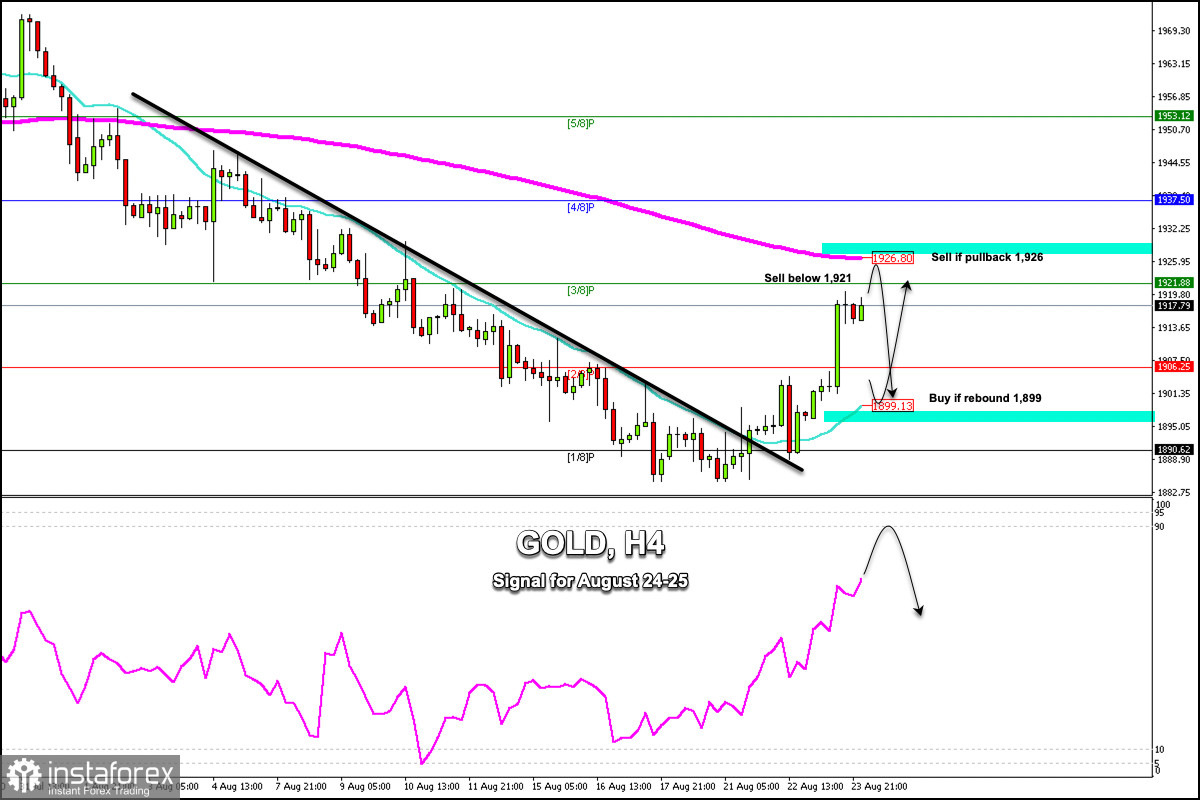

Early in the European session, gold (XAU/USD) is trading around 1,917.79 below the 200 EMA and below the 3/8 Murray which acts as a range zone.

Gold strengthened yesterday during the American session due to the fact that US Treasury yields fell after 3 weeks of gains. This happened as a consequence of market sentiment that believes that the Fed will end its cycle of interest rate increases.

On August 21, gold sharply broke out of the downtrend channel formed since early August. Now is it consolidating above the 21 SMA located around the psychological level of 1,900 and above the 2/8 Murray which acts as strong support at 1,906. This scenario means that gold could trade within a range zone between 1,926 and 1,900 in the coming days.

The Eagle indicator is approaching the overbought zone according to the H4 chart, but we still have a chance that gold will continue to rise and it could reach 1,926. If a break of this zone occurs, the metal could reach 1,937 (4/8 Murray) as a key point which could be a bullish sign in the medium term.

According to the 4-hour chart, we can expect gold to approach the area between 1,921 and 1,926 area in the next few hours. This level could be seen as an opportunity to sell gold with targets at 1,915 and 1,906.

On the other hand, in case gold falls and consolidates above the psychological level of 1,900, this could be seen as a clear signal to buy with targets at 1,921 and 1,937.

Our trading plan for the next few hours is to sell gold below 1,921 or around 1,926. The Eagle indicator on the 1-hour chart is in the extremely overbought zone. It is also approaching overbought levels on the 4-hour chart. So, a technical correction is expected in the next few hours.