Long-term outlook.

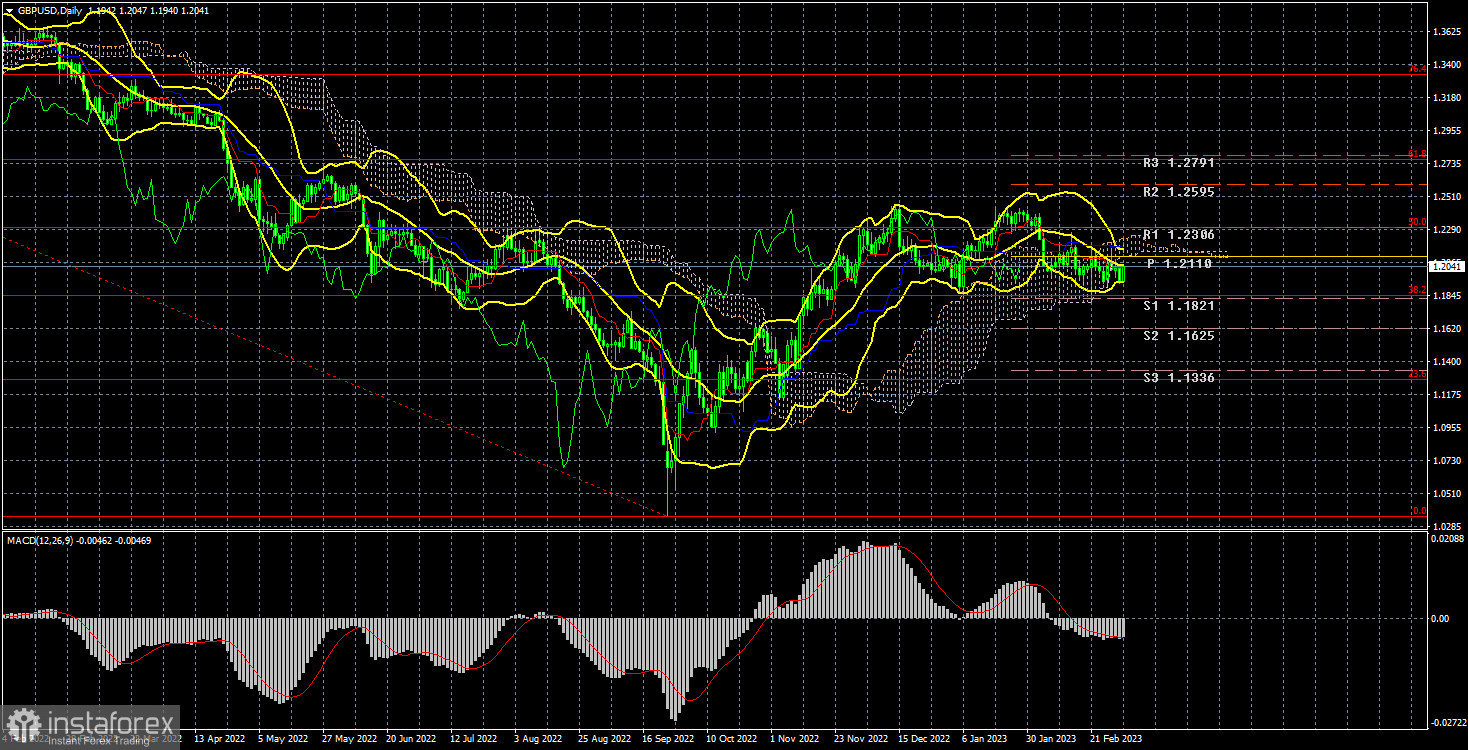

Although the GBP/USD currency pair has been moving in a variety of directions this week, it has largely stayed inside the 1.1840-1.2440 side channel. The channel is large, up to 600 points wide, although this is typical for the daily TF. It turns out that the lower TF has short-term trends, which make trading extremely feasible, whereas the older TF has narrow price ranges and no trends. We continue to think that the pound should depreciate. Its growth from September 26 to December 13 totaled more than 2000 points, which was too abrupt and too fast, much like the euro's growth. As a result, we think the drop should continue, but first, it needs to pass the level of 1.1840. Now, there aren't many unique explanations for this. The pair is in equilibrium.

