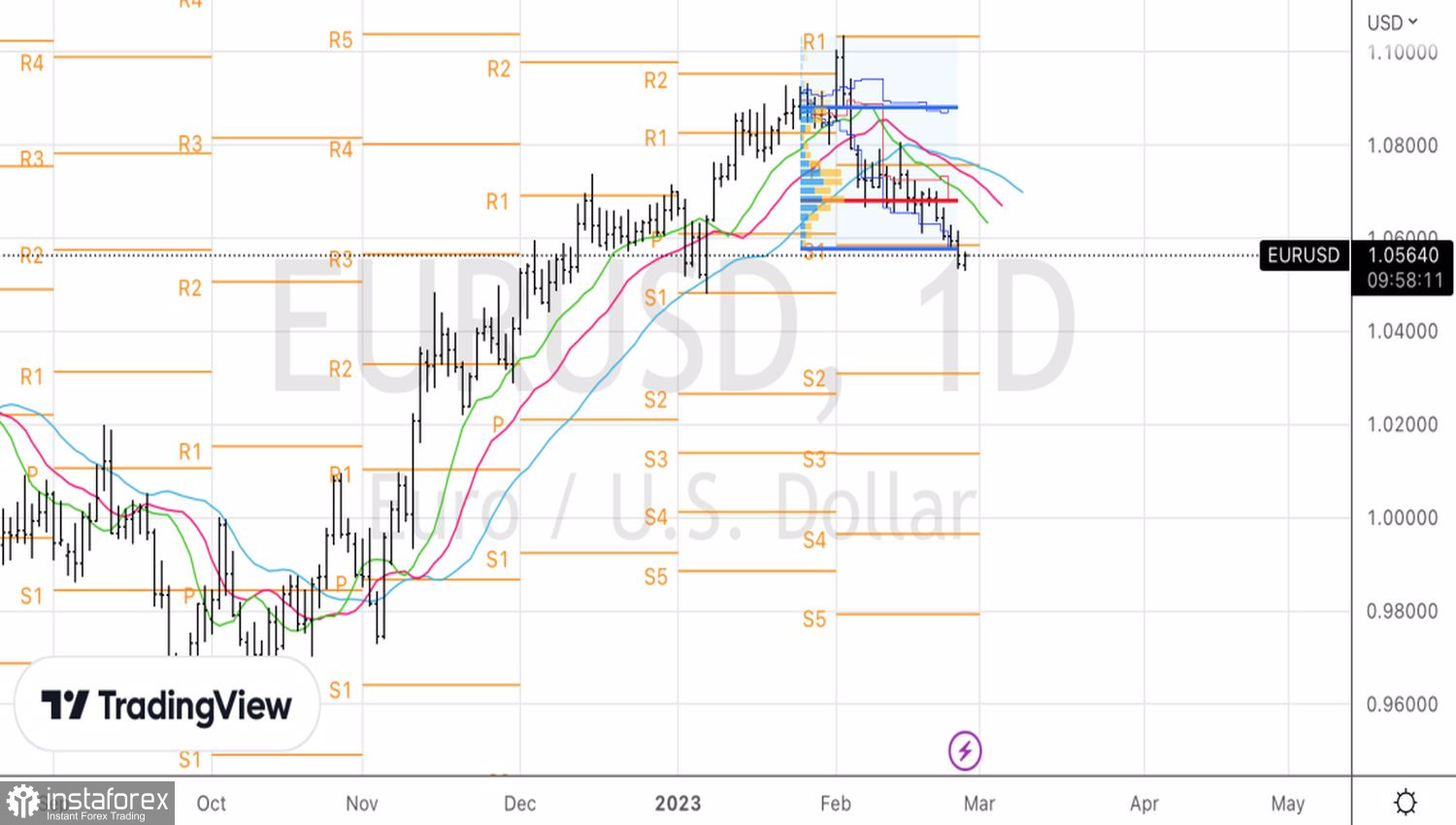

It's been a long time since I've seen the euro with so many trump cards that do not work. EURUSD continues to slide down even though Bank of America says it's time for the pair to stabilize. At the middle of the year, it will trade at 1.05, and at the end, it will rise to 1.1. Wait and see. In the meantime, note that the strength of the U.S. economy and concerns about the growth of the federal funds rate to 6% create favorable conditions for the U.S. dollar. And the USD index uses them in full.

