Yesterday, the market traded sideways. Today, we are likely to see prices swinging. In the European session, the euro/dollar pair is likely to be on the rise on the back of the released business activity data. Thus, the services PMI is forecast to rise to 51.5 from 50.8, and the manufacturing PMI is estimated to uptick to 49.5 versus 48.8. Meanwhile, the composite index is expected to increase to 51.0 from 50.3.

Eurozone Composite PMI:

In the United States, the manufacturing PMI is set to advance to 49.0 from 46.9. The services PMI is likely to grow to 48.9 versus 46.8. The composite PMI is estimated to climb to 48.9 from 46.8. In this light, the pair may go back down. In other words, we are likely to see price changes intraday and no changes at the close of the day.

Unites States Composite PMI:

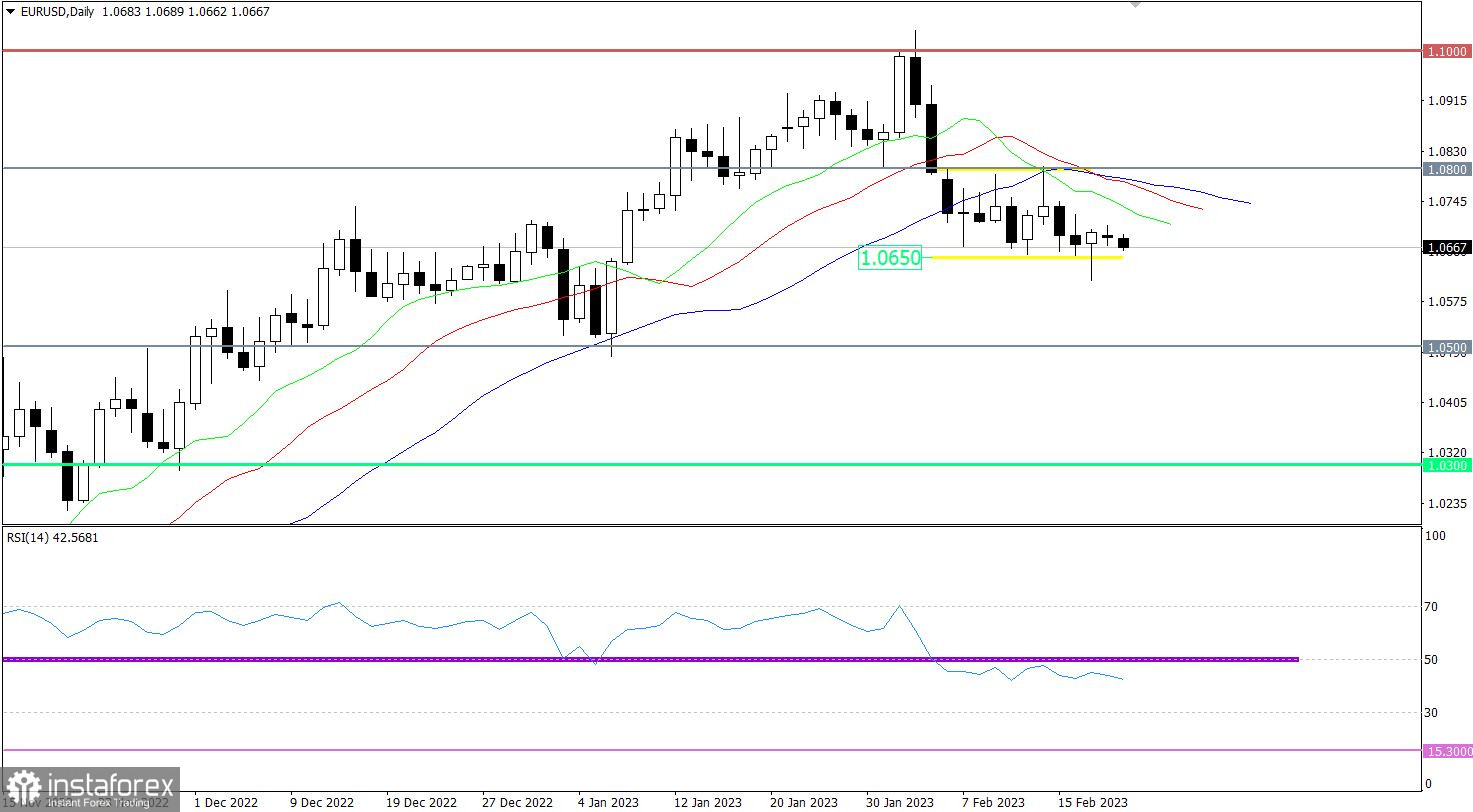

EUR/USD traded sideways near 1.0650, indicating market uncertainty. The current sideways trend is part of the corrective move from the high of the medium-term uptrend. In other words, the fact that the pair is unable to recover reflects the continuation of the corrective move.

The RSI is moving down in the 30/50 range in the daily and 4-hour time frames, signaling a bearish bias.

The Alligator's MAs in the 4-hour time frame are intertwined, illustrating a flat market. In the daily time frame, the MAs are headed down, in line with the corrective move.

Outlook

The corrective move will extend if the price settles below 1.0650 in the daily time frame. In such a case, selling volumes may increase on the way to 1.0500.

Alternatively, the quote should rise above 1.0750 for a reversal to occur. A reversal signal will be confirmed once the pair consolidates above 1.0800 in the 4-hour time frame.

As for complex indicator analysis, these are mixed signals for short-term and intraday trading due to the sideways movement near 1.0650.