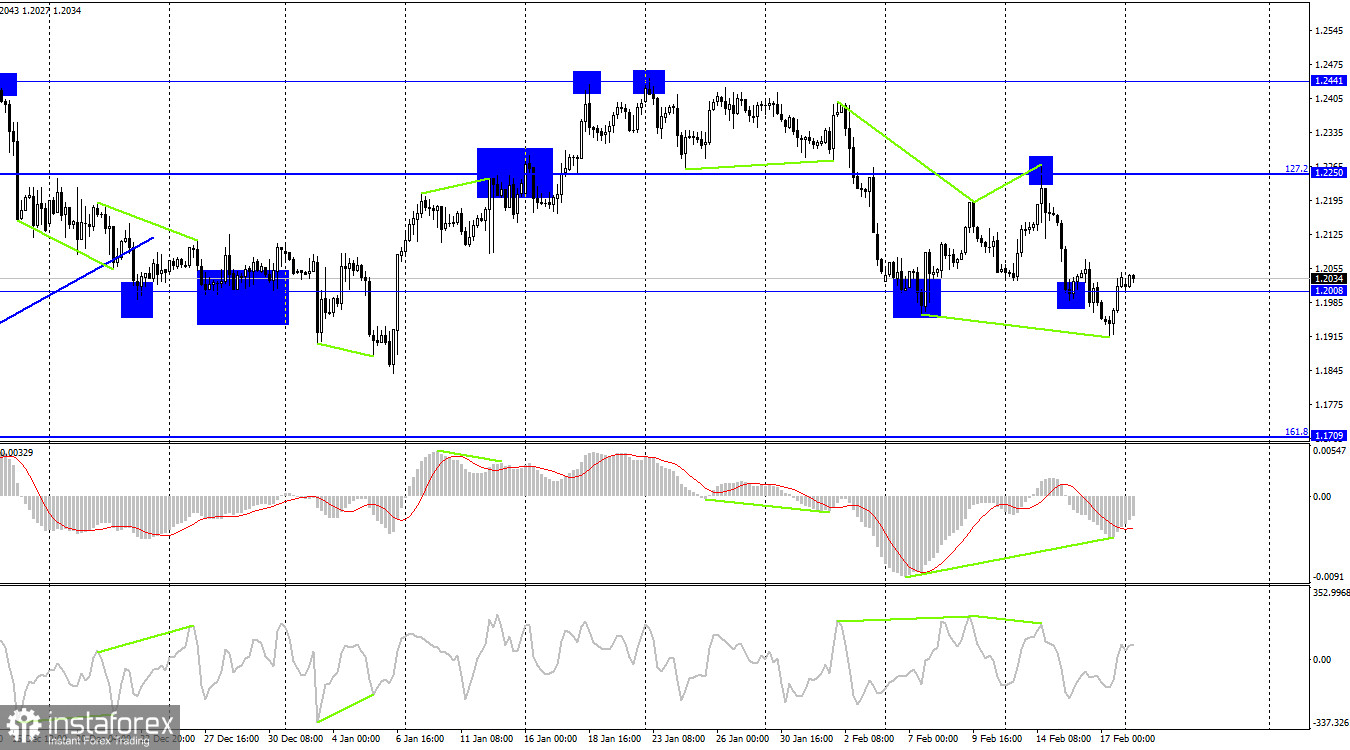

In the 4-hour time frame, the pair reversed upward after a MACD divergence. The quote also consolidated above 1.2008, indicating possible growth. Nevertheless, the downtrend may resume at any time. Neither of the technical indicators shows divergences today.