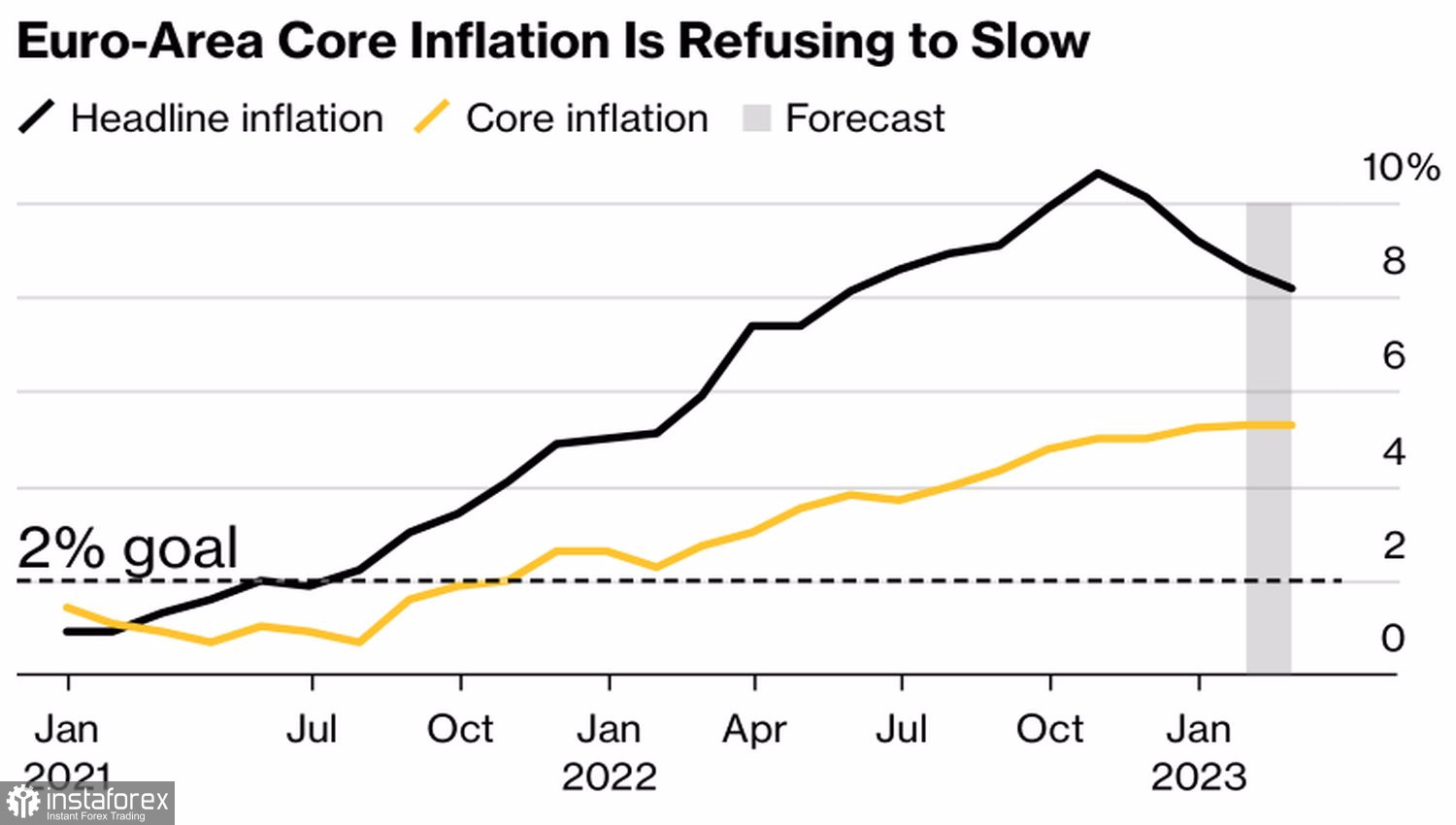

According to Bloomberg experts' forecasts, consumer prices in the euro area will slow down in February from 8.6% to 8.1% year-on-year, but the core inflation rate will remain at a record high of 5.3%. This circumstance unties the hands of the ECB in tightening monetary policy. According to Governing Council member Ignazio Visco, if the central bank needs to be stricter, it will be stricter. It's too early to say whether the deposit rate ceiling will be at 3.5%, 3.25% or 3.75%. The European regulator intends to move from meeting to meeting and look at new data.

