Euro is one step away from updating the yearly low. However, at some point, traders will get fed up with the expensive dollar and revert back to the European currency.

This is also what ECB board member Ignazio Visco hinted at when he was interviewed earlier. He said that at the moment, it is not possible to say how high rates will have to be in order to achieve the target level. Thus, it could get as high as 3.25%, 3.5% or even 3.75%. Clearly, the bank's monetary policy depends on the shifts in the economy, and the decisions will be determined directly at each scheduled committee meeting. "I don't think we can say right now what the final rate will be because it really depends on future data. Our aim is to get back to an inflation rate of 2% in the medium term. If we need to be tougher, we will be," Visco added.

The ECB has already increased the cost of borrowing by 300 basis points since July last year, bringing the deposit rate to 2.5%. In the near future, they intend to raise it by another half point, making it clear that tightening will not stop at this stage. Francois Villeroy de Galhau even said last week that the peak rate may not be reached until September this year. Some ECB officials, including Bundesbank President Joachim Nagel, argued that more steps are needed in the second quarter of this year. This means that there may be another 50 basis point hike.

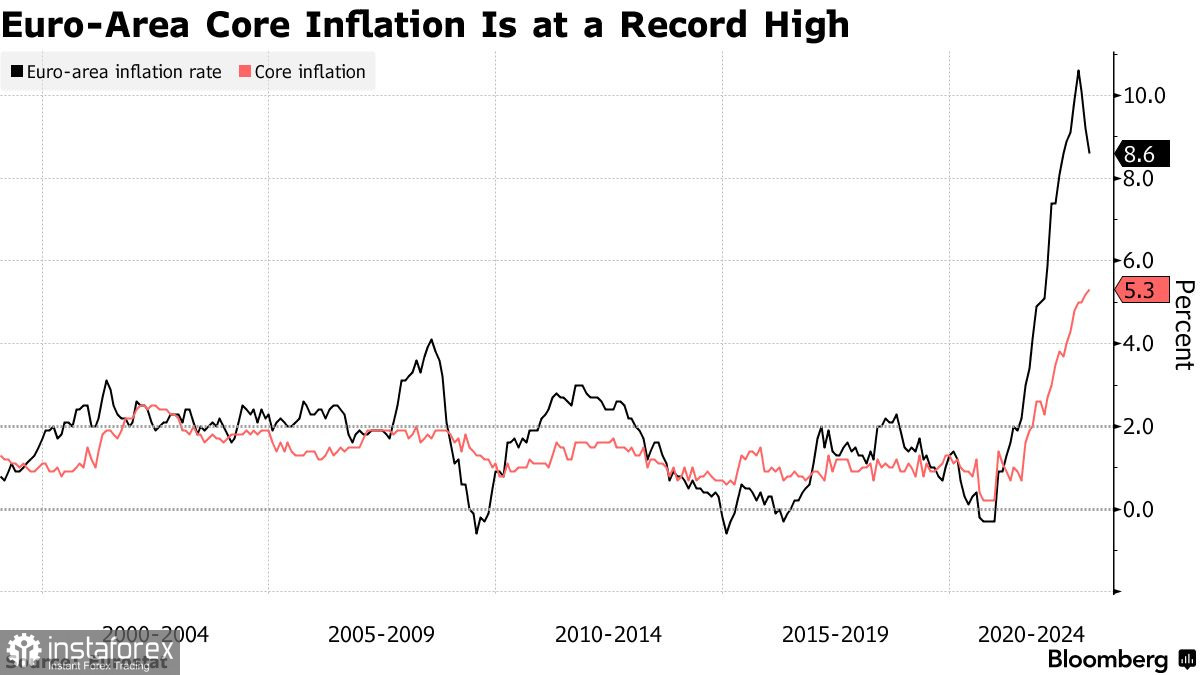

The decisive action strengthened after a report showed that core inflation was more resilient than previously thought, raising risks of price and wage growth in the eurozone as early as this spring. "We need to make sure that core inflation does not stay at this high level for longer than it should," Visco said, stressing that tight labor markets in some parts of the region require careful monitoring and surveillance. "The current situation could lead to wage increases beyond what is compatible with a medium-term inflation rate of 2%. That is why we are watching this with great caution," he added.

So far, euro is not reacting to the expected policy changes, but more restrained comments from Fed officials, who have been vocal about the need for further US interest rate hikes to combat inflation, will be enough for a bearish market reversal. To stop the decline, a break above 1.0574 is needed as that will spur a rise towards 1.0610, 1.0655 and 1.0700. But if there is a dip below 1.0530, EUR/USD will fall to 1.0480.

In GBP/USD, buyers need to climb above 1.1950 in order to push the pair to 1.1990 and 1.2030. But if sellers take control of 1.1920, the pair will go down to 1.1870 and 1.1830.