While Reuters experts expect to see EURUSD at 1.1 and 1.12 in 6 and 12 months, Bank of America believes that as long as U.S. inflation remains sticky, the Fed will continue to raise rates. And that fact allows the company to predict that the euro will be trading near $1.07 by the end of the year. That is, at about the same level as it is now. The dollar will keep its strength in 2023, though it is far from the successes of 2022.

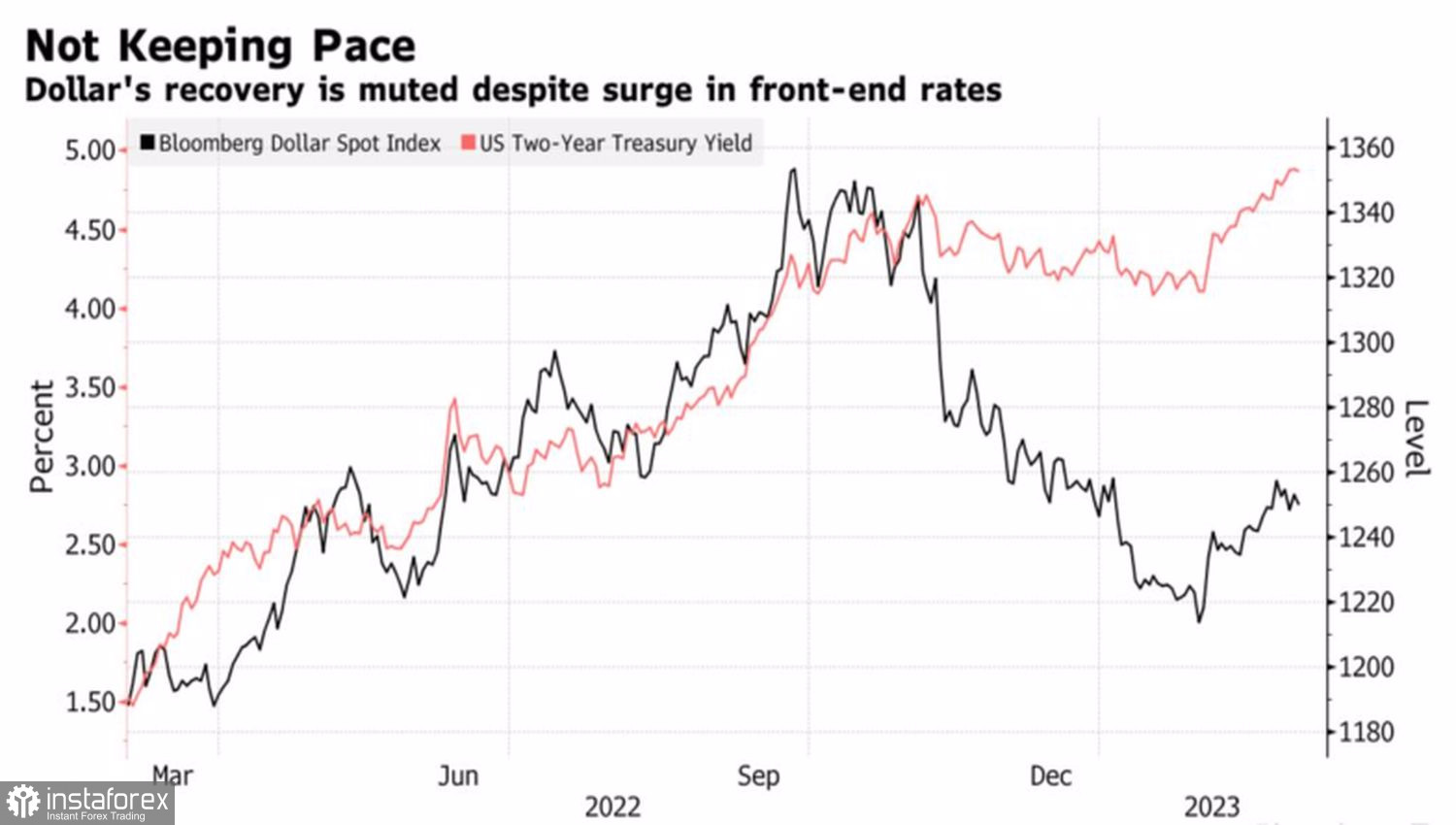

The hallmark of last year was the falling stock indices and the rising U.S. Treasury yields. Against this background, the USD index managed to reach a 20-year high. At the same time, the market has an opinion that its February rally has a lot in common with the events of that time. Indeed, the S&P 500 is declining, and 2-year Treasury bill have reached its highest level since 2008. Why wouldn't the dollar shine again like it did in the fall of 2022?

