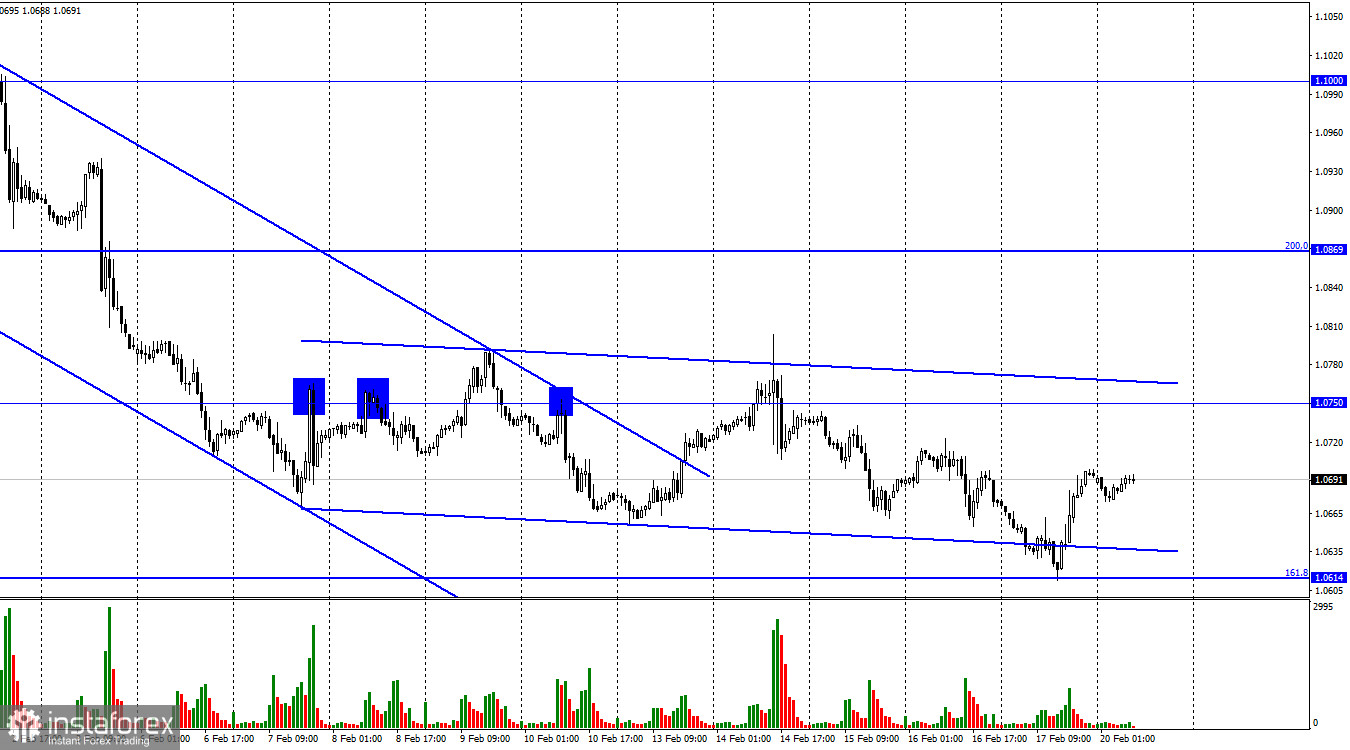

On Friday, the EUR/USD pair showed a decline to the corrective level of 161.8% (1.0614), a reversal in favor of the euro, and a rebound from that level. The growth has started to move in the direction of level 1.0750. The downward trend line continues to describe traders' attitudes as "bearish," yet this is a weak attitude. The quotes may at any time start to decrease again.

The background information was essentially nonexistent on Friday. Simply put, there were no significant occurrences or reports in the United States or the European Union. Towards the conclusion of the day, traders decided to fix some of the profit and get ready for a new week, which is why the upward pullback is overdue. The US inflation report, which may be looked at from various perspectives, was possibly the most important report of last week. Although the pair moved horizontally for the majority of the week, traders were unable to come to a clear conclusion. For now, it is quite challenging to predict how the interest rates of the ECB and the Fed will interact in the near future. The strong labor market and high inflation may be to blame for the United States central bank's recent hints towards a stronger tightening of policy. In March, the ECB announced and then approved a nearly guaranteed rate increase of 0.50%. As a result, it is currently difficult to predict how events will unfold in general. Of course, practically everything will be influenced by inflation. This week, a report on European inflation will be made public, and it could reveal a considerable decline. If this decline occurs, it would slightly soften the rhetoric used by ECB officials, which might harm the value of the euro. As a result, I anticipate that this week will see more declines in euro quotes. There won't be many other reports, therefore their influence on traders' attitudes won't be great. The 4-hour chart's graphical representation can prevent the pair from falling.

