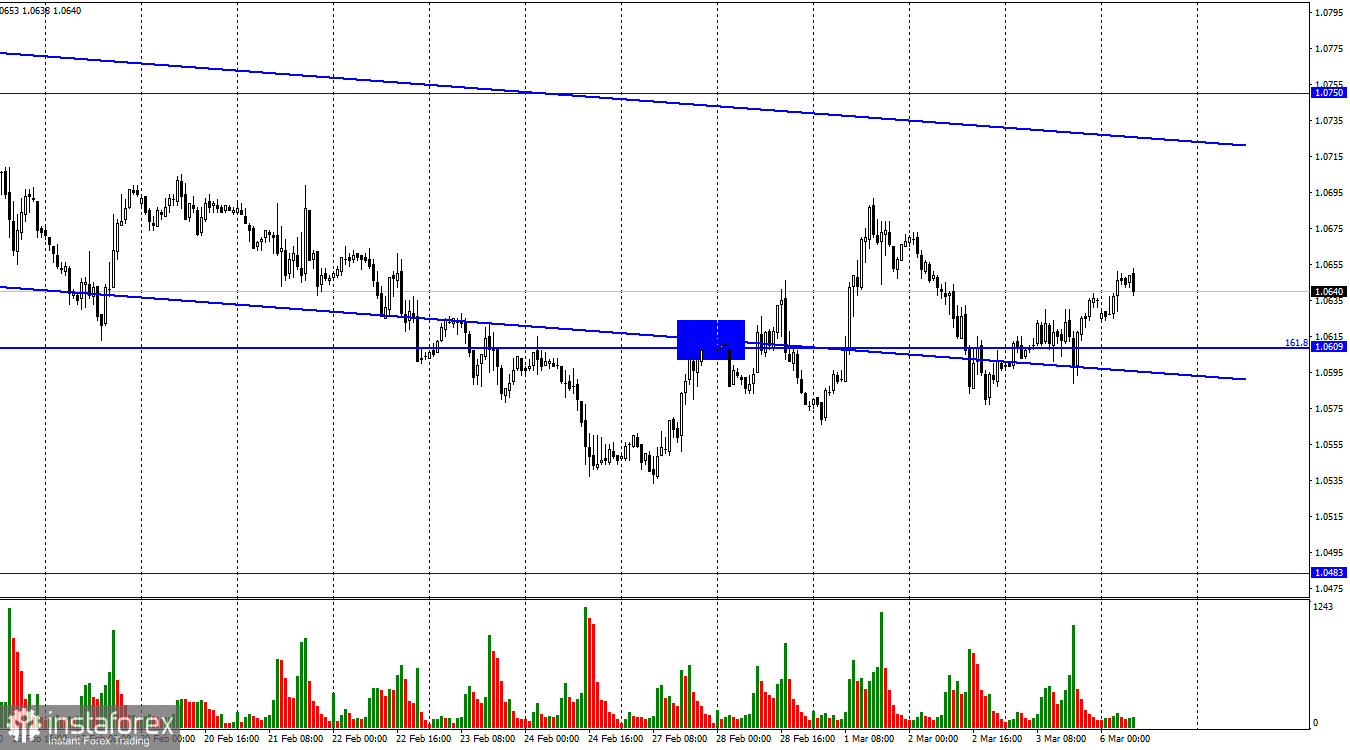

On Friday, the EUR/USD pair resumed the growth process inside the downward trend line, which still characterizes the mindset of traders as "bearish." The European currency could increase until it reaches the upper line of the corridor. The possibility of continued growth will be considerably increased by fixing the quotes above it. You can anticipate strong movements this week because there will be several significant reports and events.

On Monday, there is essentially no background information available, but this does not guarantee that the rest of the week will be the same. On Tuesday, Jerome Powell will speak, and on Wednesday, Powell and Christine Lagarde will both speak. Given that traders have recently grown somewhat confused by the topic of rates, the presidents of the ECB and the Fed's comments before the meetings are crucial. Members of both central banks gave several speeches last week, but this did nothing but increase the number of questions for the central banks. Recall that the interest rate was reduced by the Fed to 0.25% at their most recent meeting, but there are currently reports that it may increase once more to 0.50% because the most recent inflation report was insufficient. The European Central Bank (ECB) announced a rate increase of 0.50% in March, although it is still unclear whether the interest rate will rise overall this year. Traders will pay close attention to every word Lagarde and Powell say because they simply do not know what to anticipate from either central bank in the future.

