It is hard to find a more depressed asset in financial markets than oil. Brent and WTI have fallen for the fourth month in a row on fears that the Fed's overly aggressive monetary tightening will push the global economy into a deep recession. And even though the time of this recession is moving further away, neither the optimism of China's recovery nor the stability of the U.S. and the eurozone can save oil. And yet oil is traditionally regarded as an indicator of the global economy's health. If its health is improving, why are futures falling?

Monthly oil dynamics

Indeed, there are many mysteries in the oil market that create confusion in forecasts. While Bank of America lowers its 2023 Brent average price estimates from $100 to $88 per barrel, citing the remarkable resilience of Russian supply and a weak start to the year, JP Morgan, by contrast, keeps its forecast at $90. According to the company, the recovery of the Chinese economy will support the entire commodity market, and oil will benefit the most from this.

The current oil market depression can be explained by a stable supply and fluctuating demand. Alas, the optimism about China clashes with the factor of rising U.S. inventories for the 10th week in a row, bringing the figure to its highest level since May 2021. As strong as the U.S. economy has been, the demand for oil in the U.S. is not increasing, which is holding back prices and causing the rig count to drop for 5 of the last 8 weeks to its lowest level since July 2022. On paper, this means reduced supply going forward.

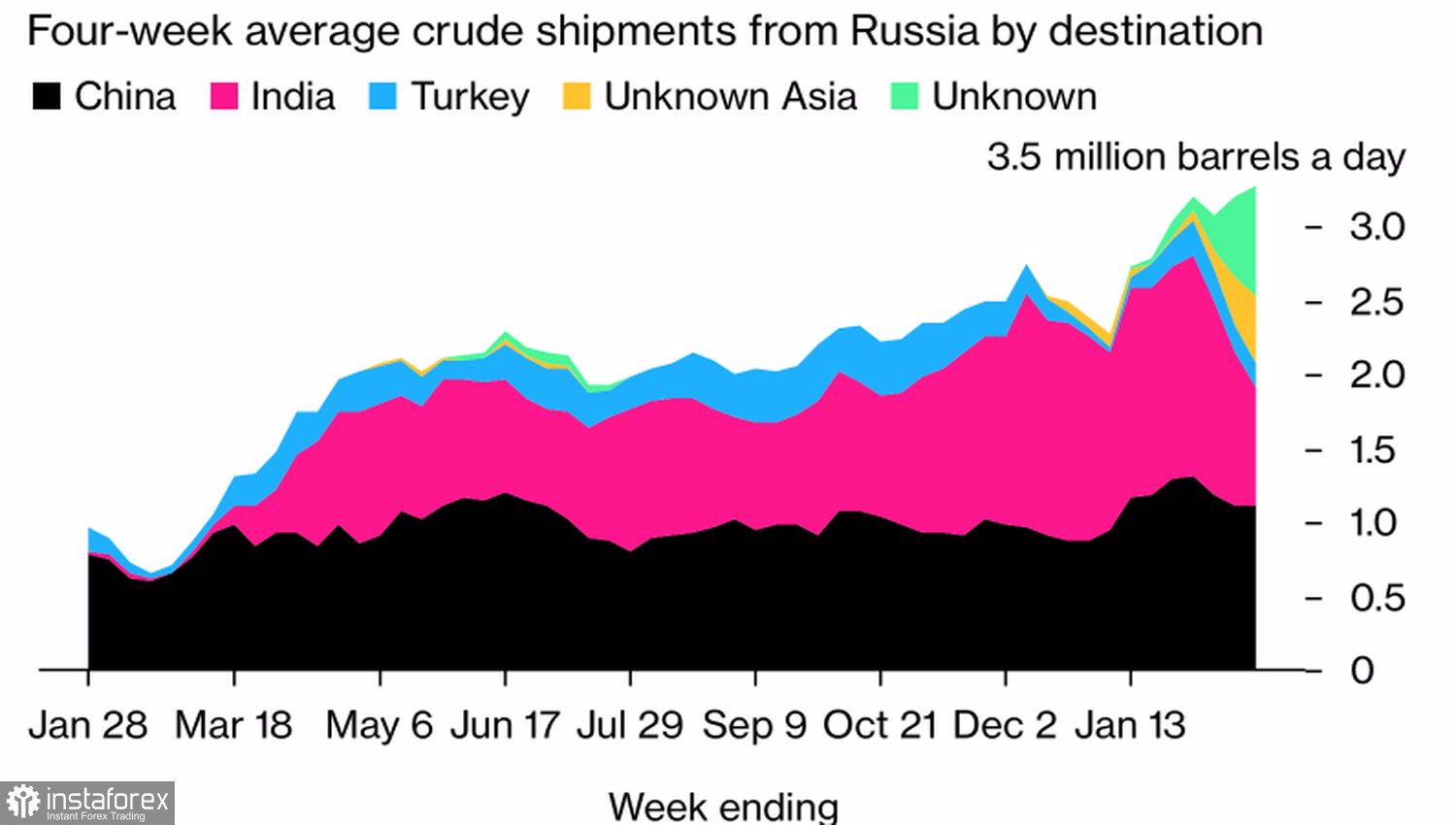

The same can be said for Russian oil. Its vital downstream market, India, faces additional scrutiny to meet the G7 oil price ceiling of $60 per barrel. This could potentially reduce the volume of purchases. As a result, the sustainability of Russian oil supplies will be called into question, which will also have a favorable effect on prices.