Dynamics of European inflation

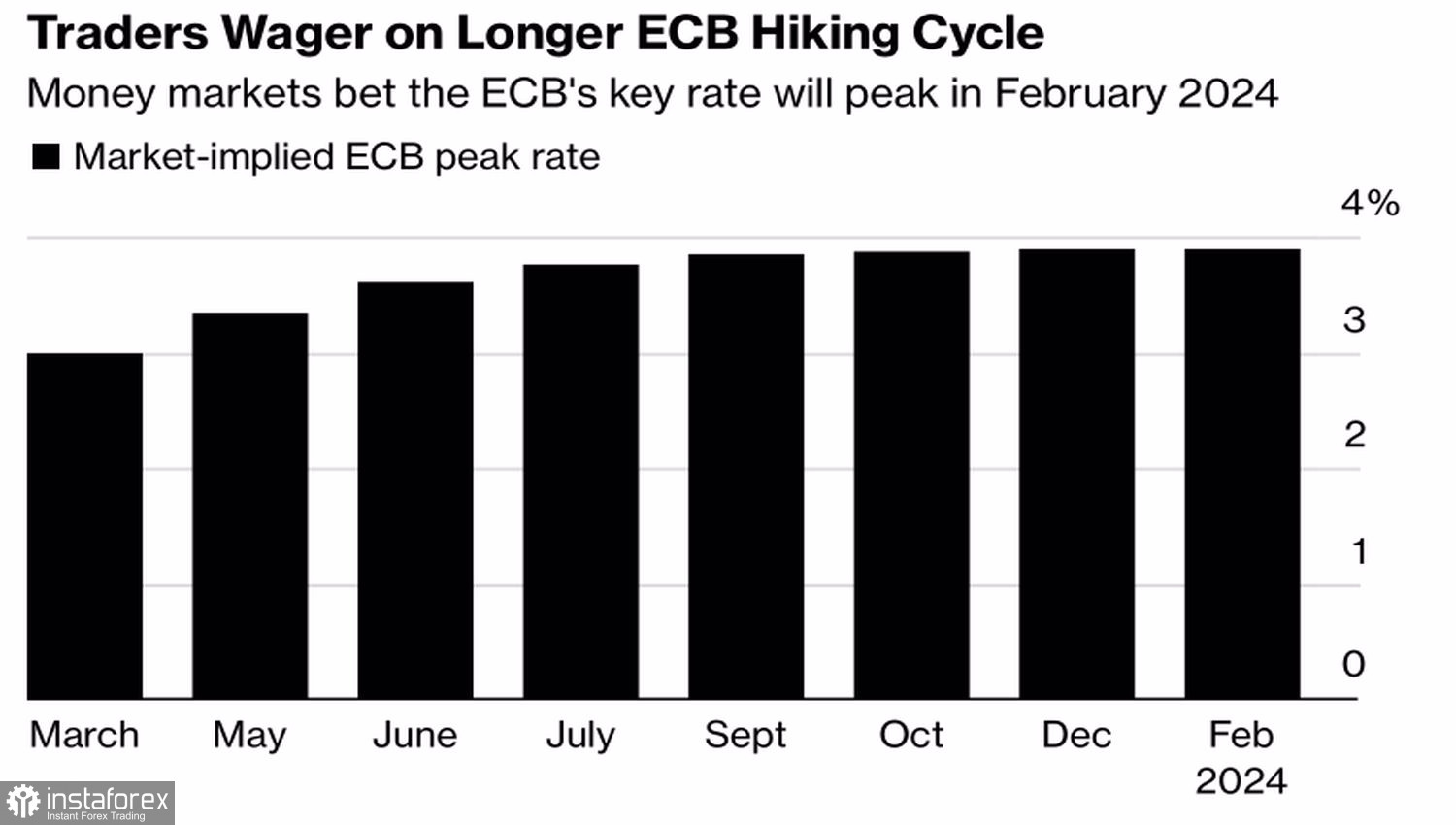

Meanwhile, the futures market raised the implied peak in borrowing costs to 3.9%, the highest value of the index since the start of the ECB's monetary restriction cycle. German bonds immediately saw another wave of sell-offs, pushing 10-year yields to their highest level since 2011. The rates on the more monetary policy-sensitive 3-year yields have now climbed to their highest level since 2008.

Derivatives not only raise the implied ceiling, they also predict that the deposit rate will stay there for a long time.

Dynamics of expectations for the ECB rate

The hawkish rhetoric of the central bank, market confidence that borrowing costs are still far from peaking, and rates will remain on a plateau for a long time, as well as positive surprises in the eurozone economy could, in any other conditions, make the euro a favorite. Alas, now all the eyes of investors are turned to the U.S. dollar.

The same trump cards that were playing during the first nine months of 2022 are still in play for the U.S. currency. We are talking about falling stocks, rising Treasury yields and the belief that monetary tightening will continue for a long time. Just as then, the Fed seems willing to sacrifice its own economy to defeat inflation, which has begun to raise its head. Indeed, instead of slowing to 4.4%, the core personal consumption expenditure index has accelerated to 4.7%.

Technically, the pivot levels 1.0585–1.061 form a convergence zone, through which EURUSD will have a hard time to break through. Failure to do this will be evidence of the weakness of the "bulls" and will increase the previously formed short positions with targets at 1.048-1.05 and 1.031-1.033.