The recent batch of US strong economic data proved the resilience of the US economy and a slowdown in annual inflation rates. Such data increased fears that the Federal Reserve will forge ahead with aggressive rate hikes. For this reason, the US benchmark stock indices slipped on Tuesday while yields of US Treasuries went up. Oddly, the US dollar advanced moderately against the basket of its rival currencies.

Lately, investors have been a bundle of nerves, responding painfully to upbeat economic statistics and hawkish remarks by Fed's policymakers. The monetary authorities advocate for a further hawkish agenda because there is some evidence that inflation is unlikely to fall to the target level of around 2%. The US regulator has always expressed its commitment to bringing inflation down to 2%. So, the odds are that interest rates will be pushed up above 5%.

Why does USD receive modest support under current fundamentals?

Indeed, yields of Treasuries are rising, having already climbed to the highs of November 2022. The US stocks are trading lower. Curiously, the US dollar's growth is subdued. From my viewpoint, two reasons lie behind the fact. On the one hand, large-scale geopolitical risks related to Russia's aggression in Ukraine and the diplomatic standoff between the US and China. Such headwinds have already crippled business activity in the world.

Because the threat of a broader conflict between Russia and the united West does not encourage a boom in the manufacturing sector. Under such conditions, the US dollar, which used to win favor with investors as a traditional safe haven asset, does enjoy buoyant demand now due to the US aggressive policy which scares off countries outside the anti-Russian coalition. They worry that Washington could use the US dollar as an economic weapon. For this reason, traders are showing less interest in the US currency.

On the other hand, investors are anticipating the FOMC minutes of the latest policy meeting which are due later today. Investors are keen to find out the true sentiment among voting members of the rate-setting committee and evaluate the real prospects of interest rates in the future. Besides, market participants will be able to assess the inflation dynamic in the US through the following economic data: the PCE price index as well as personal spending and income. These reports will be released on Friday. The US GDP Q4 data will be on tap on Thursday.

I suppose if the PCE price index reveals waning inflation pressure, investors should be braced for massive sell-offs in stock markets, a decline in demand for commodity assets, and the US dollar's significant appreciation.

Trading activity today may be somewhat subdued ahead of the release of the Fed minutes relatively late in the session. Markets will perk up in the late New York trade, but the overall sentiment will depend on the content of the minutes.

Intraday forecast

GBPUSD

GBP/USD is still trading inside a wide range between 1.1910 and 1.2440 amid the global uncertainty about further Fed's moves on interest rates. Perhaps market sentiment will improve today before the publication of the FOMC minutes. If the instrument tops the level of 1.2130, it could climb to 1.2215 intraday.

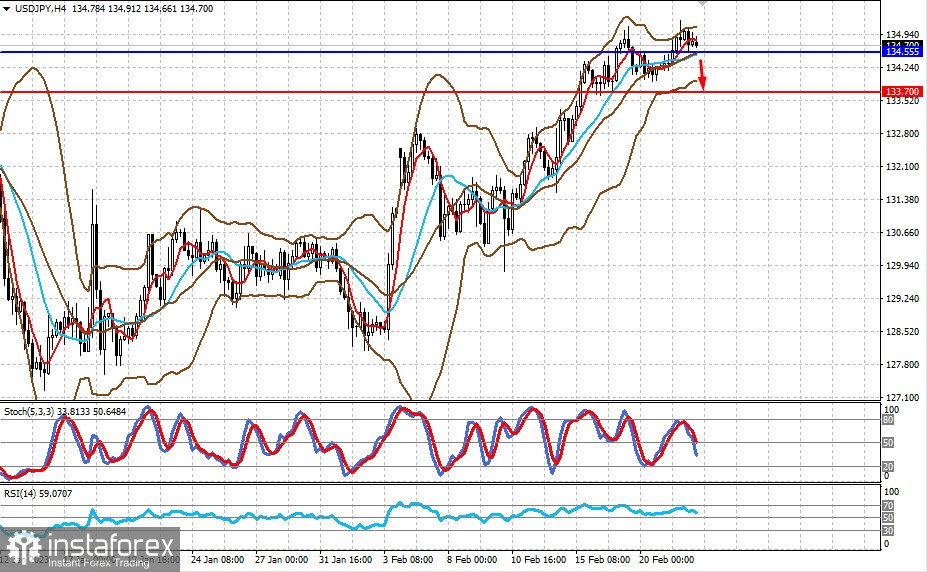

USDJPYThe currency pair received support on the back of the broad-based advance of the US dollar. However, the balance of trading forces could change if the market shifts focus towards the safety of the yen. In this case, USD/JPY might drop below 134.55 and gain downward momentum to fall to 133.70.