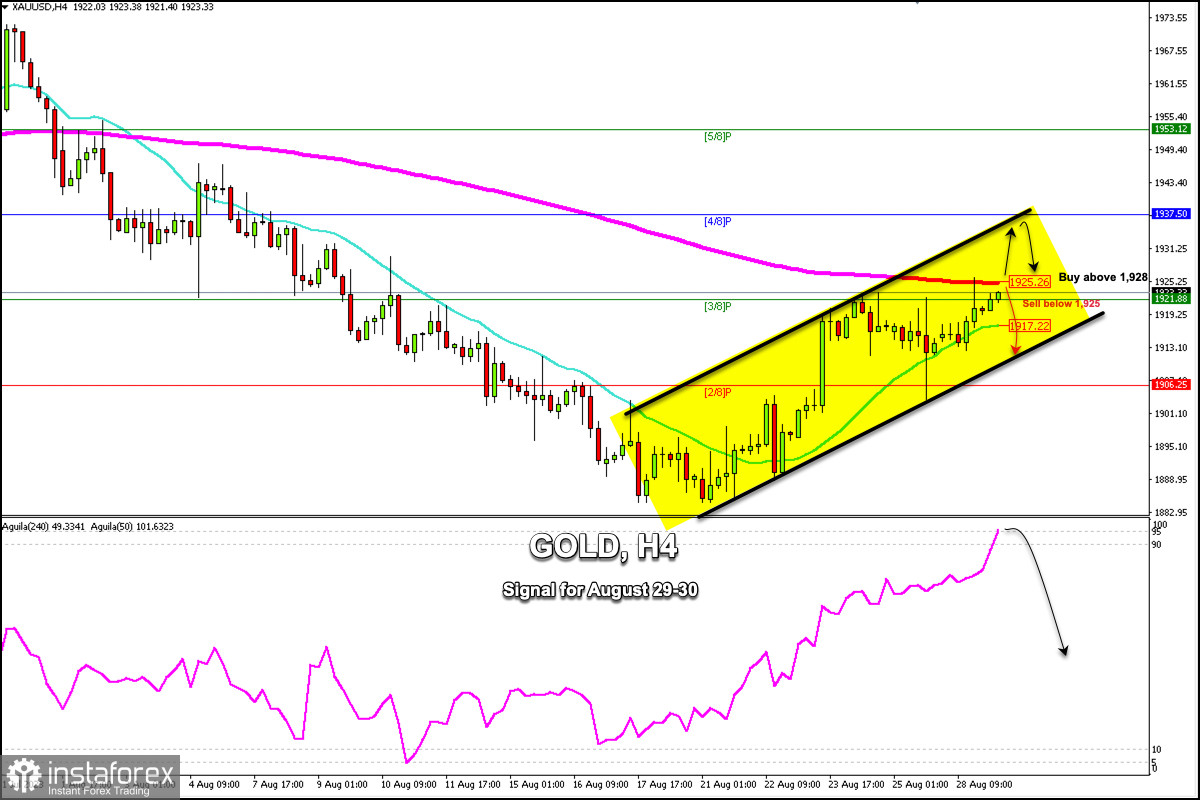

Early in the European session, XAU/USD is trading around 1,923.22 below the 200 EMA and above the 21 SMA. Gold rallied yesterday to reach 10th Aug levels at 1,925.96 and was rejected by the 200 EMA.

We can see on the 4-hour chart that gold is trading within an uptrend channel formed since August 17. In the next few hours, it is expected to continue ascending and it could reach the top of the uptrend channel around 1,937.

In case gold reaches the 200 EMA located at 1,925 and fails to break above it, this level could act as a barrier and could be seen as an opportunity to sell with the target at 1,917 and at the bottom of the uptrend channel around 1,912.

On the other hand, in case gold consolidates above 1,925 we could expect the price to reach 4/8 Murray located at 1,937 in the next few days. This level could be seen as the last barrier for gold since below this area, bearish pressure could prevail. If gold continues to rise and consolidates above 1,937, we could expect the trend to change in the short term and the metal could reach 1,953 and 1,967.

On the other hand, if gold breaks out of the uptrend channel sharply, and consolidates below 1,906, then we could expect the bearish cycle to resume and gold could fall to the low of 1,885 and even could reach 1/8 Murray at 1,875.

Our trading plan for the next few hours is to wait for gold to reach the area of 1,925 and settle below this zone. Hence, we will be able to sell with targets at 1,917 and 1,912. If bullish strength prevails, we could buy above 1,928 with the target at 1,937.

The 4-hour chart shows that gold is reaching extremely overbought levels, which is prefacing a technical correction that is going to occur in the next few hours. The 1,925 or 1,937 levels could be seen as key points to sell.