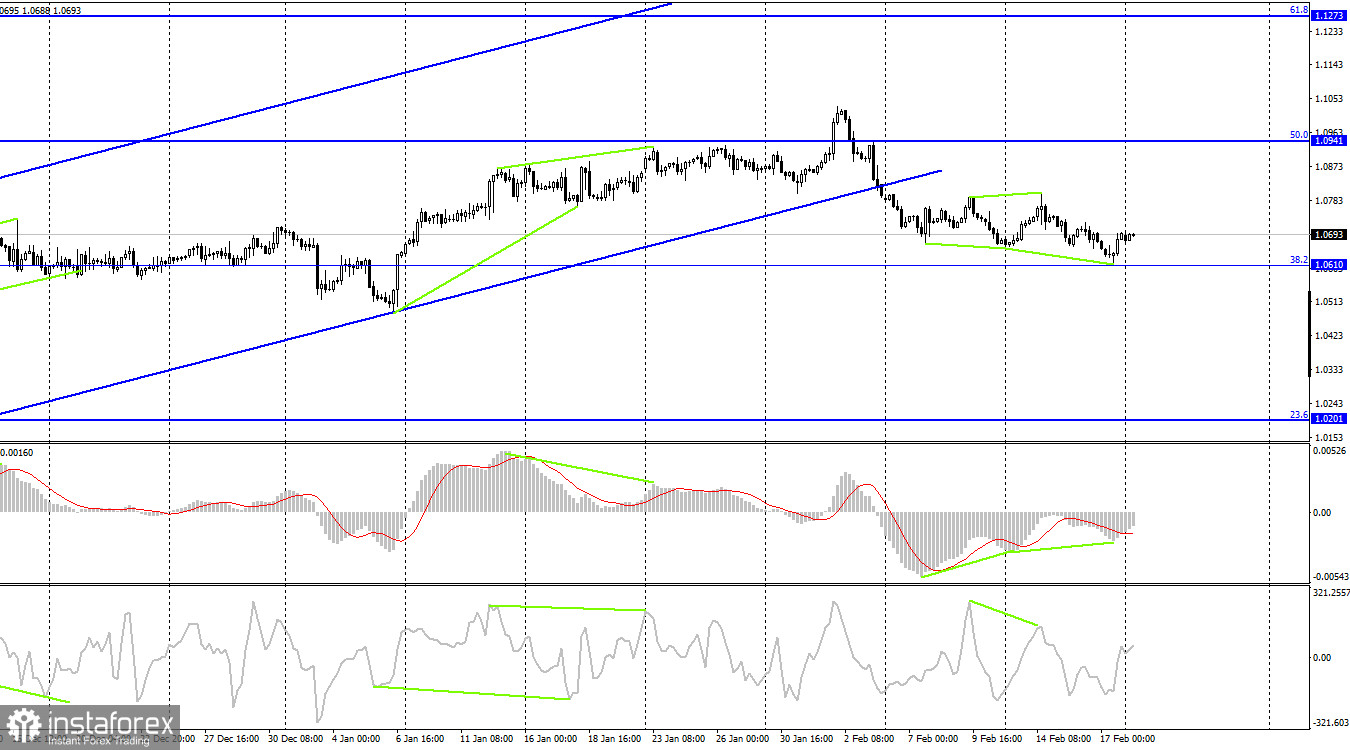

The pair was held under the upward trend line on the 4-hour chart. Because the pair left the corridor where they had been since October, I believe this moment to be of utmost importance. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. Yet, we might anticipate some growth thanks to the MACD indicator's "bullish" divergence. Moreover, the increase follows the 1.0610 level. These two signals have the potential to keep the pair from declining indefinitely.

