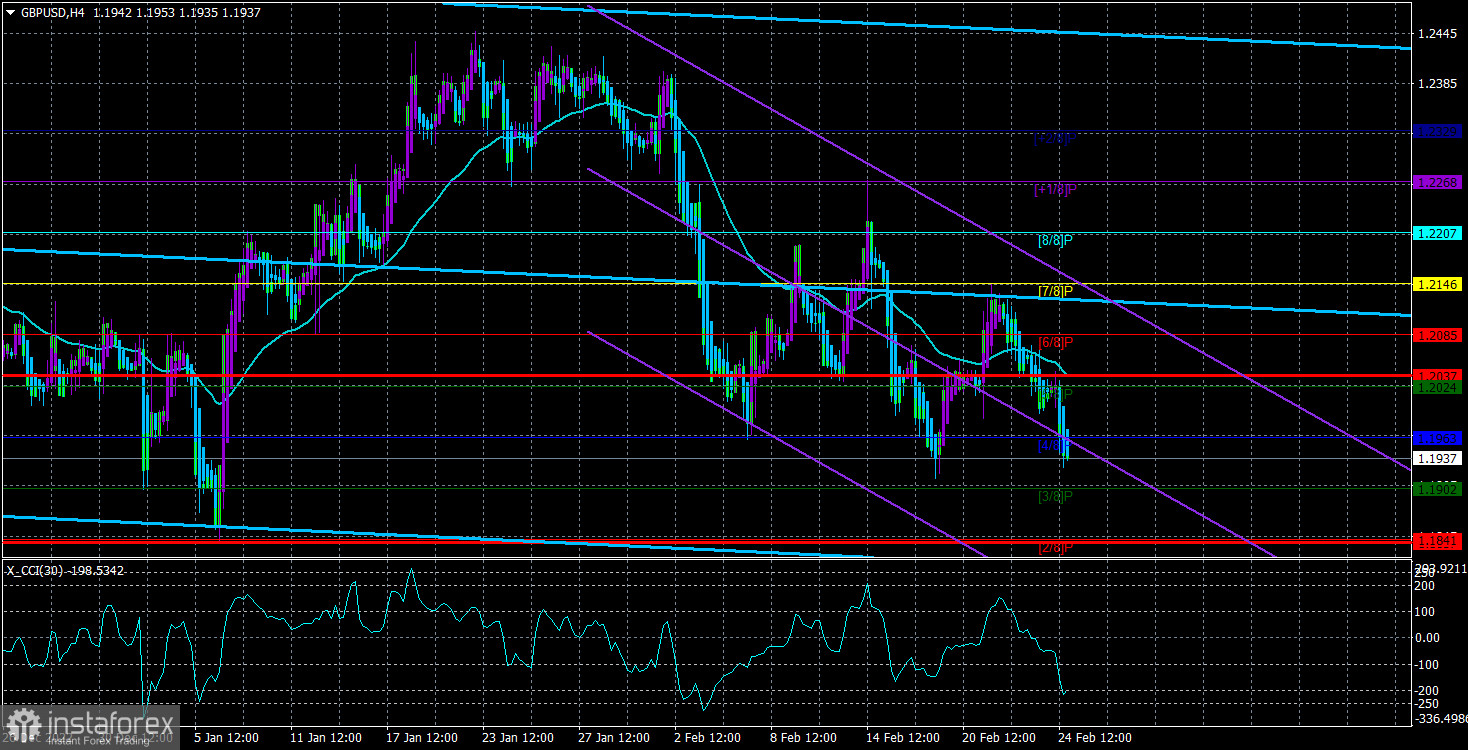

The GBP/USD currency pair dropped to its most recent local low on Friday and was almost as low as its prior and subsequent lows near the level of 1.1841. As a result, despite multiple upward corrections, the downward trend persisted as expected. All indicators point to a downward trend at this point because both of the linear regression channels are already pointing downward. Recall that we have been anticipating a significant decline in the value of the pound for a considerable amount of time and that this decline currently appears to be substantial only on the 4-hour TF. For instance, a strong round of 50% upward movement from the prior downward trend, which lasted two years, is readily visible on a 24-hour TF. However, the pair has been trading in the side channel between the levels of 1.1840 and 1.2440 for three months, so the subsequent decrease so far appears to be more of a bland flat. The movements in this channel on the 4-hour TF look serious and cannot be regarded as flat. On the daily TF, however, flat movements are also possible, so we do not rule out the possibility that a rebound from 1.1840 would start a new wave of upward movement of 400–500 points.

It is now crucial for the British pound to break through the Ichimoku cloud on the 24-hour TF, near where it is currently situated. If you're fortunate, the likelihood of a further fall (which would make the most sense) will increase. Additionally, we think that the pound may be under pressure from the Bank of England's lack of remarks or announcements regarding potential changes to monetary policy. After ten rate increases, traders just do not know what to expect from the British regulator. Especially given the likelihood of a recession within the next five quarters. After all, the more interest rates rise, the deeper and stronger the recession becomes. However, the British economy is already experiencing difficulties due to the current circumstances (Brexit, the pandemic, highway reforms, tax rises, and high inflation). So, it is doubtful that the BA will tighten without first taking a step back to get inflation back to 2%. Also, there is no urgency on the part of the indication to decrease. Even after accounting for the sharp decline in energy prices.

