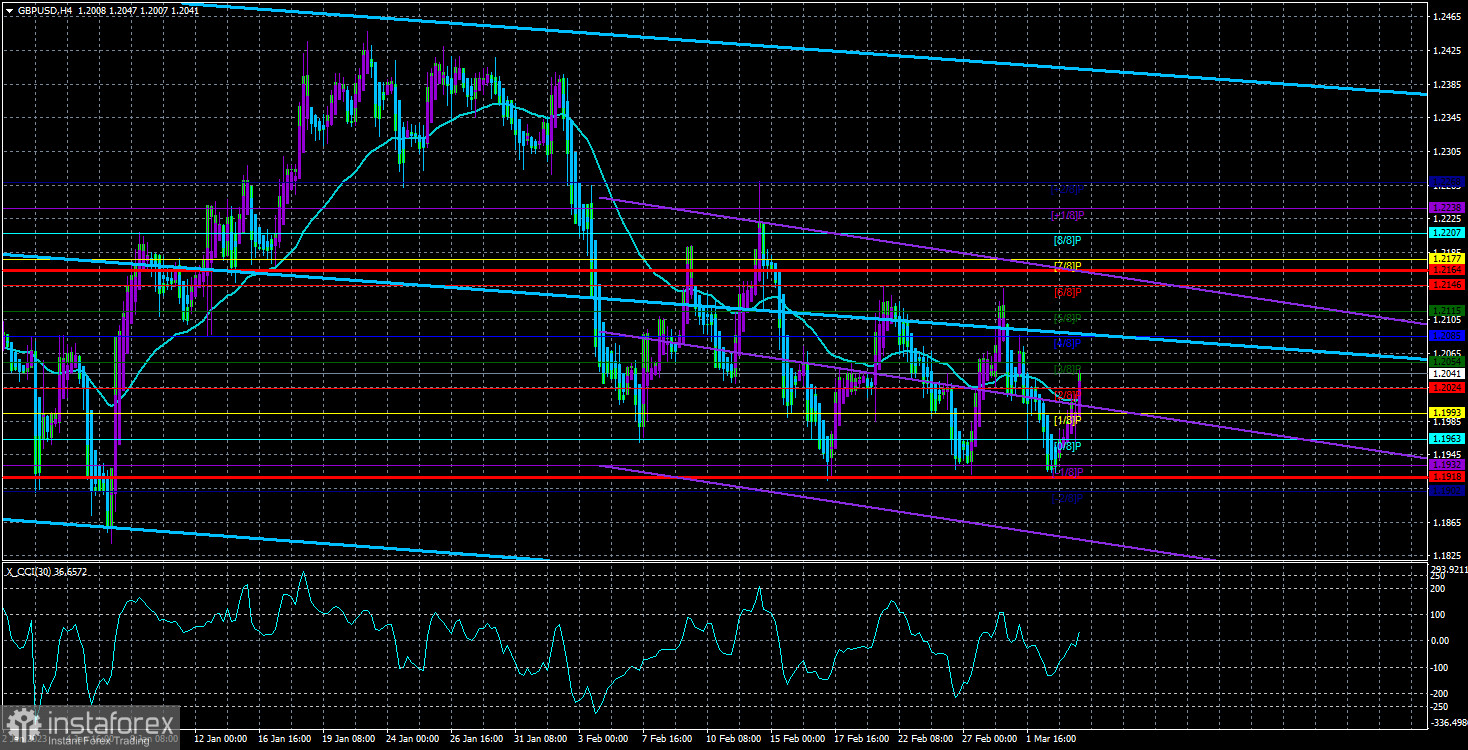

During the past few weeks, the GBP/USD currency pair has been in a "swing." You don't even need to look attentively to see this in the 4-hour timeframe. Thus, it is now unable to draw any unique technological conclusions. The pair is in a 200-point side channel and can "jump" from one border to another for as long as needed. Even fundamental events and macroeconomic news won't help you because you need extremely strong evidence to break out of a sideways trend when the pair is in it. Hence, there is no point in developing hypotheses and making informed assumptions about what the next trend will be until the price breaks out of the limited range. We think the British pound should keep losing value. This is corroborated by a price adjustment downward that was insufficiently strong following the second half of 2022's upward movement of more than 2000 points. Unreasonably high growth in the second half of 2022 supports this. The price's consolidation below the crucial level on the 24-hour TF supports this. The fact that the basic background is not shifting in favor of the British pound lends credibility to this.

The pair left the Ichimoku cloud on the 24-hour TF, however, this fact is completely illogical given that the price is still inside the flat. Hence, the same conclusion applies: you must wait till the flat is completed. Similar to the US, there weren't any significant events last week in the UK. Business activity indices are significant, although they often only affect the movement of the pair locally. New inflation reports, high-profile speeches by Powell and Bailey, and Fed and Bank of England meetings are all necessary right now. The Bank of England is currently the focus of particular interest because it is still unknown what to anticipate from it in the future. There are reports that the rate of rate increases may have already been slowed down at the March meeting, and that the regulator will ignore the poor condition of the British economy in favor of waiting for inflation to start falling on its own. Although it may take several years, BA may decide to postpone additional tightening of monetary policy in the first half of the year to avoid shocking the economy and then failing to restore it for several years.