Despite ten rate increases, the Bank of England has not been able to significantly lower inflation. Although it makes sense to keep tightening, the British regulator's ability to do so is seriously questioned by the market. After all, he must consider his economy, which is still on the verge of recession and will inevitably start, more than anybody else. And the tighter monetary policy becomes, the deeper and stronger the recession becomes. It is required to tighten the policy again five or six times given the current rate of 4% and inflation of more than 10%. Officials at the German Central Bank have previously predicted that inflation will be above target for another two to three years. Also, Germany has substantially lower inflation. As a result, the economy in the UK may continue to experience high inflation for at least a few more years. In such cases, the Bank of England can choose to sacrifice inflation by declining to further "cool down" the economy. The market is aware of this and is not in a rush to purchase the pound. The dollar has better growth prospects, but the flat is a formation from which it can occasionally be very challenging to exit, although there are important explanations for this. Thus, rather than macroeconomics or the foundation, the flat is now the most important factor.

COT evaluation.

Similarly, COT reports for the British pound haven't been available for over a month, and the most recent report shows changes for February 7. These reports' significance has diminished over time, but they are still better than nothing. The non-commercial group opened 10,900 buy contracts and 6,700 sell contracts during the most recent reporting week. Hence, an additional 4.2 thousand dollars were added to the net position of non-commercial traders. The net position indicator has been rising consistently over the past few months, but the major players' outlook is still "bearish," and even though the pound sterling is strengthening against the dollar (in the longer term), it is very challenging to explain why from a fundamental perspective. We do not rule out the possibility that the pound may start to decline more rapidly in the near future. Although it has officially started, thus far it appears to be flat. Furthermore, take note that both main pairs are currently moving quite similarly, but that the net position for the euro is positive and even suggests that the upward momentum will soon come to an end, while the net position for the pound is negative. A total of 61 thousand sales contracts and 47 thousand purchase contracts have now been opened by the non-commercial group. As we can see, the distinction is still there. We continue to be pessimistic about the British pound's long-term growth and anticipate further declines.

Analysis of important events.

This week in the UK, there was essentially nothing interesting. The service sector business activity index, which rose from 48.7 to 53.5, was only released on Friday. The market responded to this data since the growth was apparent, and the British pound showed a strong rise. Recall that the 4-hour TF also displays a side channel, which is weaker, and that the price recently bounced off of its lower limit. Hence, even though there were no data released in Britain on Friday, the pair's increase was anticipated. This week, significant ISM indicators were published in the United States. If the manufacturing sector's response to the index turned out to be unusual, the service sector's response made sense. The index dropped by 0.1 points, but traders were anticipating a bigger drop, so the dollar gained support on Friday. Overall, this week's macroeconomic statistics did not change the technical situation. The pound remained where it was in the two side channels. Such a picture of the current situation can be seen for a while.

Trading strategy for the week of March 6–10:

1) The pound/dollar pair is currently in the side channel between 1.1840 and 1.2440. Short positions are therefore more pertinent right now, although it's unlikely that the pair will emerge from the side channel anytime soon. Thus, we suggest delaying additional sales until the 1.1840 level is broken. Then, taking short positions with a target 300–400 points lower will make sense.

2) Purchases won't be important unless the price is fixed above the crucial line or there is another powerful signal. Yet, given the flat market, even fixing above Kijun-sen does not ensure the rise will resume. Moreover, purchases are possible when returning to the side channel's lower border to reach the top border.

Explanations for the illustrations: Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings) (5, 34, 5).

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "Non-commercial" category is shown by indicator 2 on the COT charts.