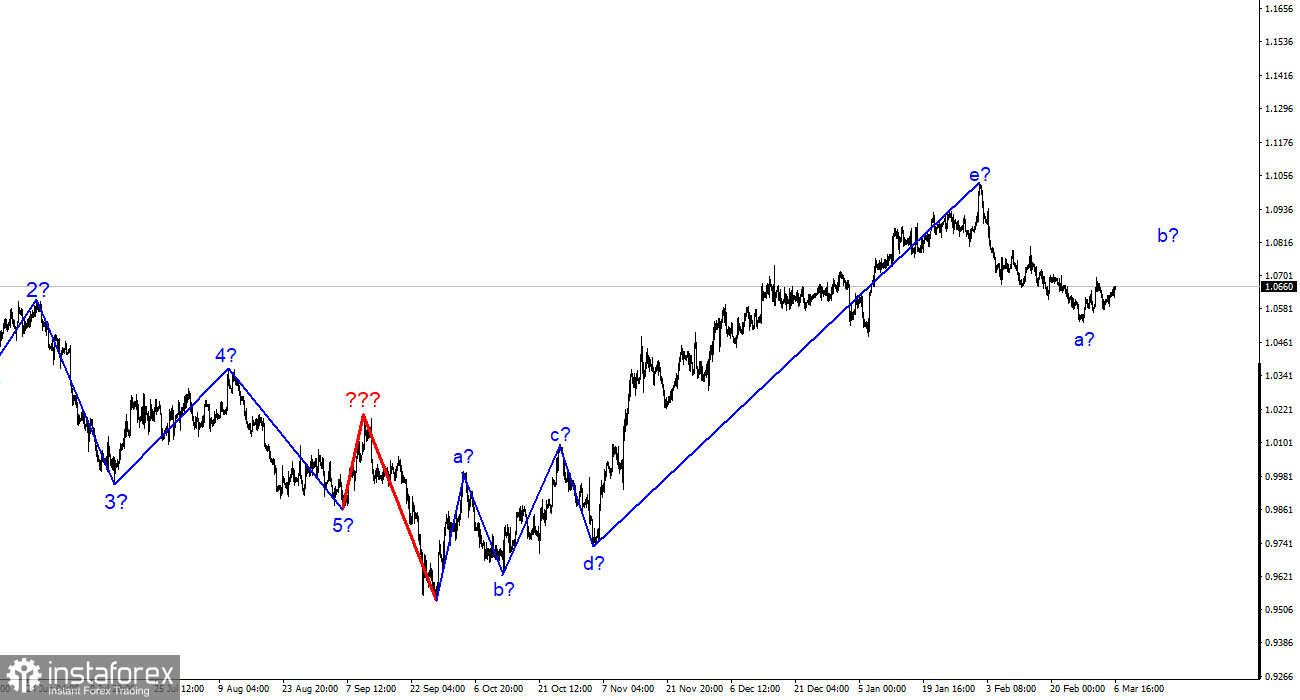

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this pattern's development is complete, and wave e was far longer than any other wave. I still anticipate a new, substantial decline of the pair because we are predicted to build at least three waves down. A few days or weeks of inactivity is possible with the pair, though. The quotes' retreat from the low they attained on Monday points to the potential start of wave 2 or b. If this is the case, then any news background will result in a rise in quotes for a while. In any event, I anticipate a new, rather sharp decrease following the completion of this wave, as the pair must first create at least three waves downward before considering a potential new upward section.

On Monday, the euro/dollar pair increased by 40 basis points, allowing us to draw the conclusion that the wave b's anticipated development is still underway. If this presumption is true, the euro may increase by another 100 points, but after that, I predict a new, sharp collapse. On Monday, there were multiple reports, but just one was significant. Markets anticipated a larger increase, but retail trade volumes in the EU increased by 0.3% in January. With a projection of -1.5%, the indicator's yearly decline was 2.3%. The index of business activity in the construction sector, which has never been regarded as significant, was also made public. Even though it increased in February, it is still below the 50 mark. It is challenging to see it as positive. The market has the potential to build a corrective wave regardless of the news background, though, as demand for the euro currency has been steadily rising today. There will be a lot more major events this week, which will allow the market to actively earn them back.

