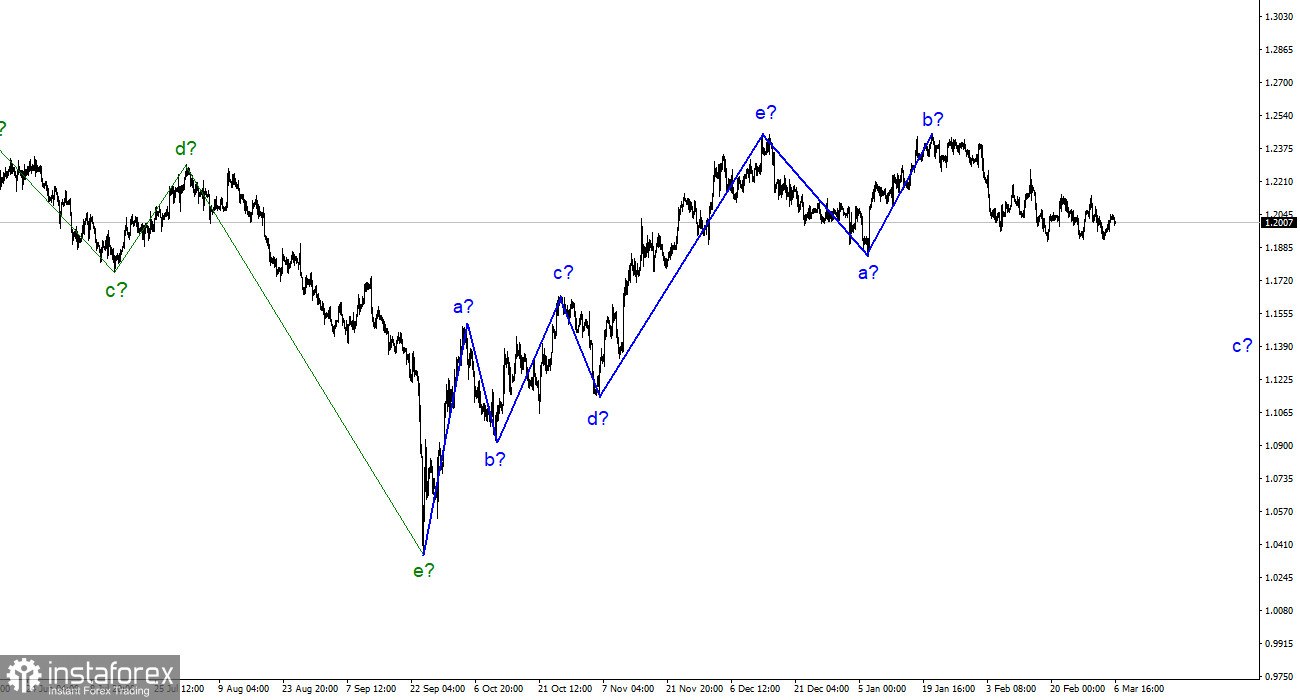

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward section of the trend has begun and will continue to develop, taking at least a three-wave form. Although Wave B appeared to be unnecessarily prolonged, it did not cancel. It is therefore likely that a wave with targets below wave a's low is currently developing from the downward part of the trend. The price would be at least 300–400 points less than it is at the moment. Although it's too soon to speculate, I believe wave c may end up being deeper and that the entire downward part of the trend may potentially adopt a five-wave pattern. For a very long time, the pair has been on the verge of starting up again with the creation of an upward trend section. Since the projected wave a's low has not yet been breached, wave c has not yet finished and does not take on a sufficiently extended form.

On Monday, the pound/dollar exchange rate decreased by 25 basis points. Today's movements were of low amplitude, and the news background was weak. The UK construction business activity index was the only report that could keep the markets interested during the day. I should point out that this index is likewise unimportant and frequently disregarded. The market does, however, occasionally nonetheless pay attention to it. Today, information about the indicator's upward rise in February (from 48.4 to 54.6) was made public. A value like that might have encouraged the pound to grow even more, but instead, the demand for it decreased. I conclude that wave analysis is presented in the lead for the market because it hasn't declined significantly. The pair has remained in a limited area for some weeks, repeatedly attempting to resume the fall, and wave c is extremely delayed in its development. I am not surprised that the British report was disregarded today; the market now needs to find a solution to the much more crucial problem of the ongoing decline.

