After a very successful January and a continuous upward trend of the cryptocurrency for 30 days, BTC takes a break in February. The second month of 2023 turned out to be an all-out battle for the initiative between bulls and bears, and, apparently, the latter managed to gain an advantage.

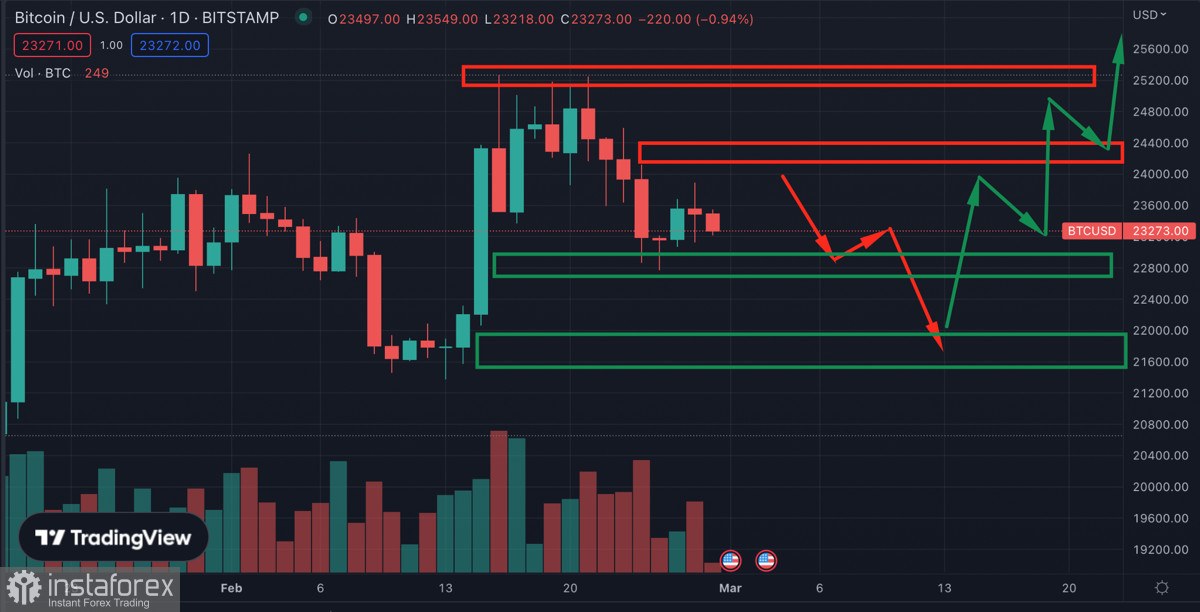

Bitcoin risks ending February on a bearish note, closing below the $23.2k level. In fact, the asset is at a crossroads, and a bearish end in February would send BTC to $20k–$22k levels, while the formation of a green monthly candle would send the asset to $25k and higher.

Fundamental background

With a bearish end to February, Bitcoin will further strengthen the correlation with stock indices, which continue to show alarming dynamics. It is also worth remembering that it is when assets are on a downward trend that the correlation strengthens.

Meanwhile, investor sentiment has changed dramatically over the past three months. If in December–January, it was expected that the Fed would have time to ease monetary policy in 2023, then, according to new data from BBG, markets are peaking at 5.5%–6% and holding the rate through the end of 2023.

Another worrisome signal, which partially confirms the statements of analysts at leading U.S. banks, was the fall in the net margin of the S&P 500. The indicator fell to 11.3% from a peak of 13% in 2021.

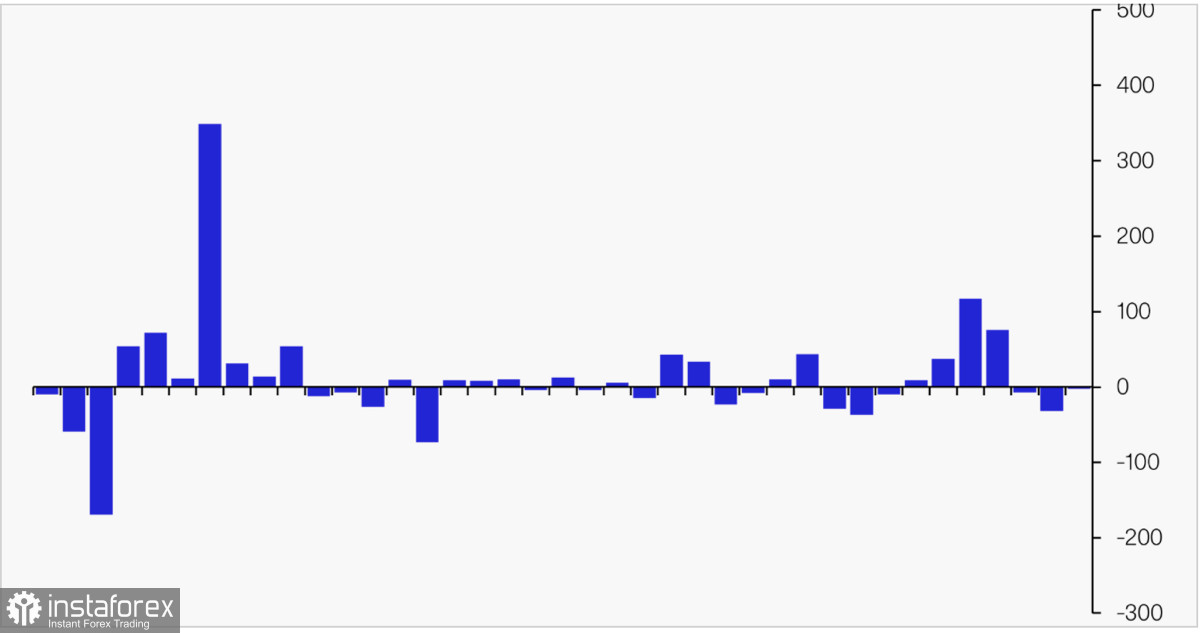

Against this background, investment activity is falling, which affects the ability of financial instruments to overcome resistance zones and hold support zones. CoinShares recorded a $1.9 million outflow from crypto funds for the third week in a row.

It is also important to emphasize that following the results of yesterday's trading day, a "bearish engulfing" pattern formed on the U.S. dollar index chart. In parallel, Bitcoin and SPX failed to take advantage of the DXY misfire, which confirms the low buying activity.

However, if at the end of today's trading day DXY continues to decline, then we can expect a bullish start to March on BTC and stock indices. As of writing, the technical indicators of the index show an upward trend.

BTC/USD Analysis

As a result of February 27, Bitcoin formed an uncertain doji candle, which drew a line under everything that happened throughout the month. The BTC bullish trend began to fizzle out, and we saw the activation of sellers who managed to bring the price to local lows.

In the first half of March, it will become clear whether February was the month of a local correction or the beginning of a new downward trend. A monthly candle close below $23.2k would signal further bearish predominance, and a green candle formation would give investors more willingness to move the price higher.

Results

If Bitcoin continues its downward movement, then the immediate target of the asset in the first half of March will be the level of $22.7k , where the 0.236 Fibo level passes. Further, the asset will follow to the area of $21.4k–$22.1k , where the investors set positions.

If the upward trend continues, BTC will head to retest the $25.1k level, but first the asset will have to overcome the $23.8k–$24.4k area. The main consolidation of the asset took place here during the assault on $25k, and therefore fixing above it will allow BTC to move towards $25k and higher.