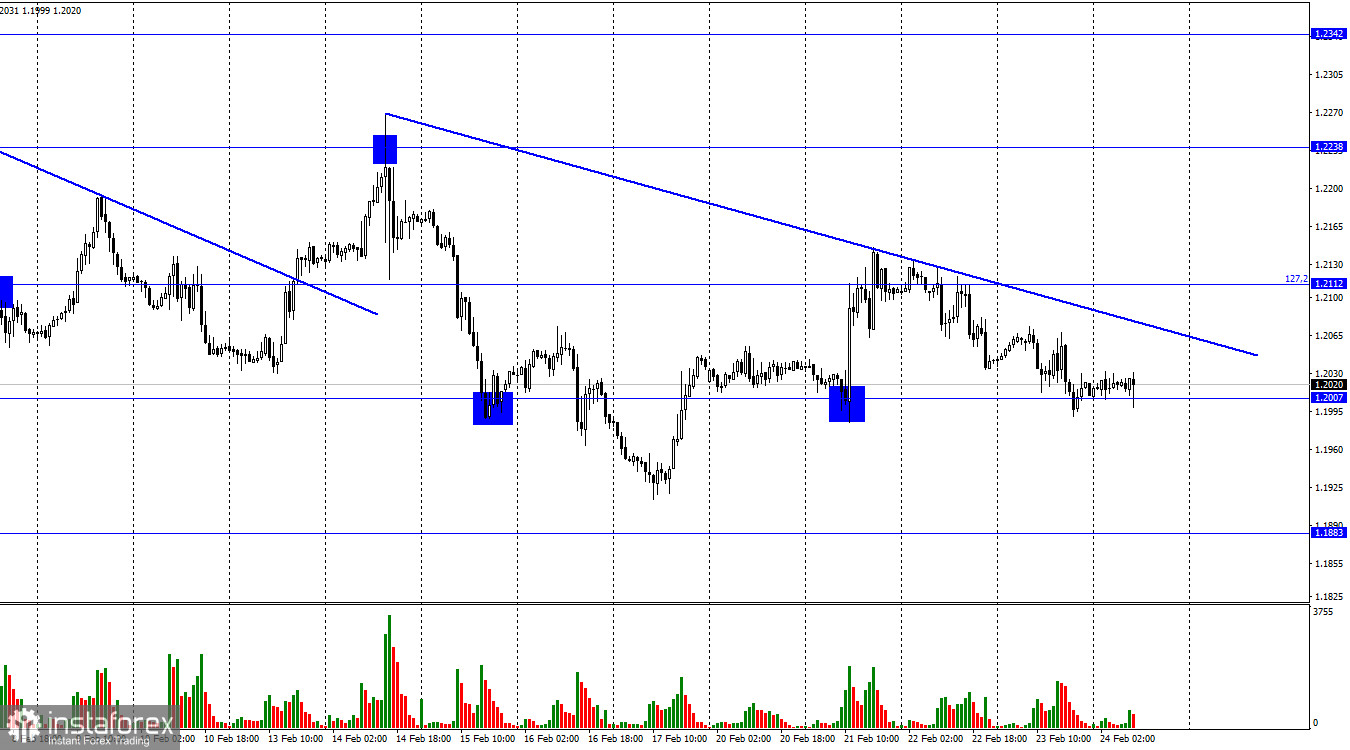

The hourly chart shows that the GBP/USD pair dropped to the 1.2007 level. The European currency will benefit from the quotes' rebound from this level and some growth in the direction of the downward trend line, which describes traders' attitudes as "bearish." The risk of a further decline towards the next level of 1.1883 will increase if the exchange rate of the pair is fixed below the 1.2007 level.

The British pound had an empty day yesterday. The second GDP report for the fourth quarter was made public in the USA, and I must admit that its value did not match either market forecasts or the previous value. If an increase of 2.9% was seen a month earlier, the value fell to 2.7%. Notwithstanding yesterday's increase, the US dollar may have been stronger if not for this data. This is not, however, the final figure for the fourth quarter. The indicator can once again receive a higher rating in the third evaluation. Also, the 2.7% increase is excellent considering that only a few months ago, everyone was predicting a recession for the American economy. Moreover, changes of 0.1-0.2% in any direction are not particularly significant. But, I should point out that the British pound is not rushing to decline like the euro, suggesting that bear traders are being restrained in some way. The bulls were undoubtedly pleased with this week's business activity indices, but it's Friday, and it's time to move on from these figures. You should pay particular attention to the trend line since it could close above it, signaling that the bulls are once again on the offensive. Just the least significant reports in the USA convey the information backdrop today. Representatives of the Bank of England, Cunliffe and Tenreyro, will speak in Britain. Their speeches can help the British pound identify its direction.

