Yesterday, the British pound gained significantly against the US dollar, although the UK economy is undergoing the most severe cost-of-living crisis in several generations. Yet, as it turned out, it is handling things better than economists and the Bank of England's policy had anticipated, which improves the likelihood that the nation will escape entering a recession.

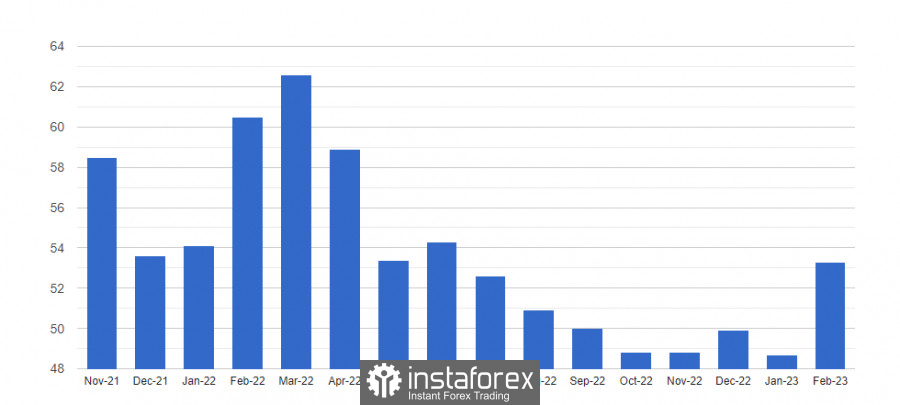

According to PMI index figures released yesterday, private sector output increased for the first time in seven months, accompanied by significant increases in tax collections and higher-than-expected retail sales. All of this suggests that the economy remains stable, defying official and expert predictions.

Prime Minister Rishi Sunak and his Conservative Party, who have a difficult task ahead of them to win the general election, might take solace in this kind of news. The resulting number, however, might force the Bank of England to keep up the sharpest rate increase in the last three decades to bring inflation back to the target level of roughly 2.0%.

The facts to date only show that the likelihood of an economic recession has greatly lessened when compared to before, but the heightened inflationary pressure has not subsided and unquestionably continues to be the regulator's top concern.

As mentioned above, yesterday's statistics showed a substantial rise in activity in the service sector, which caused the pound to rise and the weekly maximum to be updated. The Bank of England had previously revised and improved its prediction earlier this month, anticipating a contraction of less than 1% over the following five quarters. In actuality, this is a protracted period of stagnation rather than a full-blown recession.

The Treasury's demand for cash has decreased as a result of lower-than-anticipated interest payments on debt and the highest-ever income tax receipts. A warmer winter lowers energy demand, enabling government subsidies for citizens to pay their electricity and natural gas bills to be reduced. Remember, though, that the British Finance Minister rejected calls for a significant tax cut and declined to grant the unions' requests for salary rises, both of which, in theory, would have reduced inflationary pressure and limited future inflationary pressure.

"Given that debt is at its highest level since the 1960s, we must stick to our plan to reduce it in the medium term. Debt reduction will require some difficult decisions, but it is extremely important to reduce the amount that will be spent on debt interest so that we can protect our public services," Hunt said in a statement.

Inflation is not declining as quickly as anticipated, even if some indicators show a significant improvement. The most recent value of 10.1% is far from the Bank of England's targets, although being one percentage point lower than the peak in October.

Regarding the GBP/USD's technical picture, the bulls were able to halt the bear market. The bulls must ascend above 1.2140 to stabilize the situation. The only way to increase the likelihood of a subsequent recovery to the area of 1.2215, after which it will be feasible to discuss a more abrupt movement of the pound up to the area of 1.2265, is if this resistance fails to hold. After the bears seize control of 1.2065, it is feasible to discuss the return of pressure on the trading instrument. The bulls' positions will be hit if this range is broken, which could push the GBP/USD back to 1.1980 with a potential return of 1.1920.

Regarding the EUR/USD technical picture, the pair's pressure was maintained. Breaking above 1.0660 will cause the trading instrument to snap to the 1.0720 level and halt the bear market. Above this point, you can easily reach 1.0760 and update 1.0800 in the near future. I anticipate some activity from significant purchasers if the trading instrument only declines in the vicinity of 1.0615. It would be preferable to wait until the 1.0565 low has been updated if no one is there before initiating long positions.