The increase in wages is an issue for the States as well.

When employees spend more when they have more money, as we have already shown, Bank of England officials are terrified of high pay growth. Prices are beginning to grow even more quickly as a result of the rising demand for products and services. So, in a perfect world, wages would either not grow at all or grow considerably more slowly than 6%. Nevertheless, this is what the regulator believes, not common British citizens whose salaries have declined because of inflation of 10%. It turns out that a comparable issue also exists in the United States. In particular, Philip Jefferson, a member of the Fed's monetary committee, claimed that wage growth in the US is too high and that it falls short of forecasts for a swift return of inflation to 2%. He added that the disparity between the supply and demand for labor indicates that inflation would likely be high for a considerable amount of time. It most likely means what Hugh Pill and Andrew Bailey already discussed. There is a labor shortage in some places as a result of the low level of unemployment. Businesses are compelled to increase wages to attract the workers they require. That is rather intriguing given the constant news coverage that huge corporations are laying off employees as a result of the Fed's strict monetary policies.

Generally speaking, we also think that eventually, inflation will start to formally slow down (by 0.1-0.2% each month) or stop growing entirely. There are fewer uncertainties in the context of the Fed because it has ample opportunities to keep raising the rate. The market now expects no more than two tightenings in 2023, so the more he raises it, the stronger the US dollar will become. Although there might be a lot more of them. We think that the BA meeting and Andrew Bailey's speech will be the most significant of the upcoming regulatory meetings in March. The pound can be prevented from falling if the rate increases by 0.5% once more. But, there are still at least two weeks before the summit, which is more than enough time for the pound to lose another few hundred points.

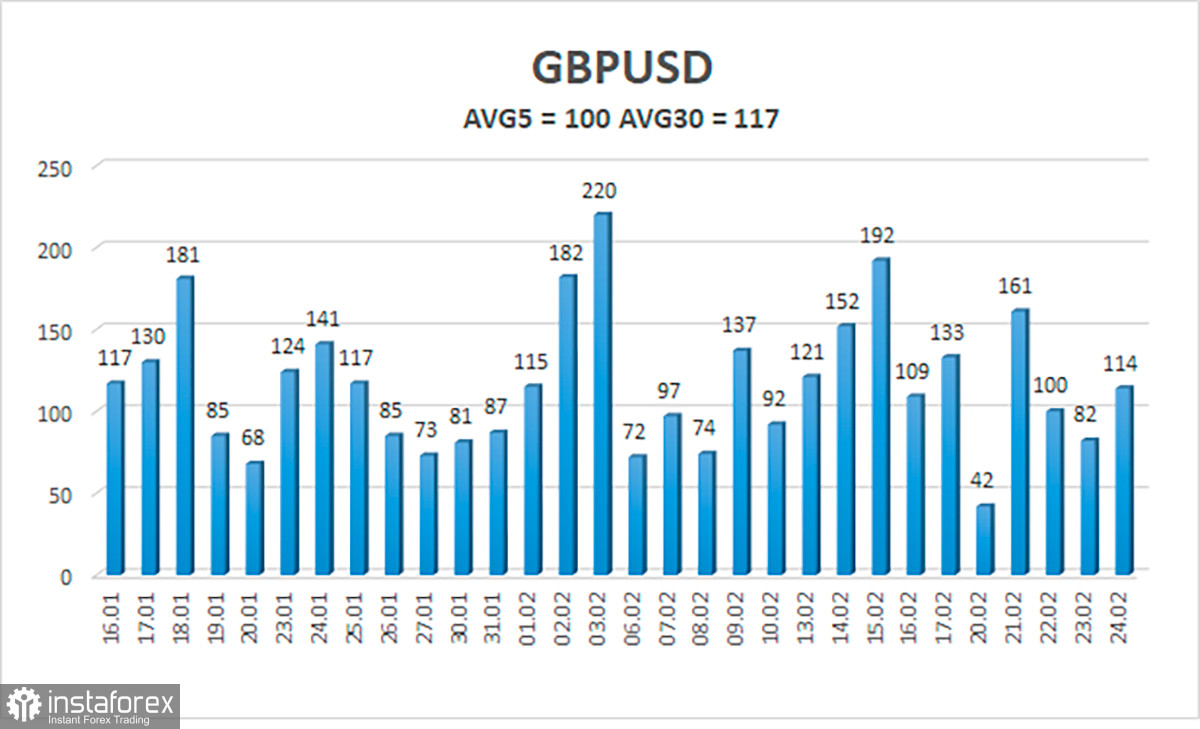

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 100 points. This value is "average" for the dollar/pound exchange rate. Hence, we anticipate movement inside the channel on Monday, February 27, with movement being limited by levels 1.1837 and 1.2037. A new round of upward correction will be indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.1902

S2 – 1.1841

S3 – 1.1780

Nearest levels of resistance

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trade Suggestions:

In the 4-hour timeframe, the GBP/USD pair once again stabilized under the moving average. So, until the Heiken Ashi indication turns up, it is still possible to hold short positions with targets of 1.1902 and 1.1841. If there is a consolidation above the moving average, long positions with targets of 1.2085 and 1.2146 can be opened.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.