The pound had at least two reasons to be positive at the beginning of the week. The dollar rally momentarily stopped and Britain and the EU have compromised on Northern Ireland. However, both factors have a short-term impact. The prospect of the deal might have cheered up the pound, but only temporarily. In addition, the dollar is bullish today ahead of the data release.

With the prospect of a longer period of high rates still on the table, the greenback will be supported further. In addition, the rates theme is constantly on everyone's lips, and market players are now competing in predictions: who is bigger and higher? The main question is how far the Federal Reserve can go in tightening the policy.

However, everything is shaky in the market, and new economic data, if it comes out against the consensus, may once again call back high interest rate expectations.

In addition, the market does not really believe that the U.S. central bank will be willing to significantly raise the rate further. Any hint of weakening inflation will be used to reorient investors.

If they completely trusted what Fed members were saying, 10-year Treasury yields would have jumped to at least 4.5-5.0 years ago.

Once again there is uncertainty in the markets, new cues and drivers are necessary to fuel the dollar's rally. The U.S. dollar is likely to have trouble with further gains. In case of a positive scenario for it, the year's high at 105.6 can be updated. Marks above 106.0 are still an insurmountable barrier.

In addition, officials' statements about inflation do not look threatening. U.S. Treasury Secretary Janet Yellen, in an exclusive interview with CNN News, said that everything is now under control and the authorities are successfully dealing with rising prices.

"Inflation is still too high, but overall, if you look over the last year, it's coming down. And I know the Fed is committed to continuing the process of bringing inflation down to a more normal level, and I believe they will succeed in that," Yellen said.

One could see this interview as a confirmation of more aggressive rate hikes by the Fed. It's hard to follow the direction of the market which often takes wishful thinking and goes against reality.

Sooner or later it catches up with investors. We will wait for more commentary and data that will either confirm the Fed's more hawkish attitude or refute it.

The pound and the deal

As for the pound, the mood here is very dim, traders do not see good reasons to buy the British currency.

"While the announcement of a deal could temporarily support the pound, it is unlikely to have a significant and lasting impact on GBP performance. The recent broad US dollar rebound and deterioration in global investor risk sentiment are more important in driving cable lower in the near-term," commented MUFG economists.

Meanwhile, other experts see the deal as a long-term positive for the pound. While it is not noticeable, and it is unlikely to be seen if the dollar resumes growth.

The deal should further add calm to the pound, not volatility. Yesterday's positivity is a tribute to the unexpected.

The currency markets are not surprised by the deal itself, but rather by the scale of the concessions Prime Minister Rishi Sunak received from Brussels. This means that the deal could prove to be long-lasting and really end years of uncertainty.

The pound's first reaction suggests that markets see the deal as a sign that the EU and Britain are mending relations after several tense years.

Acceptance of the deal removes the prospect of a trade war, a lingering concern that may have deterred investors from investing in the British economy. For the pound, removing any lingering risk is supportive.

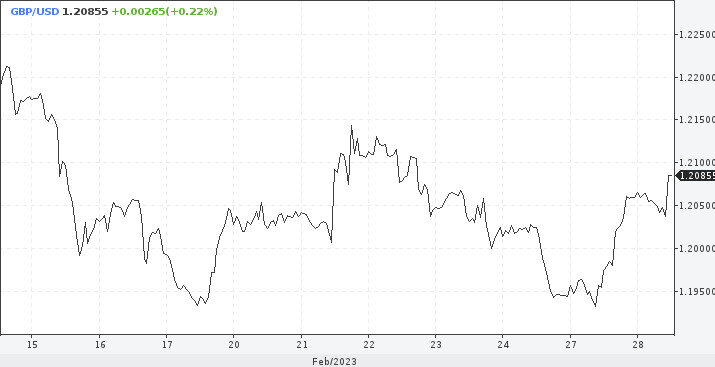

"Any deal is a mild GBP positive. In this context and in the light of recent USD gains we would note that the GBP/USD correction, back towards strong support at 1.1915, in line with the 17 February low looks increasingly attractive as UK recession risks moderate. The early week risk rebound, exemplified by the rally in US equity futures, points towards 1.2010/15," says Jeremy Stretch, a foreign exchange strategist at CIBC Capital Markets.

GBP/USD has entered a consolidation phase and may trade in the 1.1970-1.2150 range. New drivers are needed to move higher, but they are not visible on the short-term horizon. Weakening of the exchange rate is possible and also within reason. A steady decline beyond 1.1915 is unlikely.

In the view of UOB Group's Economist Lee Sue Ann, "GBP could rise further even though it is unlikely to challenge the major resistance at 1.2150. Note that there is another resistance level at 1.2100. On the downside, a breach of 1.2010 (minor support is at 1.2040) would indicate that upward momentum has eased."

For the next three weeks the risks for the pound have shifted to the downside.