Dynamics of the dollar and U.S. bond yields

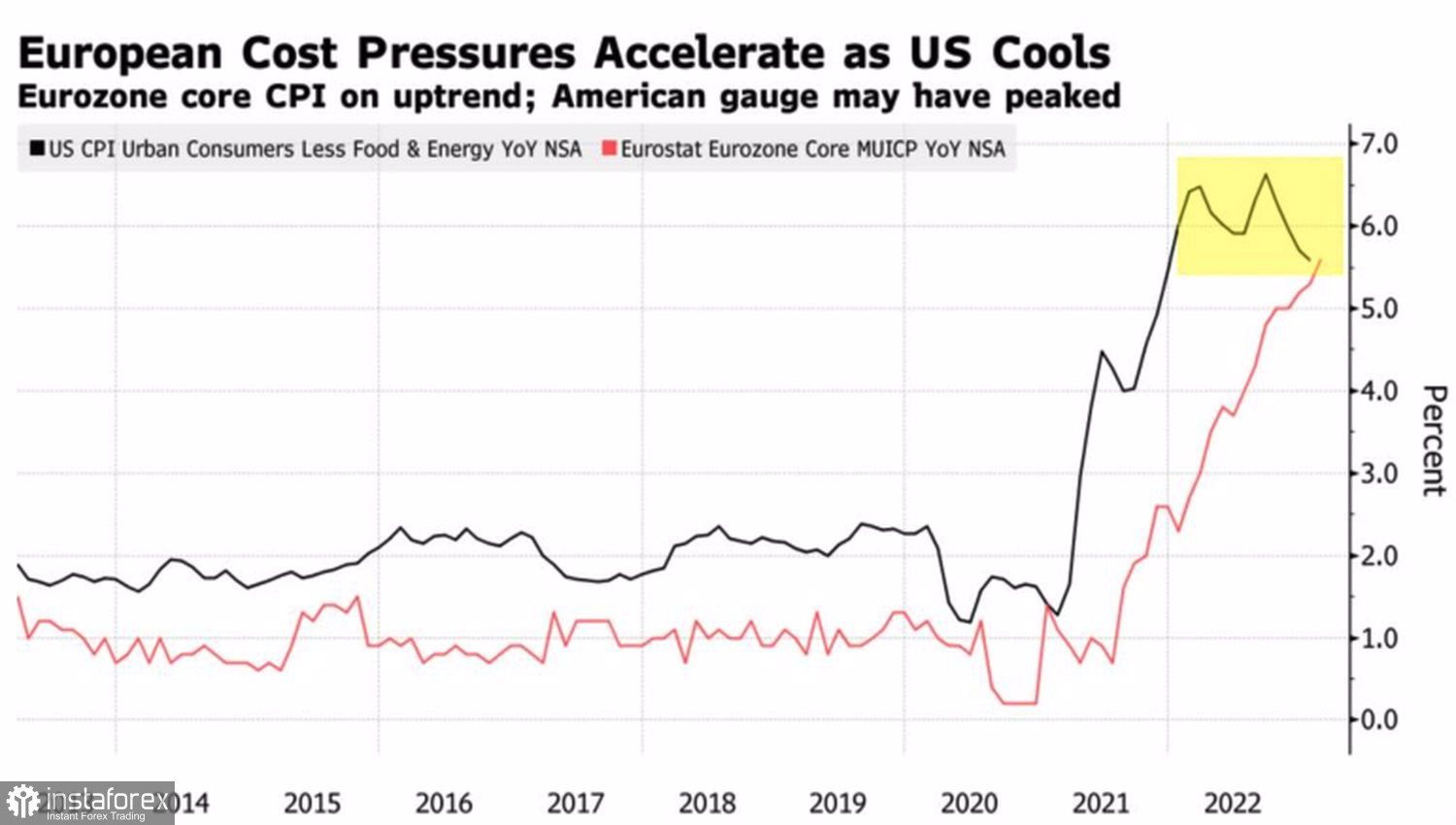

To the disappointment of the EURUSD bears, their adversaries are no longer the same. While earlier Europe, burdened by the armed conflict in Ukraine and an energy crisis, dreamed of a short and shallow recession, now everyone says there will be no recession. One of the last to say so was Bank of France Governor Francois Villeroy de Galhau. The impressive growth in business activity at the beginning of 2023 was another proof of the eurozone's resilience to external shocks, and the acceleration of core inflation to a record peak of 5.6% forces the ECB to show determination.

According to ECB President Christine Lagarde, inflation is a monster that needs to be knocked on the head. To do so, the European Central Bank simply must raise the deposit rate to 4%, as the derivatives market expects. Otherwise, no slowdown in prices is worth dreaming of, as is the case in the U.S.

Dynamics of inflation in the Eurozone and the U.S.