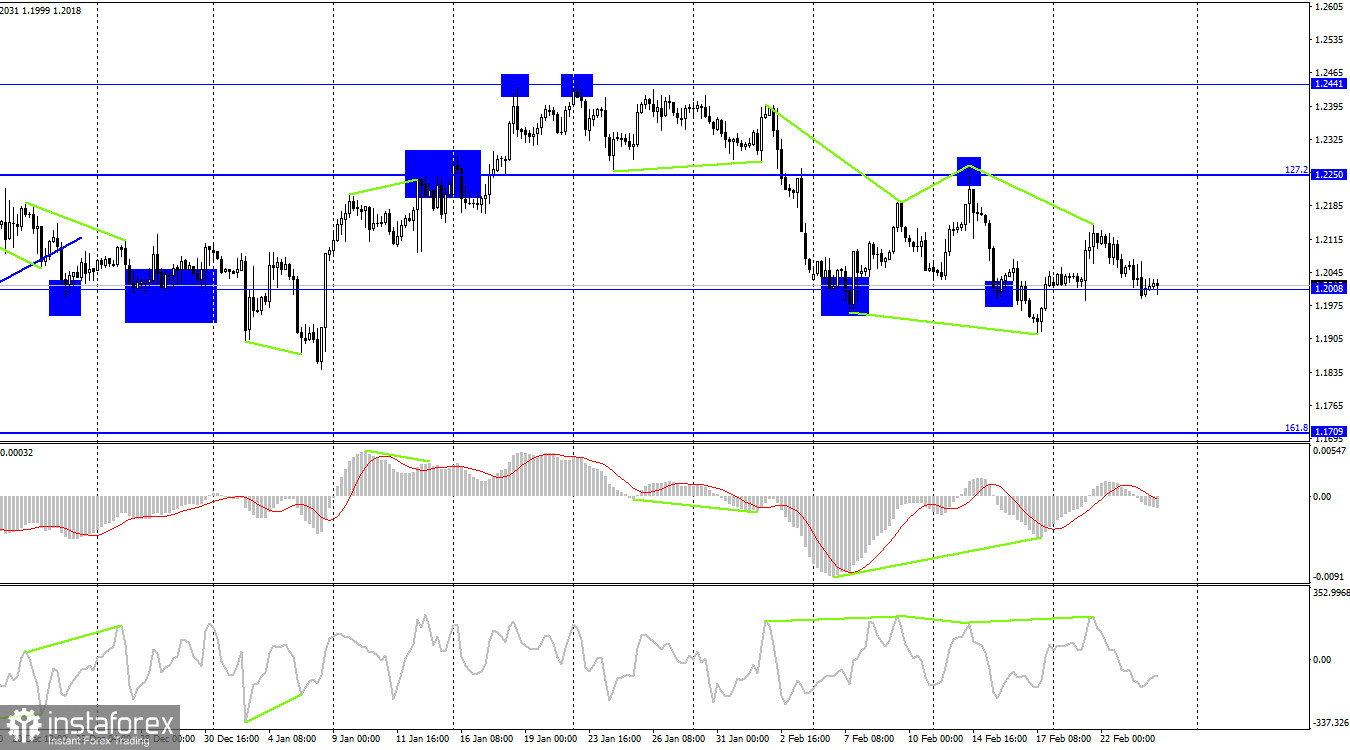

The pair reversed in favor of the US dollar on the 4-hour chart as the CCI indicator showed a "bearish" divergence. The 1.2008 level is where the pair is currently headed, which shouldn't be a challenge to overcome. This success will enable us to anticipate a further decline in the direction of the following corrective level, which is 161.8%-1,1709. No indication shows any new emerging divergences.