On Friday of this week, the UK will only release the GDP reports. And these will be monthly values rather than quarterly or annual ones. They have a lesser market share and are less likely to impact the market. The news background will be more interesting in America. There will be two speeches by Jerome Powell in addition to the nonfarm payrolls, unemployment, and salaries that I have already discussed. Now, the market is waiting for any indications that a decision may be made this month. The likelihood of a 50 basis point rate hike in March increased significantly after the weak February inflation report, but I still don't think it will happen. The Fed is not allowed to slow down rate increases to speed them up again in a month and a half. Powell, however, can help in the market's understanding of what to anticipate in a few weeks. Any "hawkish" suggestions will raise interest in the dollar.

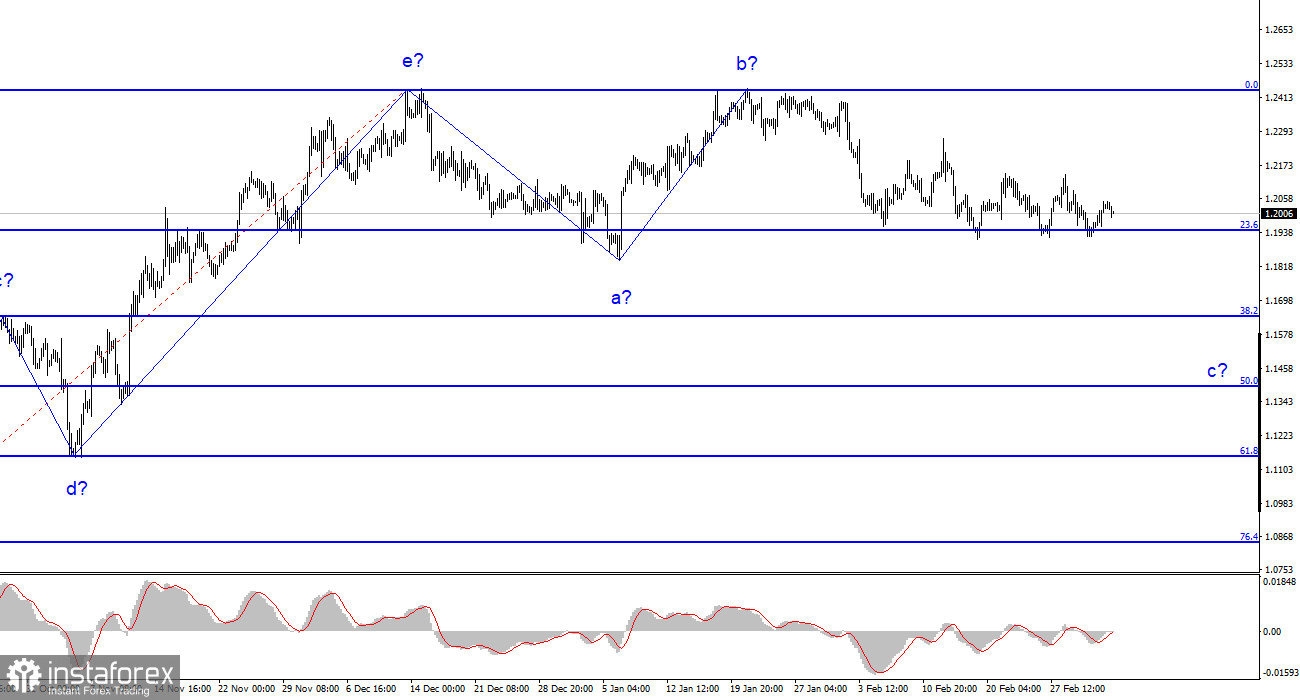

Conclusions in general.

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter in duration, but for the time being, I anticipate a minimum 300–400 point decline (from current levels).

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor differences. The upward correction part of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.