If there is no hard landing of the U.S. economy in 2023, what are investors afraid of? Why are American stock indices falling? Why is oil going down, despite all the positive forecasts from Goldman Sachs regarding commodities? The problem is that the current strength of the U.S. economy allows the Fed to continue aggressively raising the federal funds rate. And that raises the fear of a longer and deeper recession. If not this year, then next. How long will Brent be afraid?

According to A/S Global Risk Management, sooner or later the market will take into account the Fed's tighter monetary balance in quotes and turn its attention to China, whose oil imports will reach a record level this year, and rising demand in India, the third largest consumer of oil in the world. This will likely happen in the second half of the year. In my opinion, a little earlier – in the second quarter.

Data showing the worst traffic jams in China's major cities since early 2022 and a return to pre-pandemic levels in the number of people using the subway suggest that the recovery of the Chinese economy is in full swing. Further evidence is the People's Bank China keeping key interest rates at current levels because activity is already high.

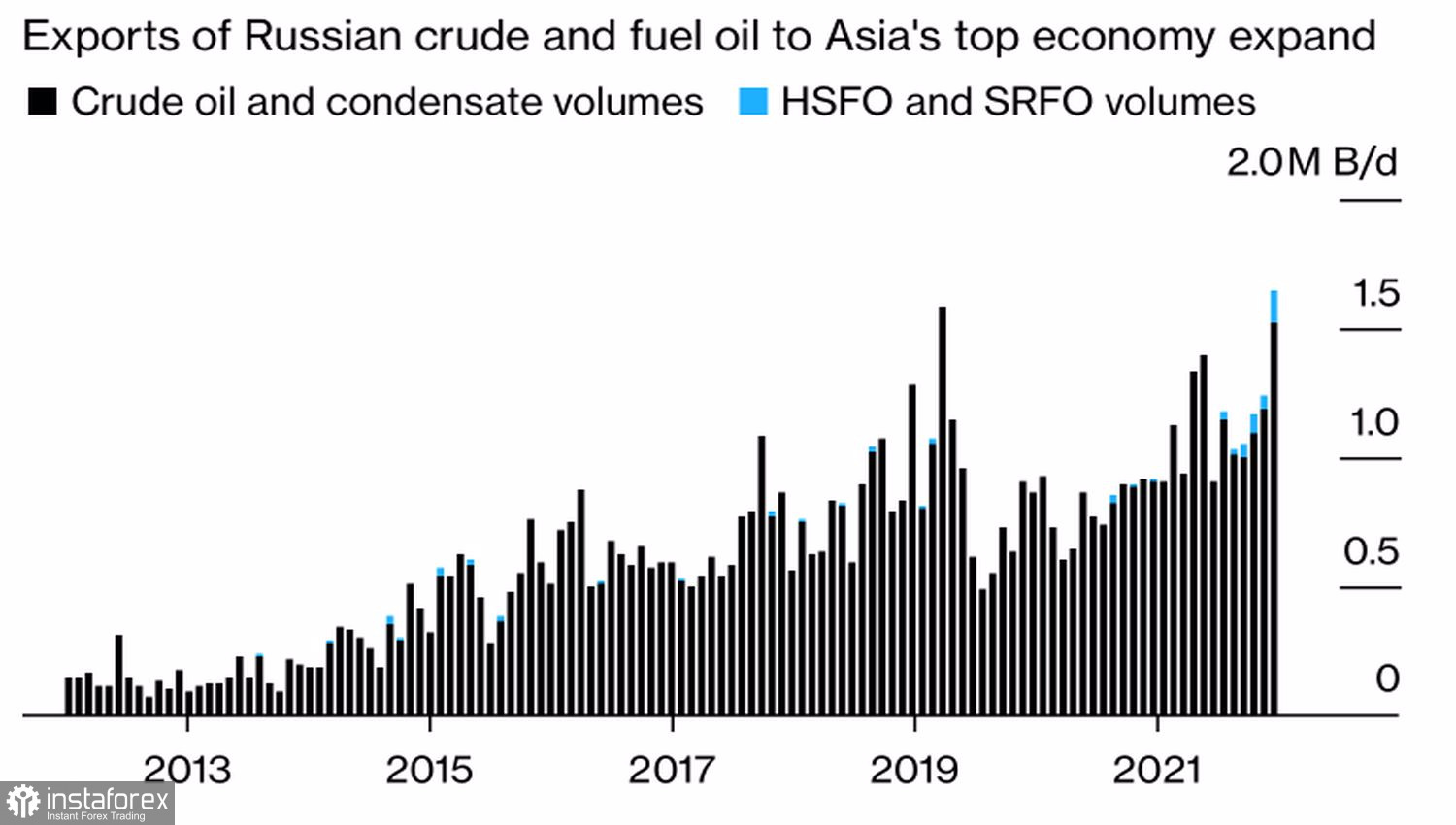

China's irrepressible demand for oil is evidenced by the growth of oil imports from Russia to 1.52 million bpd, just below the record set almost three years ago. Total purchases of oil and fuel oil reached 1.66 million bpd, which is a new historical peak. The previous one was recorded in April 2020, when Asia's largest economy was coming out of quarantine.

