The EUR/USD currency pair traded unusually on Monday. In reality, the pair frequently corrects on Friday following a long fall. This is because some traders set profit targets for positions before the weekend. At the same time, the downward trend continued on Friday, and the pair adjusted to the moving average on Monday. This pair's movement was somewhat supported by macroeconomic data. Yesterday, the United States released one more or less significant report on long-term goods orders. Although we have previously stated that we do not anticipate a significant response to this report, the dollar declined by around 60 points as a result of its release. We believe it is more likely a coincidence. The report itself revealed a considerably more significant decline in order volumes than was anticipated, disappointing buyers of dollars. As a result, the pair is currently trading close to the moving average line but has not yet surpassed it. We still don't know why the European currency can demonstrate observable growth, but if there is a consolidation above the moving average, then the bulls can take the lead for a while. The fundamental (global) background has not changed at all recently, and the euro currency is still highly overbought.

On the 24-hour TF, the situation gets a little complicated on Monday. Meanwhile, the price is below the crucial level of 1.0609 (38.2% Fibonacci), but it has not yet been able to penetrate below the Senkou Span B. If not, the pair may quickly return its steps to the critical level, which is now located close to the level of 1.0780. Therefore, the pair must at least overcome the moving average on the 4-hour TF to anticipate growth.

The rhetoric remains unchanged under Christine Lagarde.

Christine Lagarde's speech, meanwhile, was already delivered this week. More specifically, it was a meeting with the Financial Times. Lagarde asserts that the ECB may require a further tightening of monetary policy and that the question of the level of the rate hike in March has nearly been completely addressed. As the rate hasn't been a secret for very long, traders now anticipate another 0.5% increase. Remember that the ECB effectively declared a 1.25% rate increase at the next three meetings a few months ago, and so far it has followed through on that plan. Consequently, Lagarde's remarks on Monday may have potentially supported the euro, but what would have caused the market to respond if there had been no new information?

Ms. Lagarde added that the regulator is ready to increase the key rate once more if required to maintain 2% inflation. And this will certainly be necessary. A report for February will be released this week, and it predicts that the consumer price index may slow to 8.2%. We wouldn't jump to conclusions, however, given that Germany's inflation has already shown signs of growth. Ms. Lagarde may not want to shock the markets with strong pronouncements just yet because doing so will not be beneficial. What will the ECB do if inflation begins to rise again? There are already rumors that rates below 6% may not be sufficient to guarantee price stability by 2%, especially in the United States, where inflation has been declining for 7 consecutive months. It is far from certain that the ECB will be able to tighten monetary policy as sharply and enthusiastically as the Fed, given how much more complicated things are in Europe as a result of a rate hike.

In general, as previously stated, 2023 may bring surprises, and all current inflation or rate projections are subject to another 1,000 changes. Remember how many experts forecast an impending recession in the US and the EU last fall and summer? And the Fed rate was at its highest point at 3.5% at the beginning of last year. As a result, this year's predictions will probably need to be updated more than once.

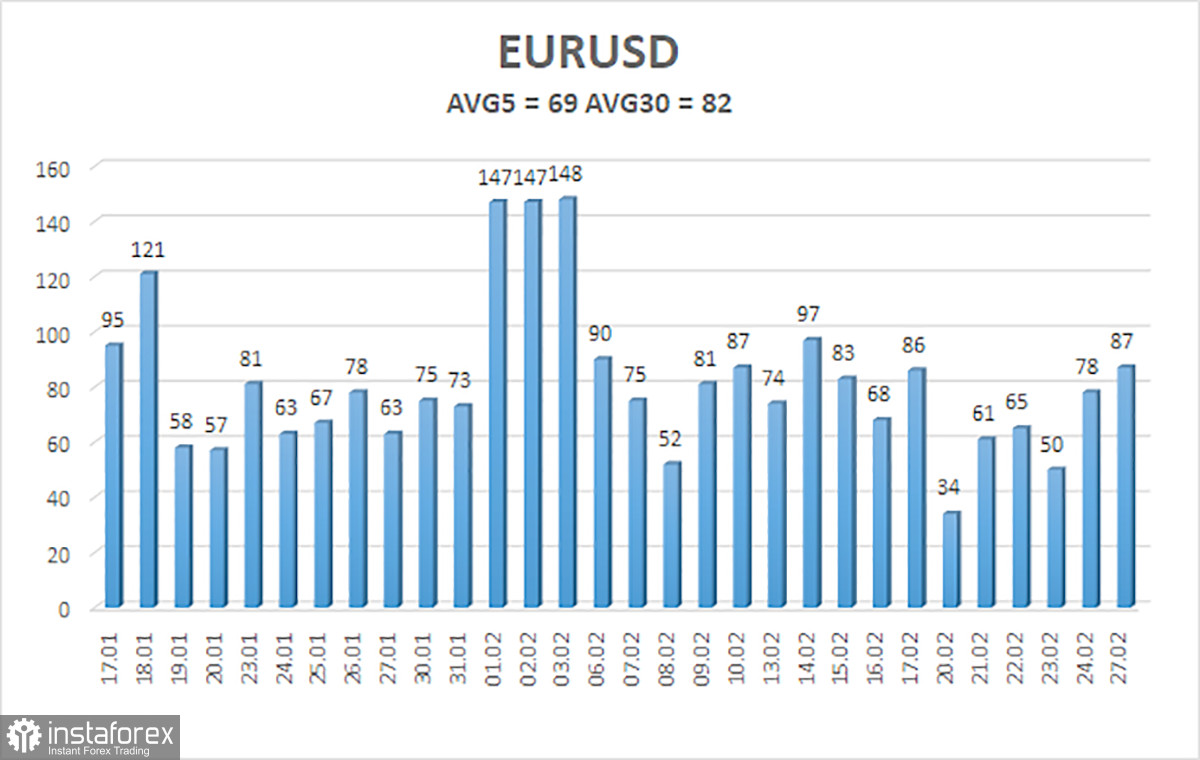

As of February 28, the euro/dollar currency pair's average volatility over the previous five trading days was 69 points, which is considered "normal." Thus, on Tuesday, we anticipate the pair to move between the 1.0538 and 1.0676 levels. The downward turn of the Heiken Ashi indicator will signal the beginning of a new downward movement.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trade Advice:

The EUR/USD pair is still moving downward. At this point, we can take into account new short positions with targets of 1.0498 and 1.0488 if the Heiken Ashi indicator reverses its upward trend. After the price is fixed above the moving average line, long positions can be initiated with targets of 1.0676 and 1.0742.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.