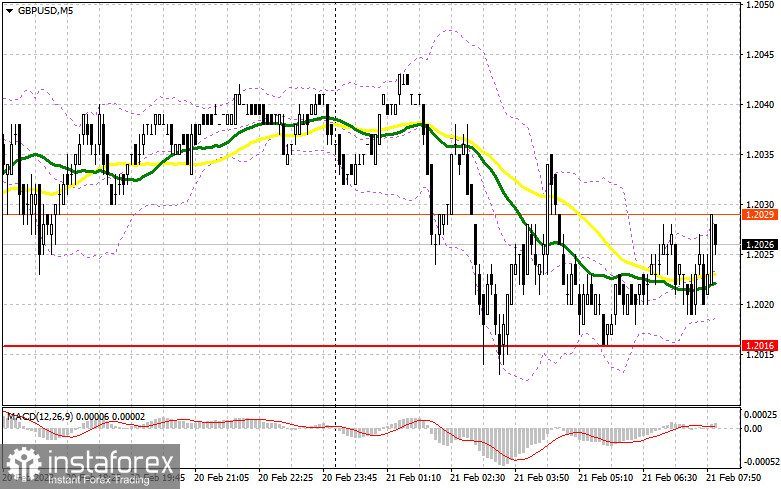

Yesterday, no signs were created to enter the market. I advise you to examine the 5-minute chart and determine what happened. In my morning forecast, I focused on the 1.2016 level and offered advice based on it for trading decisions. A decline in the area of 1.2016 did occur, but only a few points were sufficient to prevent the creation of a false breakout at this level. Due to the weekend in the United States, trading volatility was at a relatively low level, making it impossible to wait for new entry points in the afternoon.

To open long positions on GBP/USD, you will need the following:

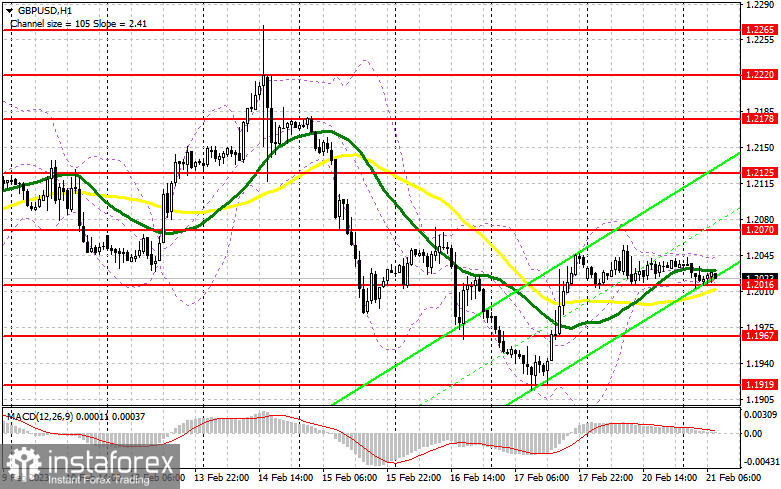

The composite index of the UK PMI for February of this year, the indicator of business activity in the manufacturing sector, and other pretty significant data are being released today. These numbers have the potential to have a significant impact on the direction of the pound. Positive data suggest that the upward correction seen last Friday might continue. The Confederation of British Industrialists predicts that the balance of industrial orders won't have a significant effect on the market. In the case of weak statistics, it would be advisable to wait for a decline and the development of a false breakout in the area of the nearest support of 1.2016, just below which the moving averages on the bulls pass. I'll be watching the buyers' activity there for a signal to buy the pound in anticipation of a rise to the 1.2070 level. I will only wager on the continuance of the movement of the GBP/USD up to the maximum of 1.2125 when fixing and testing from top to bottom of this range. A pullback above this level will also bring growth prospects to 1.2178, where I've fixed profits. The bears will retake control of the market and put more pressure on the GBP/USD if the bulls are unable to complete the tasks assigned and hit 1.2016. In this situation, I suggest against making hasty purchases and only starting long positions at the next support level of 1.1967 and only in the event of a false breakout. I'll buy GBP/USD right away only if it rises over the monthly low of 1.1919 with the intention of a correction of 30-35 points during the day.

