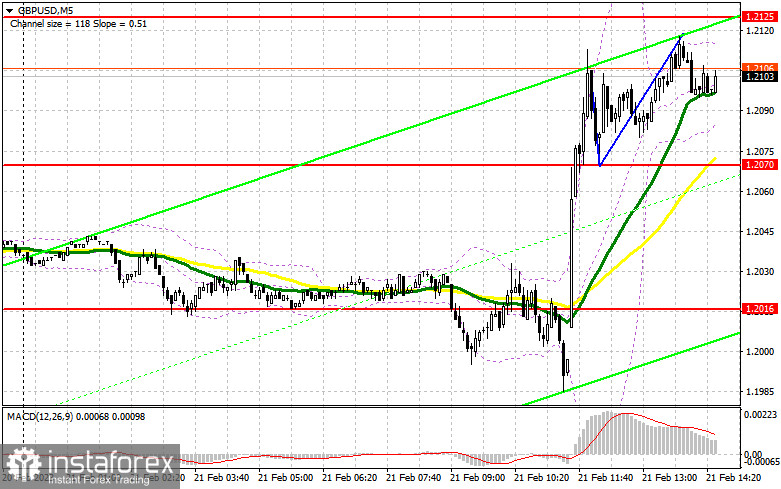

In my morning forecast, I focused on the 1.2016 level and offered advice based on it for trading decisions. Let's analyze the 5-minute chart to see what happened. Before the publication of significant reports on PMI indices, there was a slight increase in volatility, which prevented us from obtaining a typical entry point at the level of 1.2016. I was unable to enter long positions after the sudden development and breakthrough of 1.2070 since there was no reverse test. The technical situation had fully changed by the afternoon.

You require the following to open long positions on the GBP/USD:

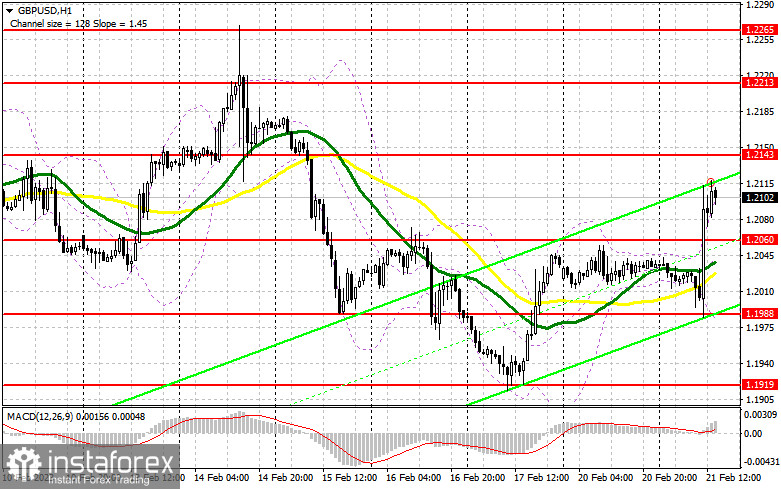

The release of comparable US PMI indices could cause the pound to rise again, as the data is expected to be quite poor. Another incentive to sell the British pound is if it turns out that the experts were mistaken and activity shows, even if not growth, then at least a slower slowdown. As a result, I encourage you to hold off on opening long positions until the price declines and a false breakout forms near the new support level of 1.2060. In anticipation of a breakthrough and strengthening to the area of 1.2143, this will provide a new signal to buy the pound. I won't wager on the continuation of the movement of GBP/USD up to the maximum of 1.2213 until setting and testing this range from top to bottom against the backdrop of really poor PMI indices. At 1.2265, where I fix profits, an exit above this range will also open up growth chances. The Federal Reserve System's aggressive stance will once again seize control of the market, placing more pressure on the GBP/USD exchange rate if the bulls are unable to complete the tasks assigned to them and miss 1.2060 in the afternoon, which is also possible. In this scenario, I suggest that you wait before making any purchases and only open long positions around the next support level of 1.1988 and only in the event of a false drop. I'll buy GBP/USD right away only if it rises over the monthly low of 1.1919 with the intention of a correction of 30-35 points during the day.

