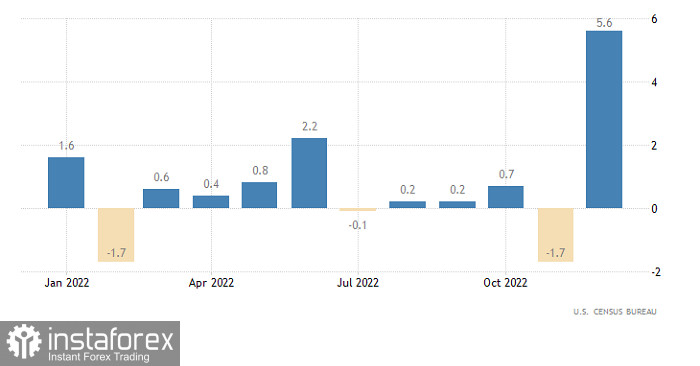

The greenback keeps strengthening, and its overbought status signals just an insignificant slowdown in growth. In fact, US macro statistics have contributed to the dollar's bull run. For instance, new home sales unexpectedly surged by 7.2% on Friday. The reading for the previous month was also upwardly revised to 7.2% from 2.3%. No wonder, the greenback rose higher.

United States New Home Sales:

Anyway, the dollar is expected to pull back today, and the reason for that will be a 3.5% drop in durable goods orders in the United States. In this light, consumer spending, which is the locomotive of economic growth, is likely to decline as well. However, US macro data have been upbeat lately, and there is no guarantee that the trend won't go on.

United States Durable Goods Orders:

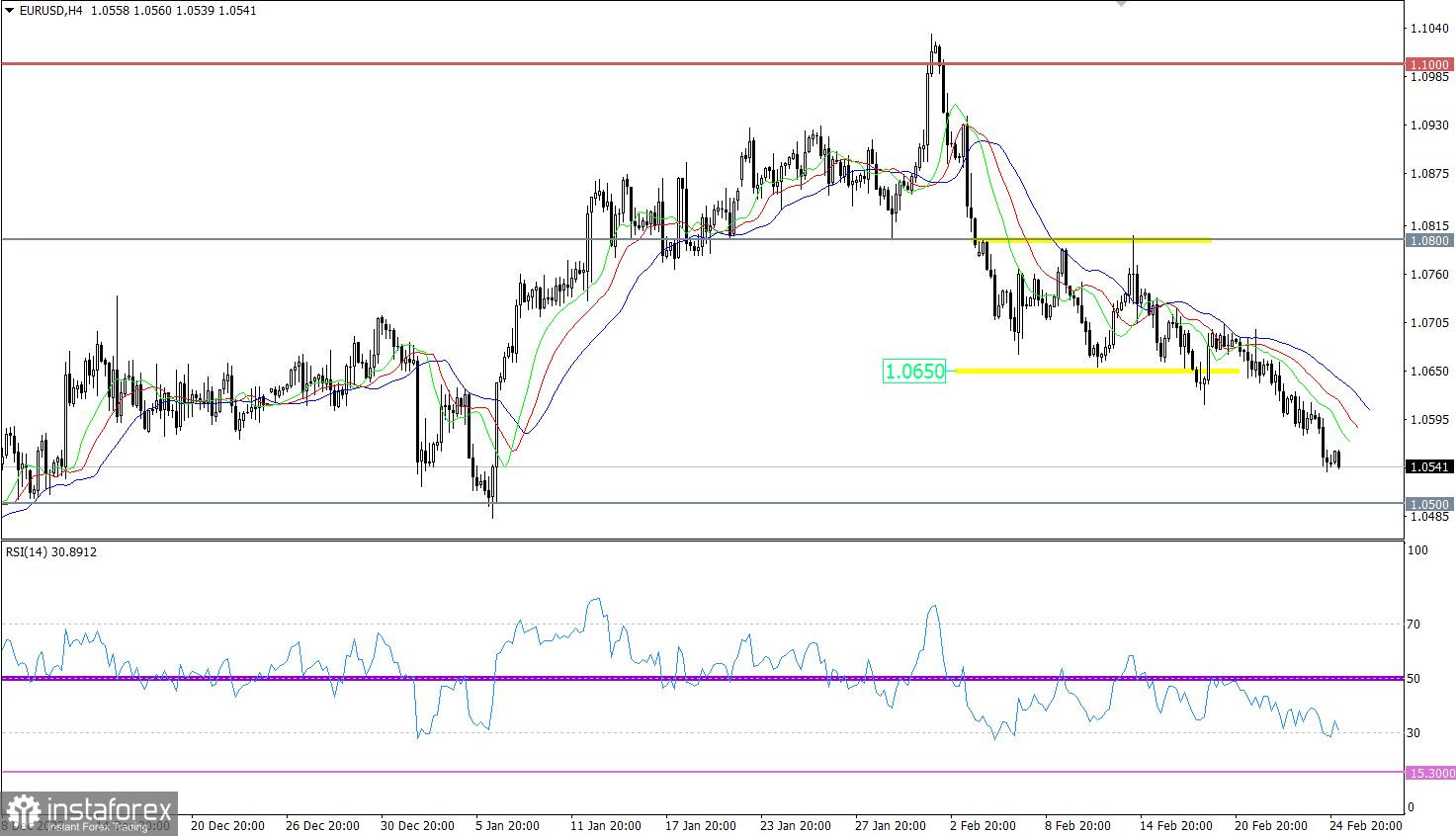

EUR/USD lost about 1.4% last week. Consequently, the corrective move from the high of the medium-term uptrend continued.

The RSI is moving in the oversold zone on the H4 chart, reflecting the overheating of short positions. On the daily chart, it has approached the oversold zone, which is also a sign of overheated short positions.

The Alligator's MAs are headed sown on the h4 and daily charts, confirming the corrective move.

Outlook

The 1.0500 level stans as support and may exert some pressure on short positions. In such a case, the sideways trend may begin, and the price may then bounce.

Alternatively, if the price settles below 1.0500 on the daily chart, the medium-term uptrend may come under bearish pressure.

In terms of complex indicator analysis, there is a signal to sell for short-term and intraday trading because the corrective move goes on.