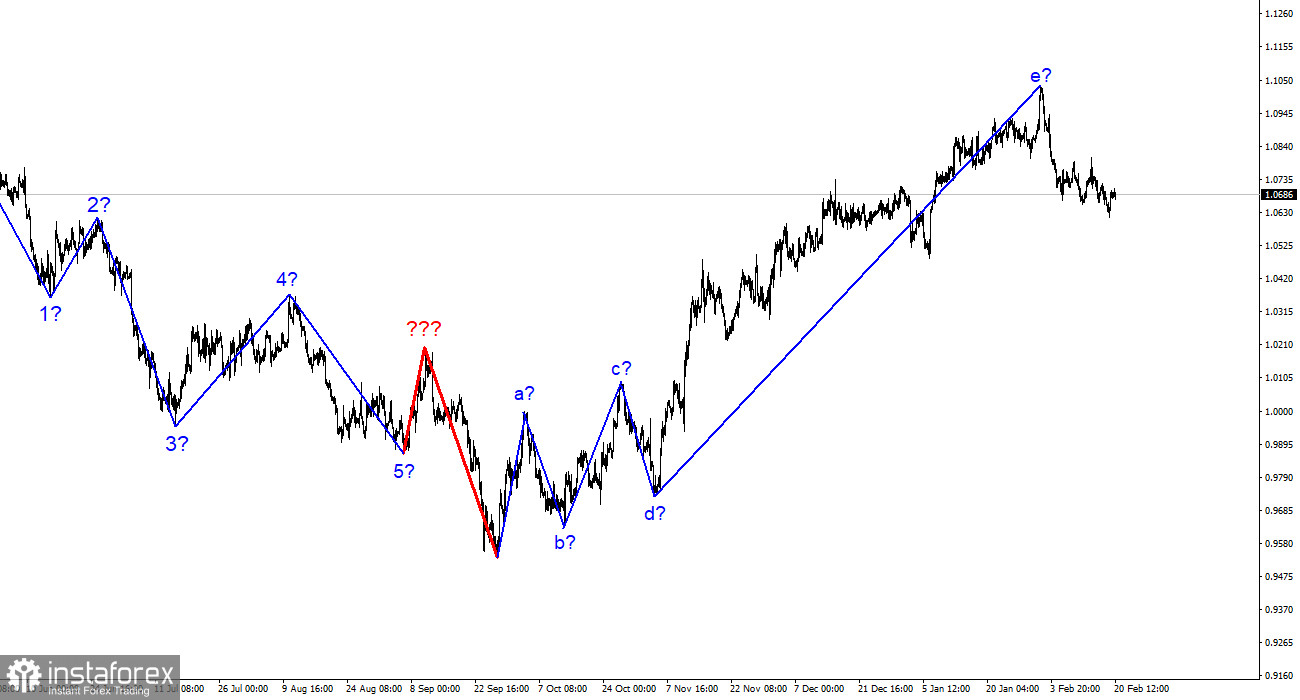

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this pattern's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to deviate marginally from previously reached peaks. The US currency did, however, manage to avoid market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new downward trend section, which I was simply hoping for. I hope that the current news environment and market sentiment will not impede the formation of a downward series of waves this time.

The demand for the euro is gradually decreasing.

On Monday, the euro/dollar pair moved with low amplitude. Today's news background was so minimal that it was impossible to single out even one noteworthy occurrence. I want to make a significant point at the same time. The pair has already moved 400 basis points away from its early-February peak. The formation of a downward wave, presumably a, may take some time, but the stronger this wave emerges, the greater wave C. As a result, the pair is already poised to fall another 300-400 basis points. If this scenario comes to pass, the euro will virtually reach parity with the dollar, from which it has been trying very hard to distance itself in recent months. I believe that the current prospect for the euro is quite weak.

The market has factored in all potential rate rises from the ECB, and it is unaware of any more increases. This is because, throughout the three meetings, Christine Lagarde practically outright revealed a plan to raise the rate by 125 basis points, giving the market the chance to profit in advance. The scenario is a little different in the case of the Fed, as the likelihood of a more significant tightening of monetary policy grew dramatically last week. Based on this, the market favors a cautious increase in demand for the dollar and does not know how much further the Fed rate can rise. This situation is ideal for wave analysis, which at the moment entails lowering the pair and developing at least three wave sections of the trend. I anticipate that the euro will continue to weaken over the next three to four weeks. Until the following Fed and ECB meetings, at which the market might be presented with new information that will influence its mood. I wouldn't claim that the euro has great chances for 2023, but there's no need to wait for a major collapse either.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the anticipated level of 1.0350, or 261.8% Fibonacci, can now be taken into account. Yet, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend section. The likelihood of an even bigger complication of the upward trend segment still exists.

On the older wave scale, the ascending trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it can take any kind of pattern and extent.