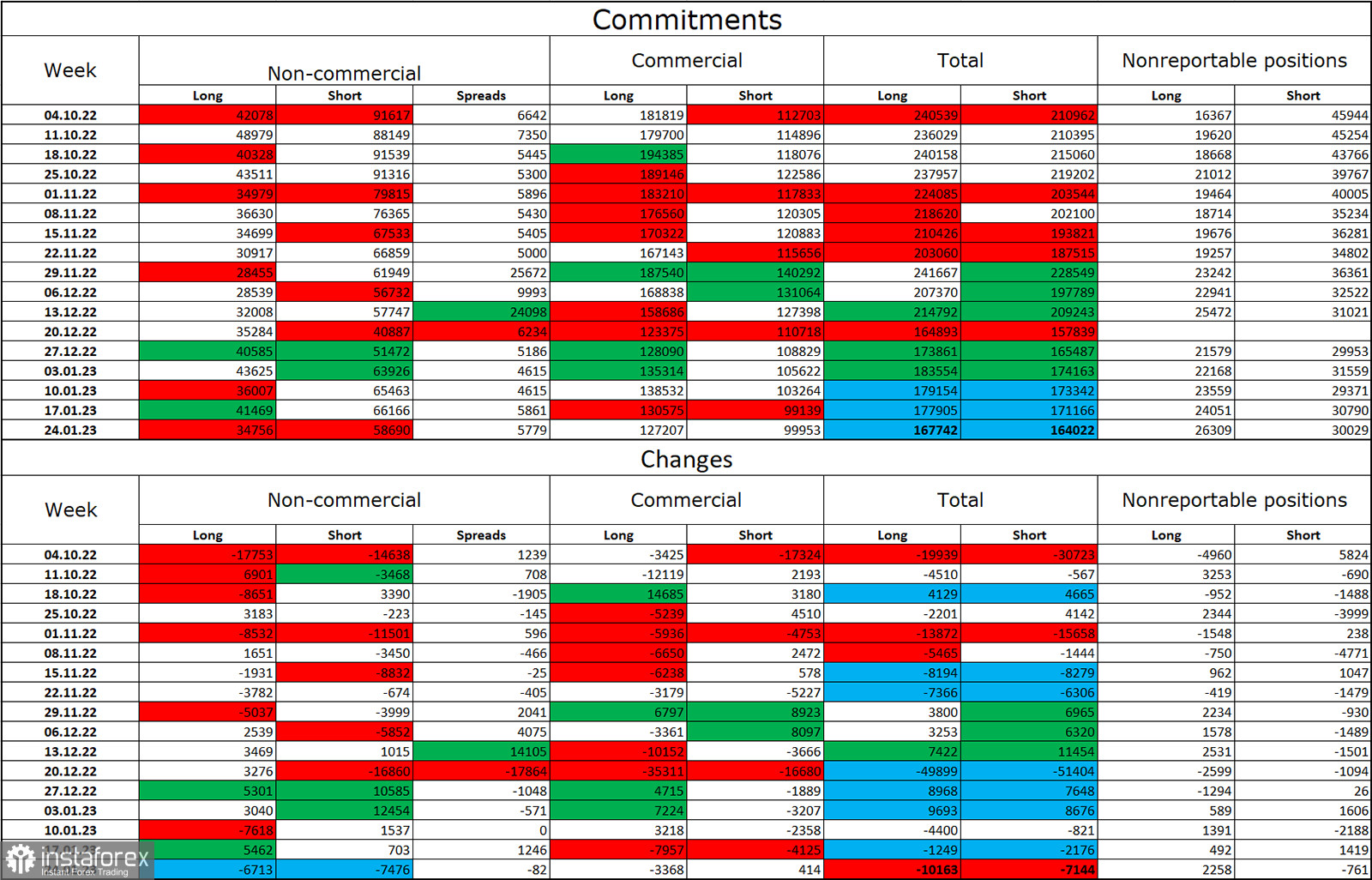

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short in the hands of speculators is nearly doubled once more. As a result, the prospects for the pound have once again declined, but the British pound is not eager to decline and is instead concentrating on the euro. An escape from the three-month ascending corridor was visible on the 4-hour chart, and this development may have stopped the pound's growth.

News calendar for the USA and the UK:

US - basic price index of personal consumption expenditures (13:30 UTC).

US - income and expenses of individuals (13:30 UTC).

US - consumer sentiment index from the University of Michigan (15:00 UTC).

There are no significant reports in the US on Friday, and there are no economic events scheduled at all in the UK. The information background may not have much of an impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

When the pound retreated from the level of 1.2112 on the hourly chart, I suggested selling it with targets of 1.2007 and 1.1883. The initial target has been completed. At the close, new sales were below 1.2007. As the pair rebounds from the 1.2007 level, buyers may choose to buy it with 1.2070 (trend line) and 1.2112 as their targets.