For opening short positions on the GBP/USD, you will need:

There was no explanation for the bears' lack of activity yesterday. It is a top priority to protect the nearest resistance level of 1.2070, which in the present condition would be a great indication to sell the pair. The rise and development of a false breakout there following positive PMI indicators can result in the initiation of short positions and additional movement of the GBP/USD down to the area of 1.2016, which must simply be brought under control as soon as possible. A break and reverse test of this level will cancel out buyers' plans for an upward correction, reinforcing bears' position in the market and generating a sell signal with a fall below 1.1967. The 1.1919 area will be the farthest target, and an update there will signal the continuation of the downward trend. I'll set the profit there. Bulls may continue to actively enter the market given the possibility of a GBP/USD rise and the lack of bears at 1.2070. In this scenario, the bears will pull back, and an entry point for short positions will only be formed by a false breakout at the next resistance level of 1.2125. If there is no activity there, I will sell GBP/USD right away at the highest price of 1.2178, but only if I believe the pair will fall back by 30-35 points over the day.

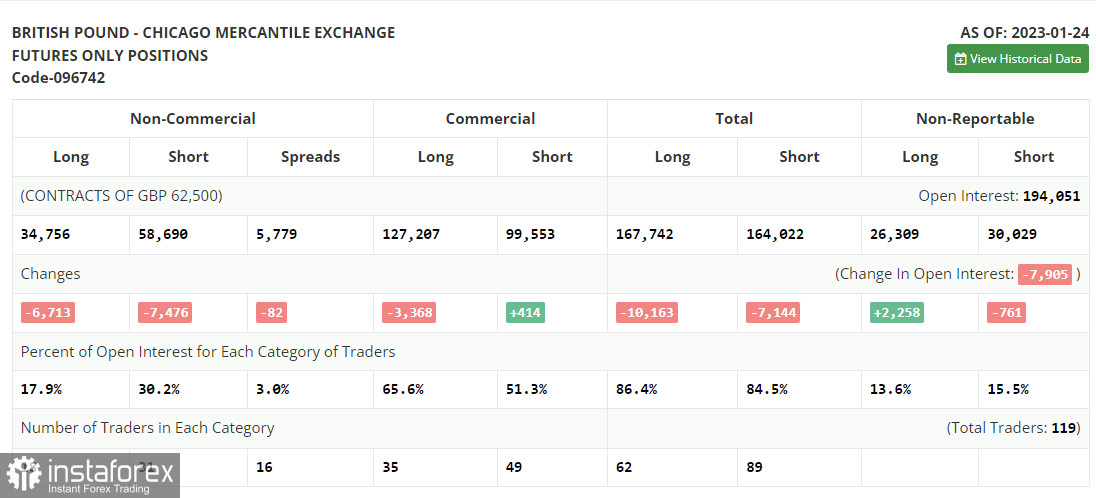

Due to a CFTC technical fault that has been ongoing for more than two weeks. The most recent COT reports have not yet been released. Following the data for January 24.

Both long and short positions were dramatically reduced in the COT report (Commitment of Traders) for January 24. But, given the difficulties the UK government is now facing, including dealing with strikes and demands for wage increases while also attempting to achieve a continuous fall in inflation, the recent reduction was within the acceptable threshold. According to the most recent COT data, long non-commercial positions declined by 6,713 to 34,756, while short non-commercial positions decreased by 7,476 to 58,690, resulting in a fall in the non-commercial net position's negative value to -23,934 from -24,697 a week earlier. We will continue to keep a careful eye on the economic indicators for the UK and the decision made by the Bank of England because such insignificant changes do not dramatically alter the balance of power. In contrast to 1.2290, the weekly ending price increased to 1.2350.

Signals from indicators

Moving Averages

Trade occurs in the area of the 30 and 50-day moving averages, a sign of market ambiguity over future direction.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

In the event of the growth, the indicator's upper limit near 1.2035 will act as resistance. The indicator's lower limit, which is located at 1.2015, will act as support in the event of a downturn.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.