We are first discussing the US figures from last Friday. At the start of every month, statistics on the state of the labor market, unemployment, and wages are typically released. Over the week, Jerome Powell and Christine Lagarde will each give two performances. There will also be ADP reports, speeches by members of the Fed and ECB, and a report on GDP in the European Union. I have only highlighted the most significant events, though. The upcoming week looks highly interesting, and the ECB and Fed will meet later this month, which is usually crucial. Notwithstanding the news context, I think the demand for the euro should start to drop again. Currently, the dollar appears more intriguing than the euro.

Conclusions in general

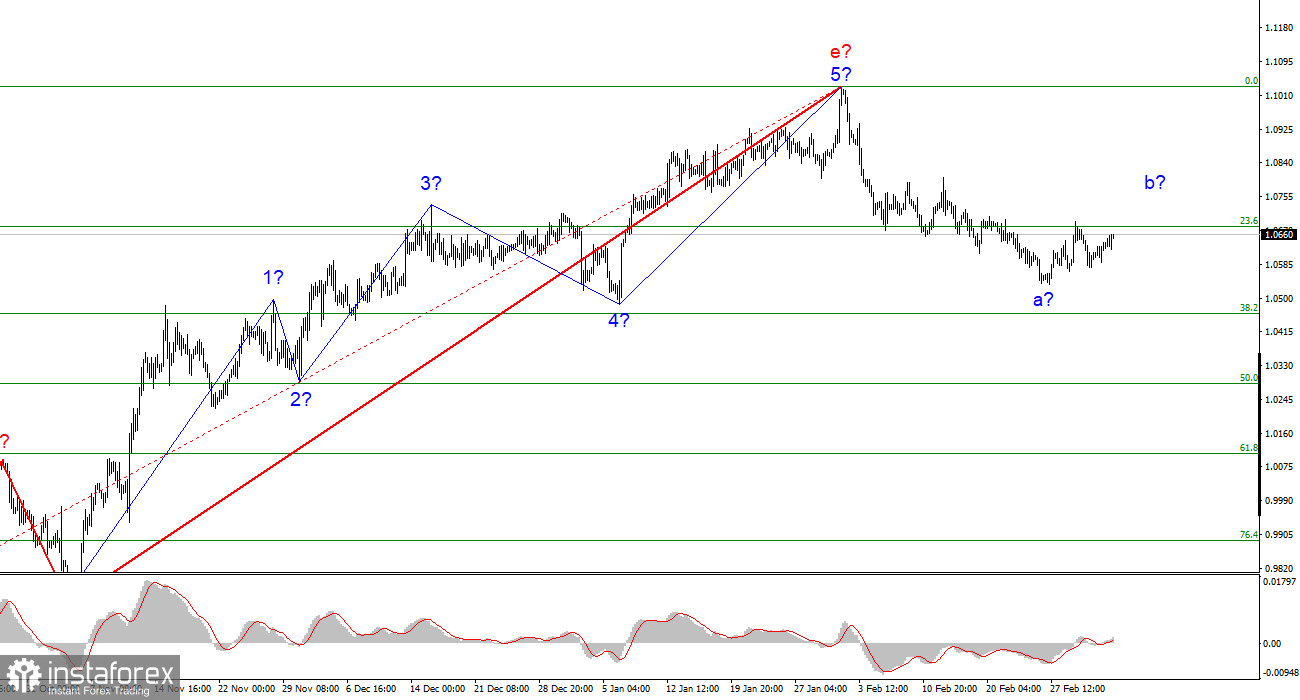

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A correction wave 2 or b can be developed at this point, which should be considered. Opening sales now on the MACD "down" indications would be a good idea.

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it might have any length or structure.