Currently, investors are confident that inflation in the currency bloc will return to the target of 2% later than in the United States. This means that the ECB will tighten monetary policy longer than the Fed. Therefore, in the medium and long term, the chances of EURUSD rising to 1.15 are higher than falling to parity.

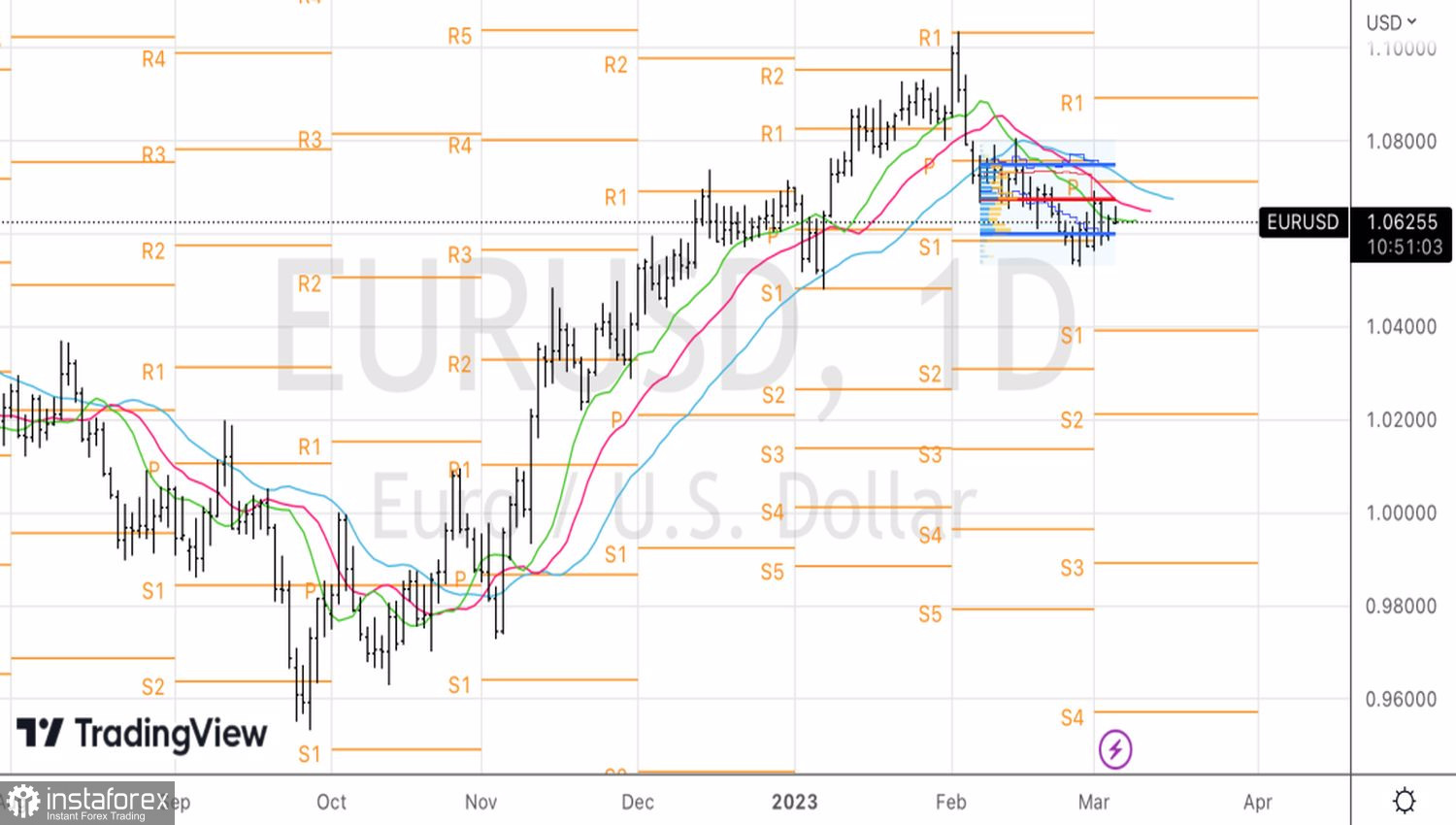

Another thing is that as long as the U.S. economy continues to surprise, the Fed will not stop raising rates. The cost of borrowing can jump up to 6%, and this circumstance still serves as a guiding star for the "bears" on the main currency pair. In the case of a strong U.S. employment report for February, the euro can collapse to the area of $1.04–$1.05.

Technically, the inability of the EURUSD bulls to win back the inside bar is a sign of their weakness. The return of quotes to its low at 1.0585 may be the basis for short-term sales. However, in anticipation of the release of important statistics on the U.S. labor market, there is a high probability of false breakdowns, so the fall of the euro below $1.0565 and $1.0535 is likely to be temporary.