A rate of 5% to 6% is not acceptable to the British regulator. Recently, the 5-6% rate has been frequently mentioned as an objective or minimum target, giving the central bank the chance to control inflation. The Fed, ECB, and BA are all being discussed at the same time. The Taylor rule states that the rate in the United States should increase to at least 7%. Naturally, the UK and Europe must likewise abide by this law. As a result, the UK's 4% rate will undoubtedly fall short of bringing inflation down to 2%. But what if a recession is inevitable and will be made worse by rising interest rates? What will happen to the central bank?

Based on this basic logical chain, we may conclude that the Bank of England will not tighten monetary policy as far as possible, and the consumer price index will not return to 2% in the next years. The pound loses the support of the basic background if it does not increase the rate. And the likelihood that the pound will drop to its all-time lows increases if the Fed raises interest rates. At a top value of 4% last week, members of the ECB monetary committee signaled as much as they could. They may alter their minds in a few months, but we think the UK's rate is likewise very close to its peak. The rate should be increased higher than in the US or the EU, given that inflation in Britain is still at 10%. And it's quite challenging to accept it. As a result, we think that the pound should continue to decline nearly regardless of what happens. All you have to do is watch for the pair to simultaneously exit two side channels. The 4-hour TF is no longer very important, and two linear regression channels have already abruptly decreased. This week, there are two performances by Jerome Powell and Nonpharma in the US. There will be justification for avoiding the side channels.

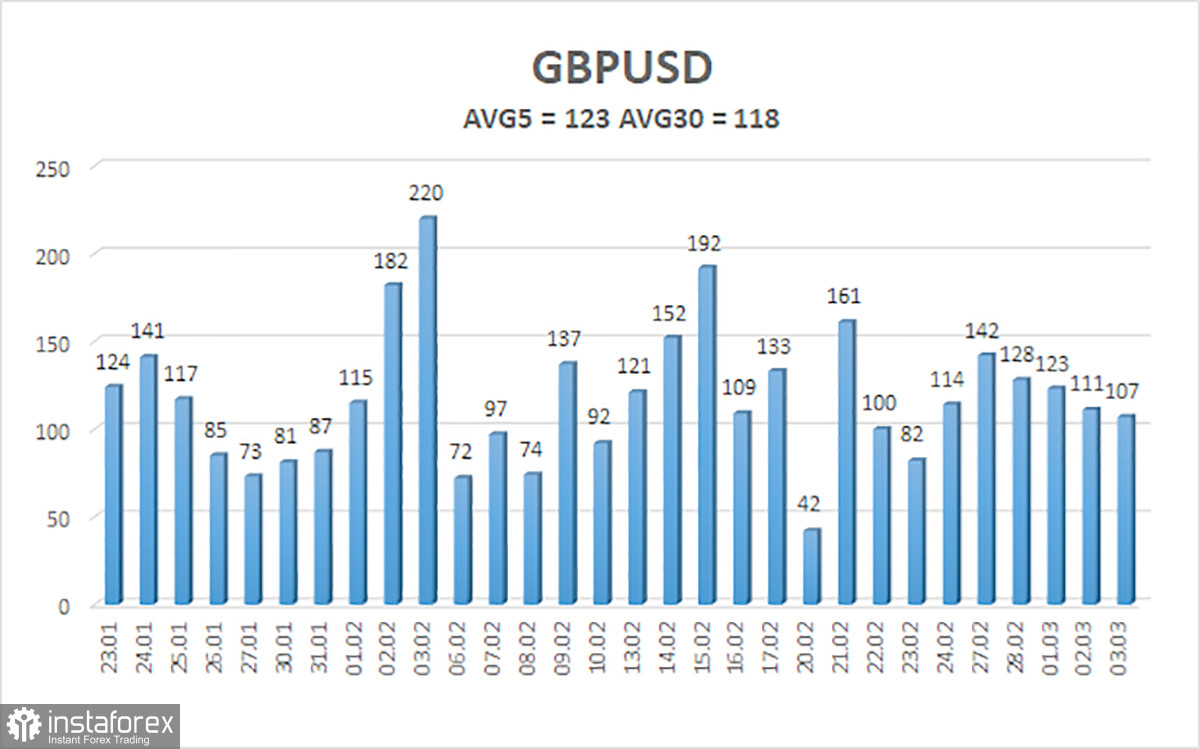

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 123 points. This value is "high" for the dollar/pound exchange rate. As a result, on Monday, March 6, we anticipate movement that is constrained inside the channel and is limited by levels 1.1918 and 1.2164. A new round of downward movement within the "swing" is indicated by the downward reversal of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.2024

S2 – 1.1993

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2054

R2 – 1.2085

R3 – 1.2115

Trade Suggestions:

In the 4-hour timeframe, the GBP/USD pair once again consolidated above the moving average. The pair is currently in a "swing" movement, which allows you to trade on a recovery from the levels of 1.1932 and 1.2115. Alternately, trade on the lower TF, where it is simpler to spot moves utilizing shorter-term and more precise signals.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.