The AUD/USD pair during the Asian session on Wednesday updated the two-month price low (0.6697), reacting to the macroeconomic reports. But bears couldn't develop their success and failed to consolidate within the 66th figure. Buyers then took the initiative, and at the beginning of the European session the pair was trading above the 0.6650 level. Despite the upward price pullback, the downward trend is still in force. The reports released today were not in favor of the Aussie: the correction of AUD/USD was caused only by the general weakening of the U.S. currency and the strong Chinese data.

Australian releases: inflation is down, the economy is growing weakly

The inflation report came out in the red today. Australia's consumer price index fell to 7.4% in January, with a forecast of a decline to 8.1%. The data suggests that the slowdown in inflation was at the expense of a slight increase in fuel and food prices. On the other side of the scale are housing prices, which remain close to historic highs (due to high mortgage rates and rising rents).

Overall, the figures reflect a contradictory situation. On the one hand, inflation is declining more sharply than most experts had anticipated. On the other hand, inflation remains close to a 30-year high, as overall spending is still relatively high.

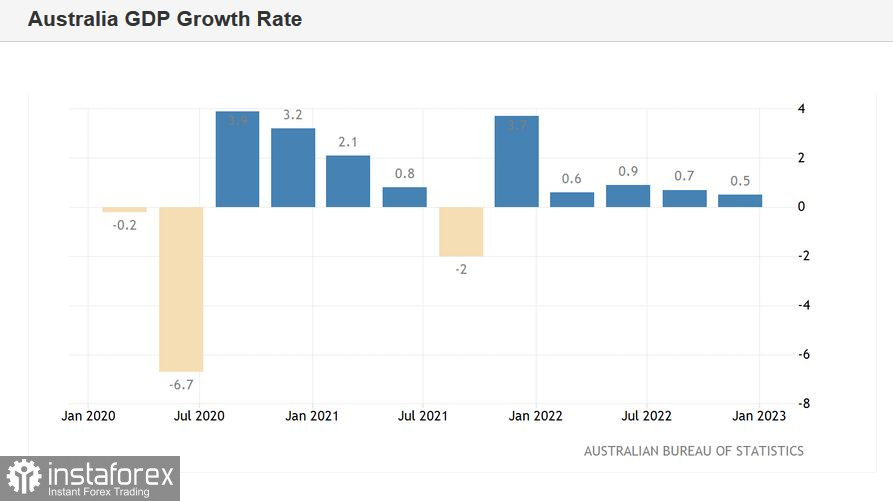

Another report that was released today was also quite controversial. It turns out that the Australian economy grew 0.5% in the fourth quarter of 2022 relative to the previous three months. On the one hand, this result was lower than expected (most experts had expected a growth of 0.8%). On the other hand, the Australian economy is de facto showing a positive trend: the volume of GDP has been growing for the fifth quarter in a row. Consumer spending in October–December increased by 0.4% (in the third quarter, there was 0.8% growth), and government spending by 0.6% (0.2% in the previous quarter). Exports grew by 1.1%, while imports decreased by 4.3%.

It is worth noting that amid slowing inflation and weak GDP growth, rather weak Australian jobs report were recently released: the unemployment rate rose to 3.7%, and the employment growth rate was again in negative territory. The estimated figure was a growth of 20,000, but actual data saw a decline of 11,500.

What do the figures say?

Recall that the Reserve Bank of Australia reduced the rate of monetary policy tightening to 25 points last fall. According to the minutes of the RBA February meeting, the members of the Governing Council at the last meeting considered the possibility of a 25 or 50 basis point rate hike. The option of a pause was not taken into account at all. Also, the document states that the further pace and duration of monetary policy tightening will "directly depend on the incoming data and the Council's assessment of the prospects for inflation and the labor market." In other words, the RBA tied its future decisions to the dynamics of inflation growth.

If we analyze the rhetoric of the RBA minutes through the prism of the published data, we can come to the conclusion that the issue of a 50-point rate hike will be definitively removed from the agenda. At the same time, it must be recognized that lower inflation and weak GDP growth amid weak labor market data will not prompt the central bank to end the tightening cycle early. The 25-point rate hike is likely to continue. According to a number of experts (ANZ Bank in particular), the RBA will tighten the rate by 25 points in March, April and possibly May, eventually stopping at 4.1%. After today's releases, however, the May rate hike will again be in doubt—the market will revert to the earlier consensus forecast of a final rate of 3.85%.

Conclusions

By and large, the reports released today have only ruled out the option of a return to the 50-point rate hike that the RBA considered at its February meeting (according to the minutes of that meeting). But let's face it, the market had little faith that the Australian regulator would actually decide to be more aggressive. That's why the Aussie reacted to the news today, and went down to 0.6698. But after a few hours, the Aussie regained its positions. Strong Chinese data supported the AUD/USD buyers as Chinese manufacturing activity rose in February at the fastest pace in a decade. There was also significant growth in the service sector (Non-Manufacturing PMI rose to 56.3 against the forecast of 55.0).

The news flow from China supported the Aussie, but this support will be temporary, situational. Greenback's weakening is also temporary amid toughening rhetoric of Fed representatives. There are no good reasons for trend reversal at the moment. The technical indicators says the same: the pair on the daily chart is between the middle and bottom lines of the Bollinger Bands indicator, as well as under all lines of the Ichimoku indicator (including the Kumo cloud). The nearest support level is 0.6700 (bottom line of the Bollinger Bands indicator on D1). The main target of the downward movement is the level of 0.6650, which is the Kijun-sen line on the weekly chart.