If you want to trade short positions on GBP/USD, you will need:

Positive UK economic data fueled concerns that the Bank of England would be compelled to raise interest rates more slowly than anticipated due to inflation, and sellers withdrew from the market. The sole hope for the bears is solid US PMI index data and defense of the nearest resistance level of 1.2143. In the current conditions, the formation of a false breakout would be a great indication to sell the pair and bring the GBP/USD back to the support of 1.2060 established at the end of the first half of the day. The purchasers' hopes for an upward correction will be dashed by a breakthrough and a reversal test of this level, strengthening the position of bears in the market and forming a sell signal with a decline to 1.1988. The 1.1919 area will be the farthest target, and an update there will signal the continuation of the downward trend. I'll set the profit there. With the option of GBP/USD growth and the absence of bears at 1.2143 in the afternoon, it may happen that bulls will continue to actively enter the market. I suggest you take your time with sales and keep 1.2213 in mind. Only a false breakout creates an opening for short positions there. If there is no movement at this price, I will sell GBP/USD right away at 1.2265, but only if I believe the pair will rebound again by 30-35 points during the day.

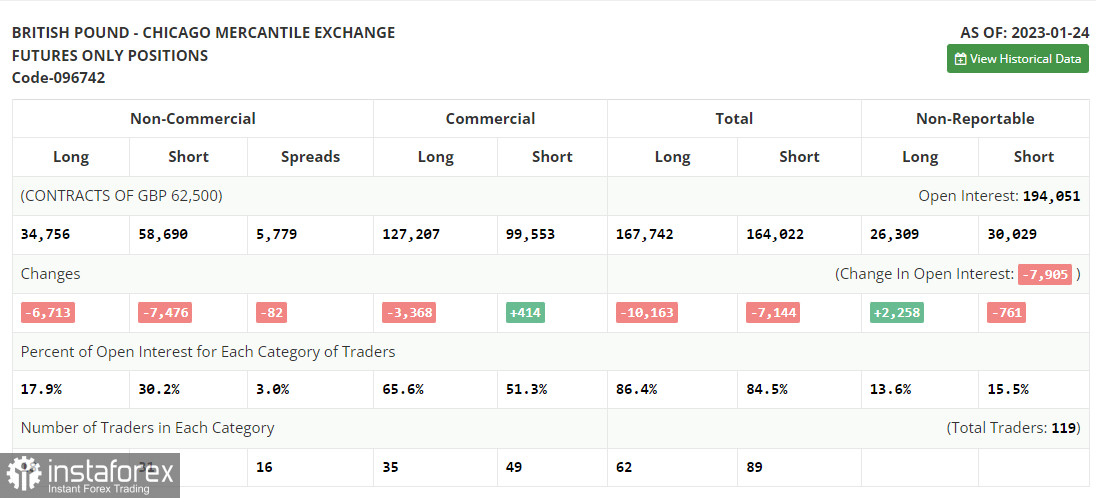

Due to a CFTC technical issue that has persisted for more than two weeks. The most recent COT reports have not yet been released. Following the data for January 24.

Both long and short positions were dramatically reduced in the COT report (Commitment of Traders) for January 24. But, given the difficulties the UK government is presently facing (fighting strikes and demands for wage increases while still attempting to achieve a continuous fall in the inflation rate), the current reduction was within an acceptable range. However, for the time being, all of this is relegated to the background as we wait for the Federal Reserve System meetings, with its anticipated less aggressive policy, and the Bank of England meetings, with its certainty to maintain an aggressive tone of statements and raise the rate by another 0.5%. All of this will help the British pound, therefore I'll wager on it strengthening even more, unless, of course, something extraordinary occurs. According to the most recent COT data, long non-commercial positions declined by 6,713 to 34,756 while short non-commercial positions decreased by 7,476 to 58,690, resulting in a fall in the non-commercial net position's negative value to -23,934 from -24,697 a week earlier. We will continue to keep a careful eye on the economic indicators for the UK and the decision made by the Bank of England because such insignificant changes do not significantly change the balance of power. In contrast to 1.2290, the weekly ending price increased to 1.2350.

Signals from indicators

Moving Averages

Trade is taking place above the 30 and 50-day moving averages, indicating an effort to return purchasers of the pound into the market.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.1988, will serve as support in the event of a downturn.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.