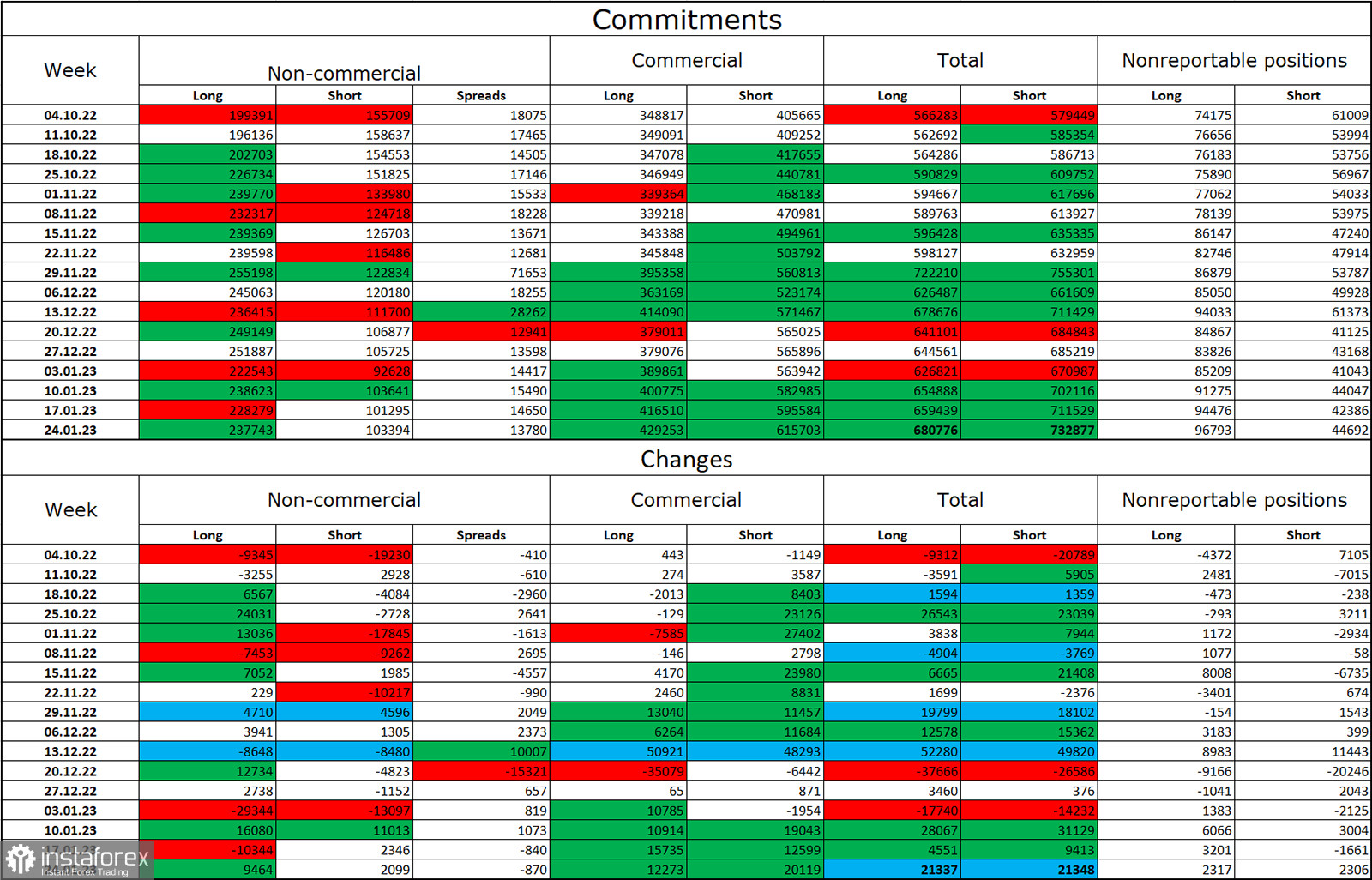

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now increasing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events in the United States and the European Union:

There are no significant events on the economic calendars for the European Union or the United States on February 20. The background information will not affect the traders' mood today.

Forecast for EUR/USD and trading advice:

When the pair closes below the level of 1.0610 on the 4-hour chart, new sales of the pair with a target price of 1.0483 are probable. In the 4-hour chart, purchases of the euro currency are possible when it recovers from the level of 1.0610 with a target of 1.0750.