Dynamics and structure of Russian oil supplies by sea

Thus, in the next 3–6 months, the market will begin to face a lack of supply, which, against the backdrop of growing demand, is good news for Brent and WTI.

Indeed, why is oil in no hurry to grow amid the pleasant surprises from the U.S., Eurozone, British and other economies? As a rule, the stronger the global economy, the better it is for oil. My guess is it is hindered by a strong U.S. dollar. Due to sticky inflation, it sincerely hopes for an increase in the federal funds rate to 5.5% or higher. U.S. currency-denominated commodity market assets, on the other hand, tend to struggle during a USD index rally.

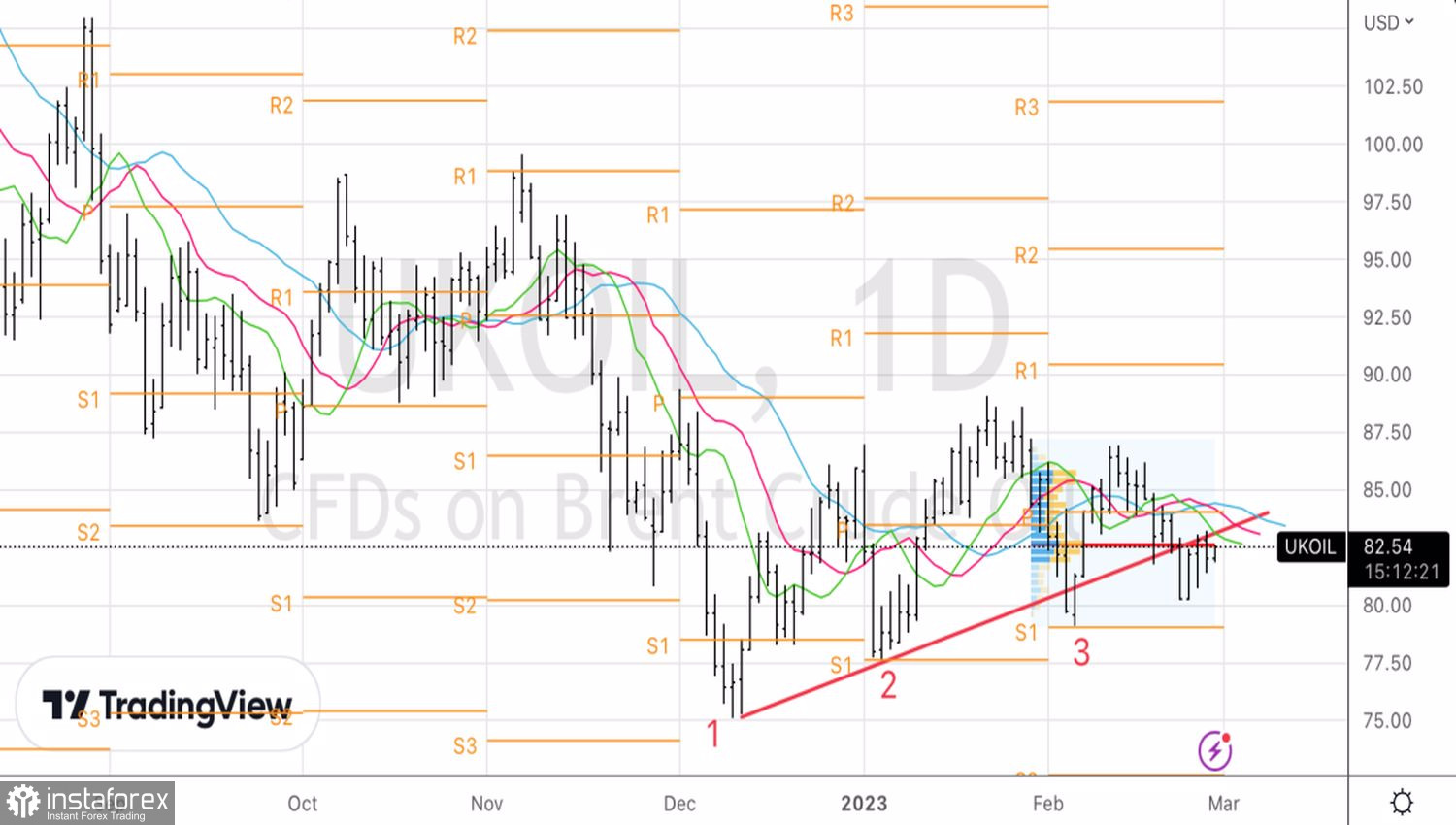

Technically, on the daily chart, Brent clearly won back the inside bar, allowing us to make money on falling prices. As noted in the previous article, the return of oil to its upper limit at $84.4 per barrel is a reason to buy. You can try to enter long earlier—at a breakout of $83.3.