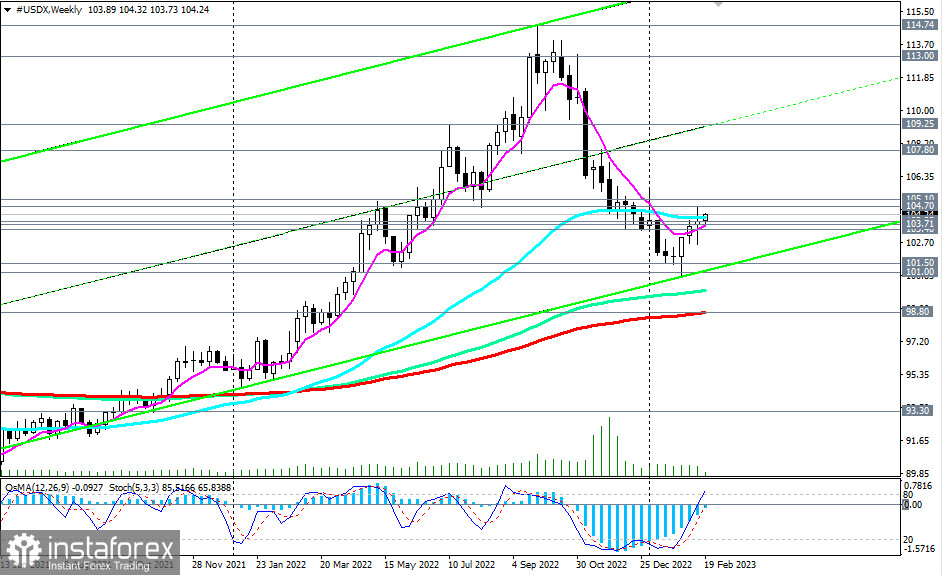

The dollar and its DXY index have been rising since the opening of today's trading day. As of writing, DXY futures (CFD #USDX in the MT4 trading terminal) were trading near 104.20, while remaining in the ranges between 104.60, 102.39, 105.50, and 100.68.

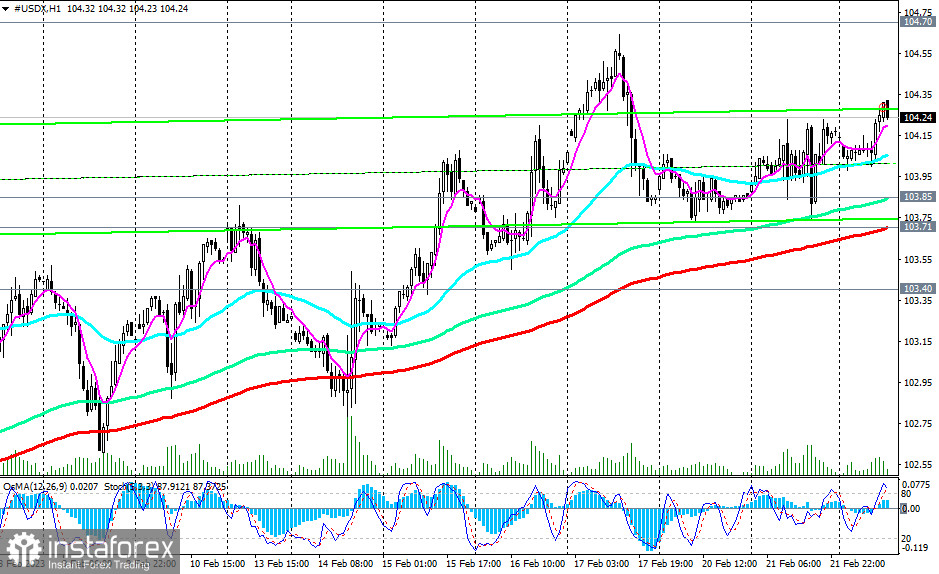

Below the key resistance level 104.70 (200 EMA on the daily CFD #USDX chart), the DXY index remains in the bear market zone.

The breakdown of support levels 103.85 (144 EMA on the daily chart) and 103.71 (200 EMA on the 1-hour chart) may become a signal for the resumption of short positions on DXY with targets at local support levels 101.50, 101.00.

In case of further decline, the targets will be the key support levels 100.00 (144 EMA on the weekly chart) and 98.80 (200 EMA on the weekly chart). The breakdown of the long-term support level 93.30 (200 EMA on the monthly chart) will confirm the final return of the dollar and its DXY index to the global downward trend zone.

In an alternative scenario, after the breakdown of the resistance levels 104.70 and 105.10 (144 EMA on the daily chart), DXY will resume growth, returning to the long-term bullish trend zone.

And today, market participants who follow the dollar quotes will be waiting for the publication (at 19:00 GMT) of the minutes from the Fed meeting, which ended February 1.

Support levels: 104.00, 103.85, 103.71, 103.40, 102.00, 101.50, 101.00, 100.00, 98.80.

Resistance levels: 104.70, 105.10, 107.80, 109.25.

Trading scenarios

Sell Stop: 103.60. Stop-Loss: 104.80. Take-Profit: 103.40, 102.00, 101.50, 101.00, 100.00, 98.80.

Buy Stop: 104.80. Stop-Loss: 103.60. Take-Profit: 105.10, 107.80, 109.25.