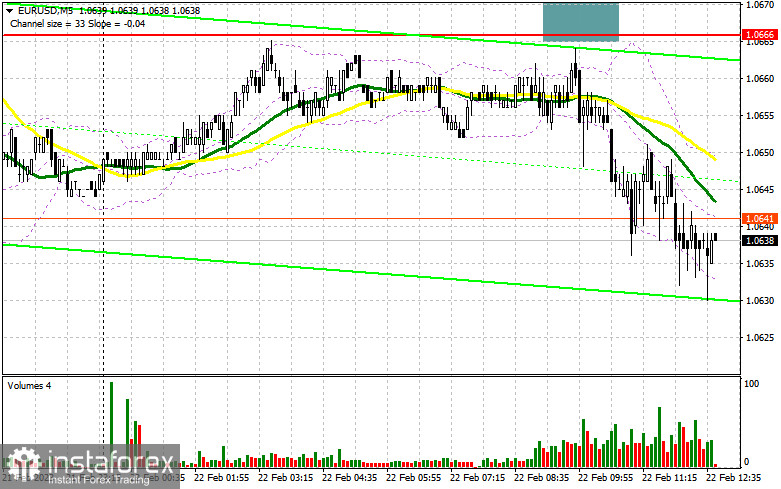

In my morning forecast, I focused on the level of 1.0666 and offered recommendations based on it for market entry decisions. Let's analyze the 5-minute chart to see what happened. Although there was growth in the area around 1.0666, we were unable to confirm a false breakout and a sell signal before the level's test because only a few points were absent. I, therefore, missed the sale opportunity. The technical situation has not changed for the second half of the day.

If you want to trade long positions on EUR/USD, you will need:

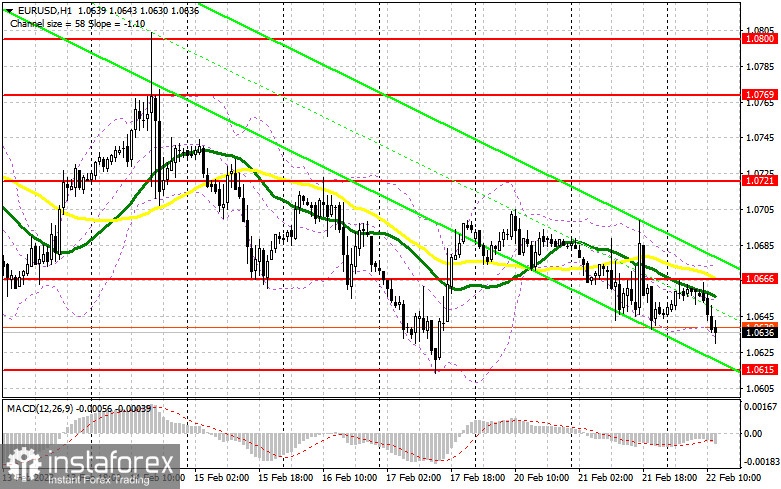

The Federal Reserve System meeting minutes from the February meeting are all that are available in the afternoon, and I don't think they will have a significant impact on the market. The main focus will be on how many Fed officials were committed to pushing forward with aggressive rate increases despite fundamental changes that, as it proved out later, took place in January of this year. If the Fed decides to raise interest rates by another 0.5% at the next meeting, the euro will suffer even more against the dollar. In this situation, the area where the bears are steadily pushing the euro, at 1.0615, is where I will only catch the pair. When a false collapse occurs again, I purchase to regain the previous resistance level of 1.0666, which was created in light of yesterday's performance. In light of the Fed's continued dovish stance, the breakout and top-down test of 1.0666 create an extra entry point for accumulating long positions with a movement to 1.0721. When 1.0721 is broken, the stop orders for the bears will be hit, shifting the market and maybe bringing it to 1.0769, where I will fix profits. The pressure on EUR/USD will stay if it lowers and there are no buyers at 1.0615 in the afternoon; a break of this level would only make the bearish trend stronger. In this instance, the following support level of 1.0565 will be highlighted. The only reason to buy the euro is the emergence of a false collapse. For a rebound from the low of 1.0525, or even lower - around 1.0484 - I will begin long positions right away with the target of an upward corrective of 30-35 points during the day.