This week in the USA, there will also be reports on nonfarm payrolls, unemployment, and ADP. For traders, labor market data comes in second behind inflation. The number of payrolls last month doubled expectations, proving that the US labor market is in good condition and that additional rate increases are permissible. This week, the dollar might receive support.

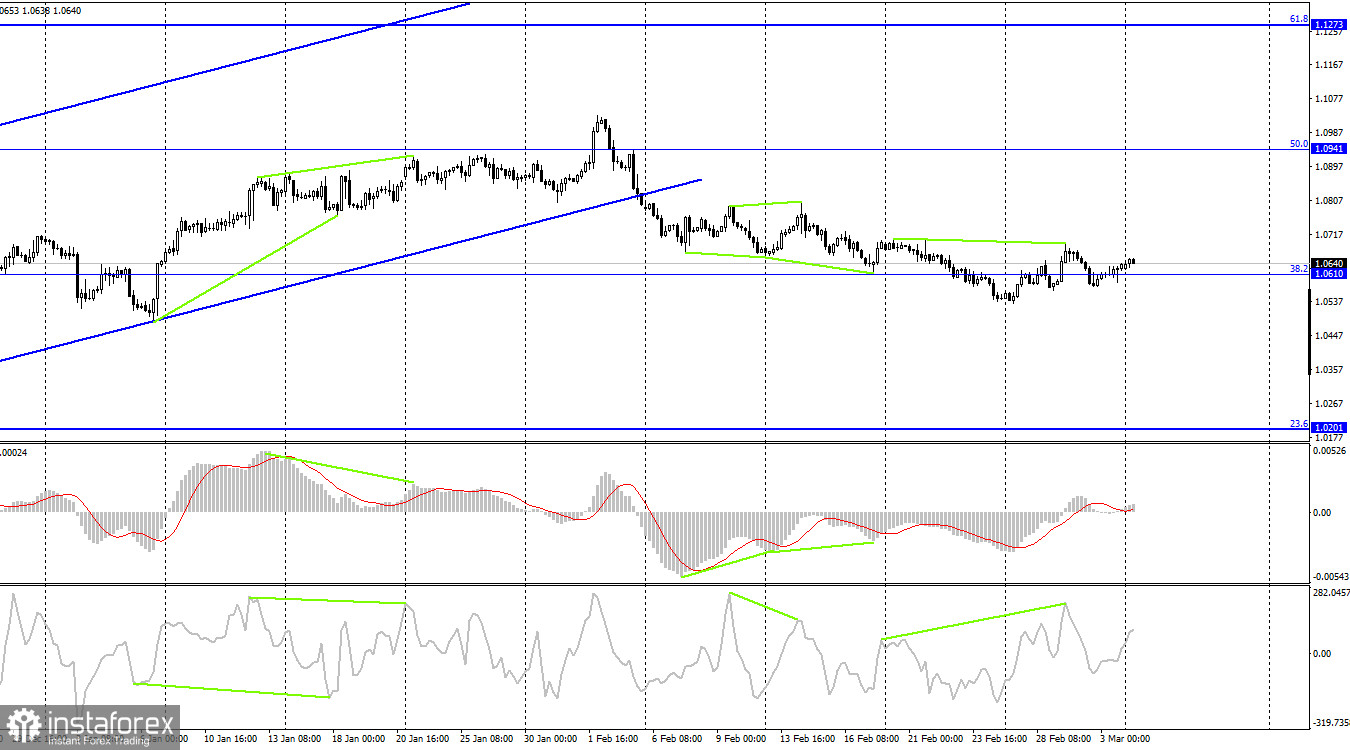

The pair was held under the upward trend channel on the 4-hour chart. Because the pair left the corridor where they had been since October, I believe this moment to be of the utmost importance. Trader sentiment is described as "bearish," which creates strong growth opportunities for the US dollar with a target of 1.0201. We can anticipate the decline in quotes to resume due to the "bearish" divergence of the CCI indicator.