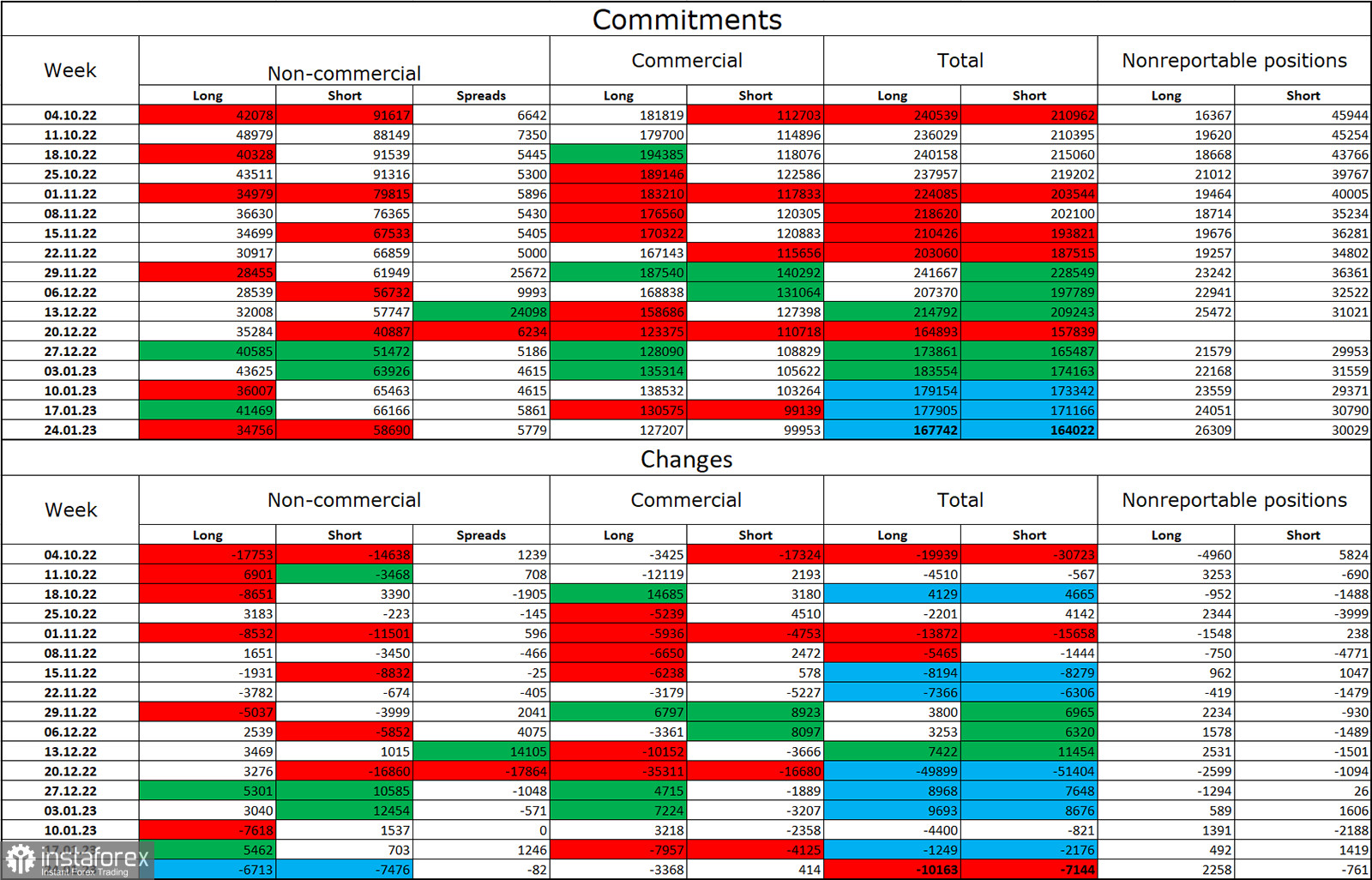

Commitments of Traders (COT):

The bearish sentiment of non-commercial traders decreased last week. Speculators closed 6,713 long positions and 7,476 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Although the pound sterling has limited growth potential now, it is in no rush to go down. In the 4-hour time frame, the pair left the limits of the 3-month ascending corridor, which may become a restraining factor for a bullish continuation.

Macroeconomic calendar:

The macroeconomic calendars of the UK and the US contain no important releases on Monday. Fundamental factors will have no influence on market sentiment in the second half of the day.

Outlook for GBP/USD:

Consider selling GBP/USD after consolidation below 1.2007 and with a trader at 1.1883. Because of the limited growth potential, consider not buying the instrument.