Dynamics of Chinese imports of Russian oil and fuel oil

Thanks to China, Russia managed to avoid severe export losses. The market is not worried about supply problems because the reduction in oil supply to Europe from the Russian Federation decreased in 2022 by only 300,000 bpd. The figure should fall to zero within a year of the embargo in early December. Moreover, the message about Moscow's intention to reduce production by 5%, which initially caused the growth of Brent quotes, actually turned out to be not so terrible. Despite this, producers intend to maintain exports at current levels.

The rapid recovery of Chinese economy may soon make itself felt. In the meantime, the market is fixated on the Federal Reserve's monetary restriction cycle and cautiously looking at the minutes of the February meeting. If its language turns out to be more hawkish, strengthening U.S. dollar will put additional pressure on oil.

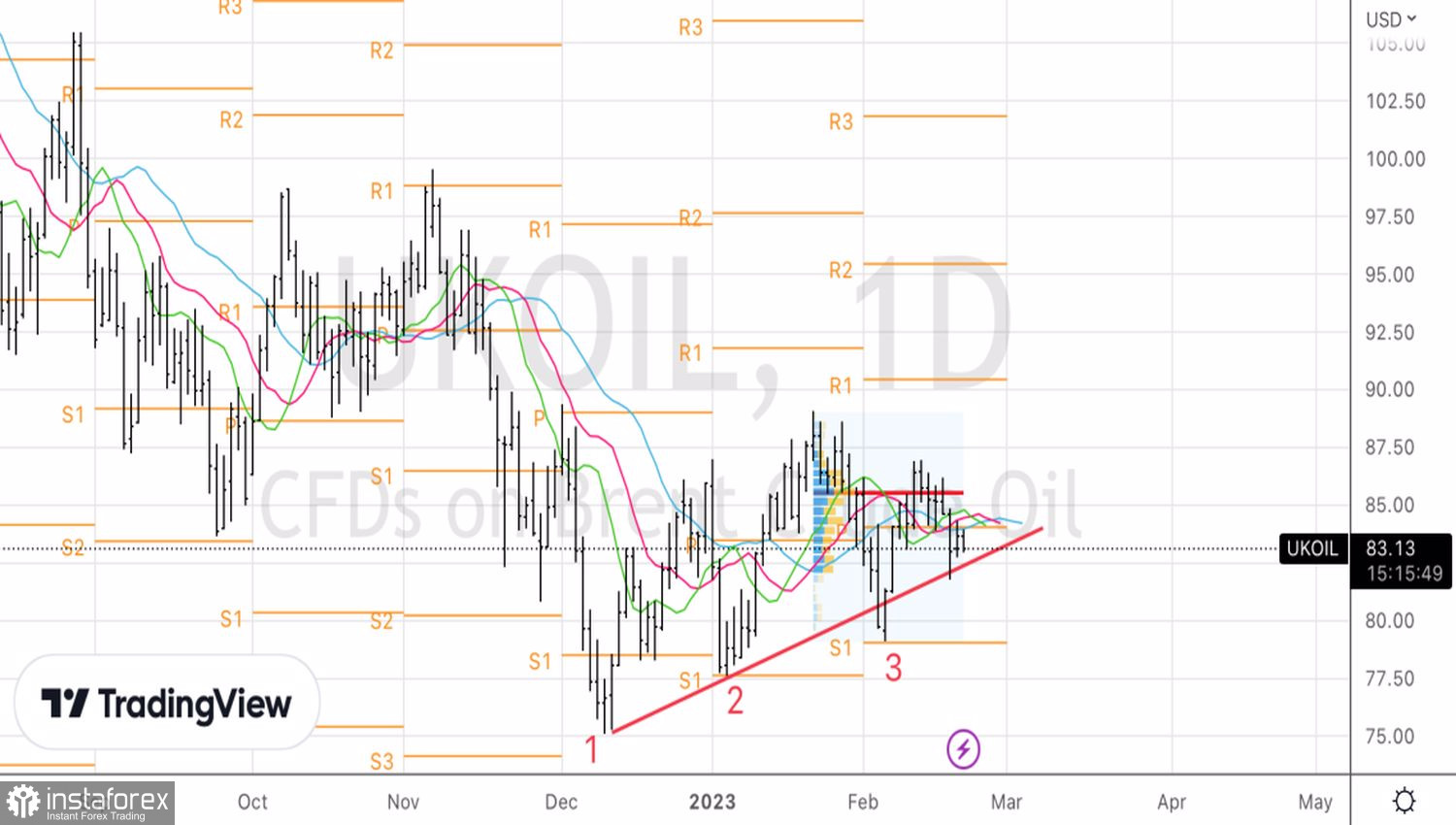

Technically, there was a fourth rebound from the trend line on Brent's daily chart, after which an inside bar was formed. As a rule, it is won back by placing pending buy orders from $84.4 and sell orders from $82.9 per barrel. At the same time, a failed test does not mean abandoning the strategy. The optimal option is a fiasco with sales followed by a return to the bar's highs and the formation of longs.