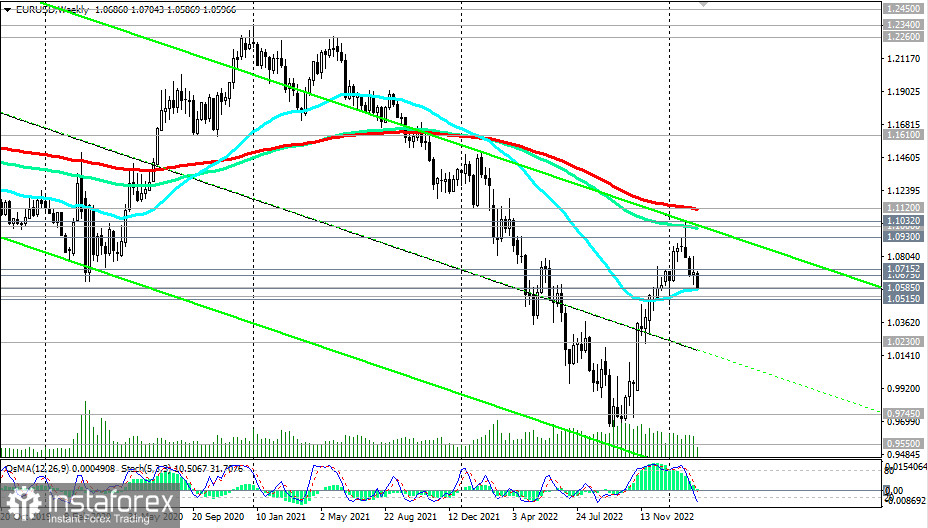

The EUR/USD pair reached a local 10-month high of 1.1032 at the beginning of the month, but then fell sharply, primarily due to the strengthening dollar, having lost about 2.5% in value since the beginning of the month to date.

And yet investors remain optimistic about the EUR/USD pair, including on expectations of a gradual narrowing of the interest rate gap between the Fed and the ECB.

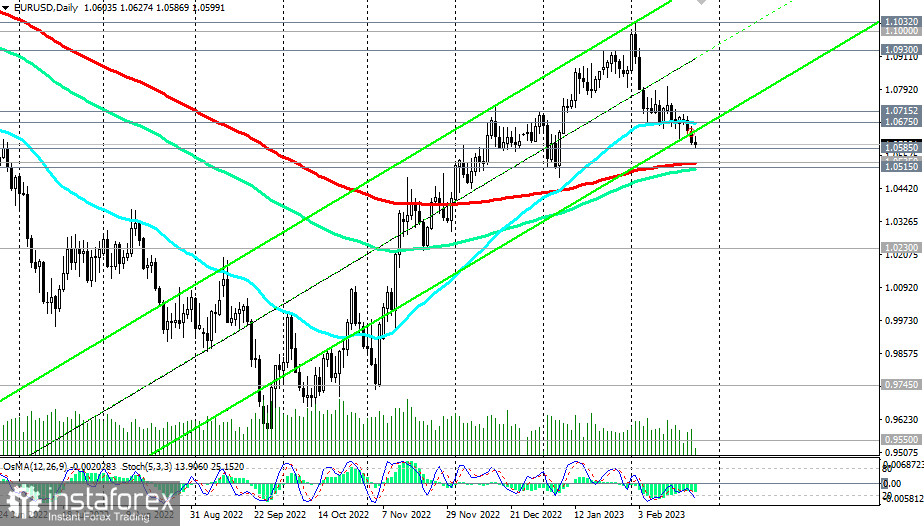

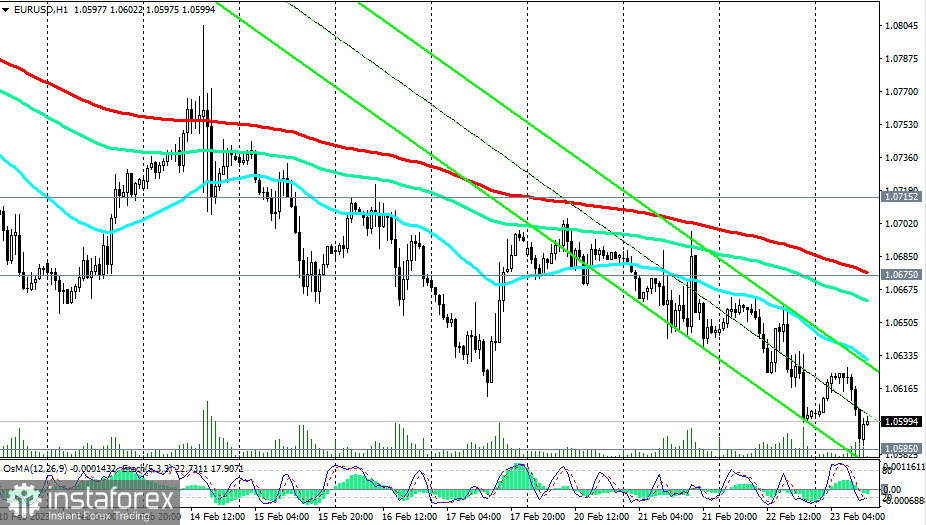

Today, the pair found support at the important level of 1.0585 (50 EMA on the weekly chart) and in case of resumption of growth, the breakdown of the important resistance level 1.0675 (200 EMA on the 1-hour chart and 50 EMA on the daily chart) will be the first signal for the resumption of long positions. At the same time, the EUR/USD pair will head towards the recent high at 1.1032, and then towards the upper limit of the upward channel on the daily chart and the resistance level 1.1120 (200 EMA on the weekly chart). Its breakdown will confirm the return of EUR/USD to the long-term bull market zone.

In an alternative scenario, EUR/USD will break through the important support level 1.0585, which will give the pair a new bearish impetus in its movement to key support levels 1.0535 (200 EMA on the daily chart), 1.0515 (144 EMA on the daily chart). Their breakdown will finally return EUR/USD to the long-term bear market zone.

Support levels: 1.0585, 1.0535, 1.0515, 1.0500, 1.0230

Resistance levels: 1.0600, 1.0675, 1.0700, 1.0715, 1.0800, 1.0930, 1.1000, 1.1032, 1.1120, 1.1610

Trading scenarios

Sell Stop 1.0575. Stop-Loss 1.0635. Take-Profit 1.0535, 1.0515, 1.0500, 1.0230

Buy Stop 1.0635. Stop-Loss 1.0575. Take-Profit 1.0675, 1.0700, 1.0715, 1.0800, 1.0930, 1.1000, 1.1032, 1.1120, 1.1610