If you want to trade short positions on EUR/USD, you'll need:

There is no alternative explanation for today's strong short-term downward movement, so sellers of the euro need the Federal Reserve System to take an aggressive stance. Of course, a false collapse in the 1.0666 resistance level, where the moving averages are situated and are on the sellers' side, continues to be the ideal scenario for initiating short positions. In this situation, sales must reach a minimum of 1.0615 per week. The market will become more negative as a result of the collapse and reversal test of this range, which is another signal to start short positions with an exit at 1.0565. Repairing below this level will result in a further drop to about 1.0525, where I'll take a profit. I suggest you delay opening short positions until the level of 1.0721 if the EUR/USD moves higher throughout the US session and there are no bears at 1.0666, which will only occur if the Fed follows a very dovish policy. Moreover, you can only sell there following a failed consolidation. In anticipation of a rebound from the high of 1.0769, I will open short positions right away with a 30- to 35-point corrective in mind.

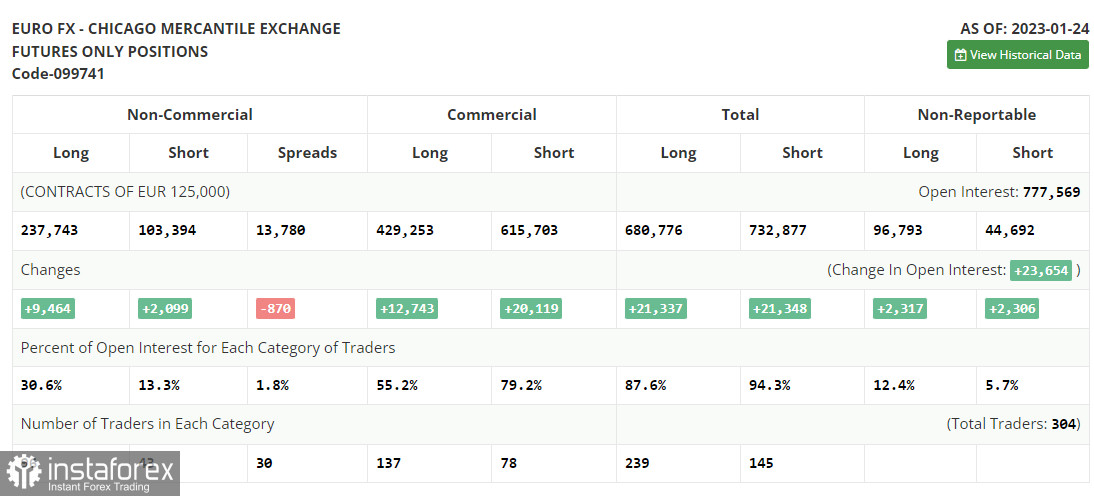

Due to a CFTC technical issue that has persisted for more than two weeks. The most recent COT reports have not yet been released. Following the data for January 24.

Both long and short positions increased as of January 24, according to the COT report (Commitment of Traders). The ECB representatives' speeches from last week had an impact on traders, who actively increased their long positions in anticipation of the ECB continuing its aggressive policy and the Federal Reserve System adopting a less aggressive stance that may, for the second time in a row, reduce the amount by which the rate will be raised. Recent weak fundamental data on the US economy, particularly the decline in retail sales and the easing of inflationary pressure, indicate that it is time to loosen up since the Fed's continued tight monetary policy could worsen the situation. This week's schedule of central bank meetings will determine the pair's future course. According to the COT data, the number of long non-profit positions rose by 9,464 to 237,743, while the number of short non-profit positions increased by 2,099 to 103,394. The total non-commercial net position rose to 134,349 from 126,984 toward the end of the week. All of this shows that investors are confident in the euro's future growth but are awaiting more information on interest rates from central banks. In contrast to 1.0833, the weekly ending price increased to 1.0919.

Signals from indicators

Moving Averages

Trade is taking place below the 30 and 50-day moving averages, indicating the sellers' advantage.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located around 1.0670, will serve as resistance in the event of expansion.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.