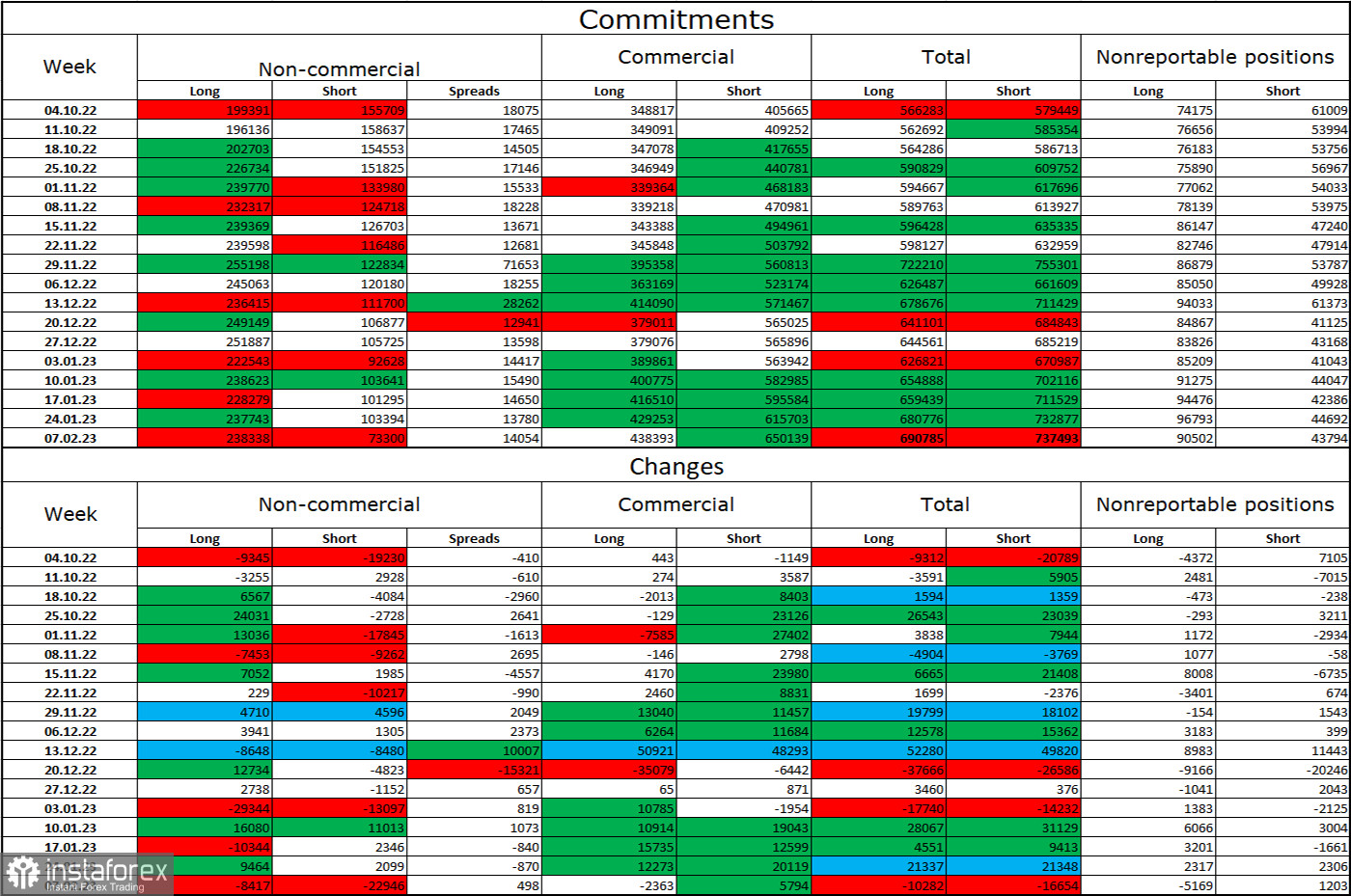

Report on Commitments of Traders (COT):

Speculators closed 8,417 long contracts and 22,946 short contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. Please be aware, though, that the most recent report is from February 7. The "bullish" attitude may have grown stronger at the start of February, but how are things now? Speculators now have 238 thousand long contracts, while just 73 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events for the United States and the European Union:

EU - volume of retail sales (10-00 UTC).

The European Union and the United States each have one entry for March 6 on their calendars of economic events, however, it may not be the most significant one. The information backdrop may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, new sales of the pair with a target of 1.0483 can be initiated when the price closes below the level of 1.0609. Alternatively, while reversing from the upward corridor's upper line with a target of 1.0609. On the hourly chart, purchases of the euro were conceivable when it closed above the level of 1.0614 with a target of 1.0710.